Uncategorized

Citigroup Eliminated More Jobs This Week. Here’s Which Roles Were Affected.

Use These ChatGPT Prompts to Boost Your Amazon Sales

Devin 1.2: Updated AI engineer enhances coding with smarter in-context reasoning, voice integration

Matthew Ball explains what happened to the gaming boom and our chances for recovery | The DeanBeat

Amarc Announces New High Grade “AuRORA” Copper-Gold-Silver Deposit Discovery in Collaboration With Freeport at the Joy District, British Columbia

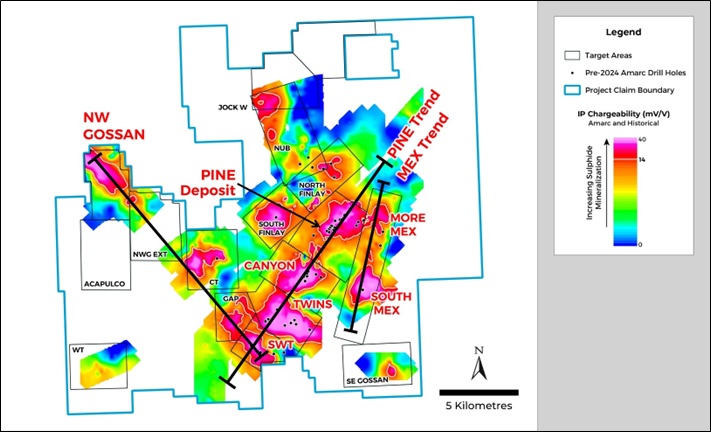

Amarc Resources Ltd. (“Amarc” or the “Company”) (TSXV:AHR)(OTCQB:AXREF) is pleased to announce discovery of the new, high grade, gold-rich porphyry copper-gold-silver (“Cu-Au-Ag”) AuRORA deposit at its 100% owned JOY Copper-Gold District (“JOY”), in the prolific Toodoggone-Kemess porphyry Cu-Au region of north-central British Columbia (“BC”). The AuRORA Deposit Discovery is located within an area of the 495 km 2 JOY District that had not previously been drill tested (see Figures 1, 2 and 3). Freeport-McMoRan Mineral Properties Canada Inc. (“Freeport”) is fully funding work programs at JOY to earn an interest in the project, and Amarc is the operator of all programs.

Highlights from Initial AuRORA DEPOSIT Discovery Drill Holes Include:

|

Drill Hole |

Int.1,2,3 (m) |

From (m) |

Incl. |

Au (g/t) |

Cu (%) |

Ag (g/t) |

CuEQ4 (%) |

|

JP24057 |

82 |

18 |

1.24 |

0.38 |

2.47 |

1.08 |

|

|

42 |

58 |

Incl. |

1.97 |

0.49 |

3.58 |

1.61 |

|

|

JP24059 |

271 |

24 |

0.98 |

0.25 |

1.93 |

0.81 |

|

|

171 |

24 |

Incl. |

1.32 |

0.34 |

2.62 |

1.09 |

|

|

89 |

106 |

and |

2.29 |

0.46 |

3.65 |

1.76 |

|

|

JP24071 |

212 |

21 |

1.36 |

0.40 |

3.35 |

1.18 |

|

|

108 |

104 |

Incl. |

2.38 |

0.60 |

5.17 |

1.96 |

|

|

JP24074 |

162 |

69 |

2.19 |

0.63 |

6.95 |

1.90 |

|

|

147 |

84 |

Incl. |

2.40 |

0.69 |

7.60 |

2.08 |

|

|

108 |

111 |

and |

3.09 |

0.82 |

8.99 |

2.59 |

|

|

81 |

135 |

and |

3.69 |

0.92 |

9.72 |

3.04 |

Notes: See Table 1.

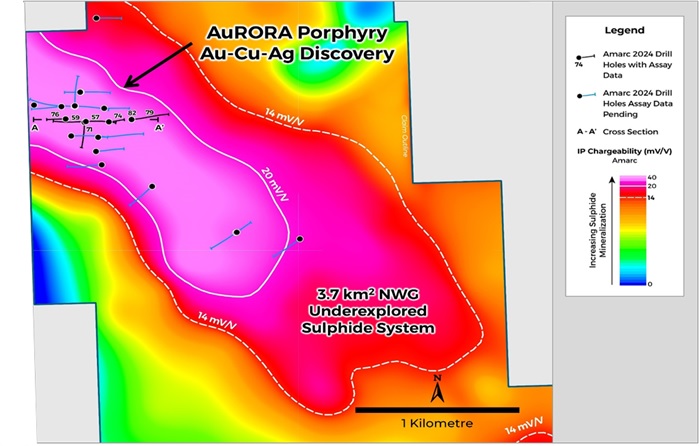

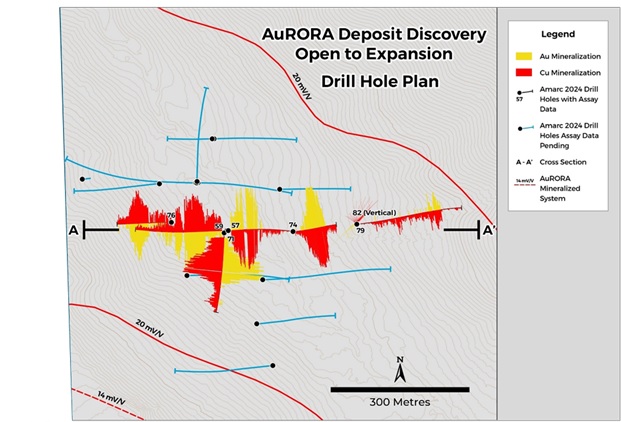

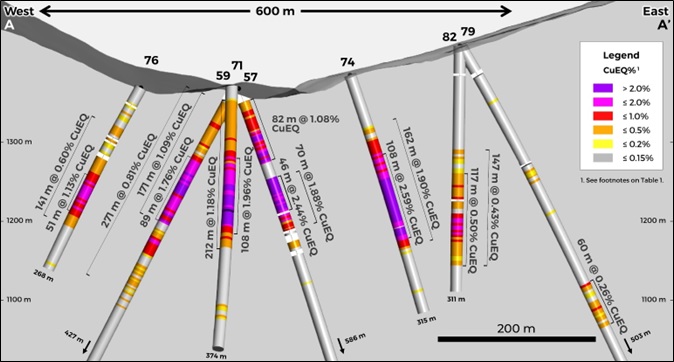

Hole JP24057, the first hole ever drilled at AuRORA, intersected a new porphyry Cu-Au-Ag system hosting high and continuous Au grades (see Tables 1, 2 and 3). Following completion of this discovery hole, Amarc, with Freeport, systematically stepped out, aggressively drilling with three core rigs, with a view to begin outlining an outstanding Cu-Au-Ag deposit and to confirm its high grade potential. This release details the results of discovery hole JP24057 and six other holes drilled at approximately 100 m intervals on east-west section 7800N (see Figures 2 and 3). Drilling on this section established a 600 m wide zone of porphyry mineralization encountered from near surface that is open to lateral expansion, and which is characterized by excellent lateral and vertical continuity. Final compilations and confirmatory analyses from six additional holes drilled at AuRORA along east-west section 7900N, a 100 m step out to the north of section 7800N, are near completion and will be released in the very near future. These additional results show similar very encouraging grades and characteristics to those reported in this release.

“This impressive new, high grade porphyry copper-gold-silver discovery is a pivotal moment for Amarc and its shareholders,” said Dr. Diane Nicolson, Amarc President and CEO. “It represents a significant inflection point in the exploration of the JOY District with Freeport. Our discovery is the culmination of years of relentless groundwork by the Amarc team, coupled with the firm, unwavering belief, shared by Freeport, that the JOY District holds significant potential for high grade porphyry gold-copper deposits. This discovery comes during a period of positive market sentiment for gold, copper and silver, which we believe further increases the attractiveness of Amarc as an exciting investment opportunity.”

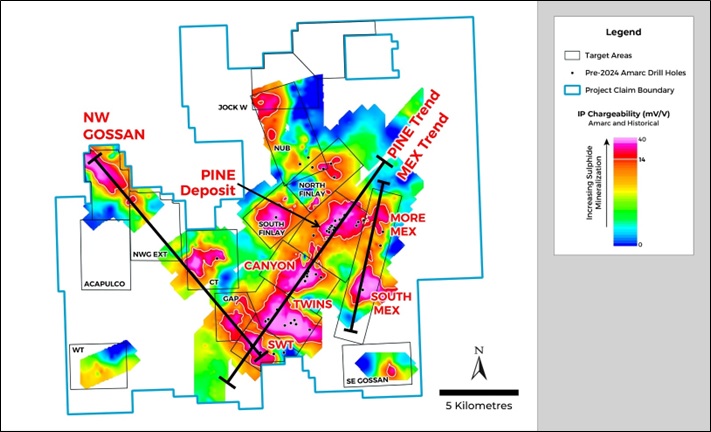

The AuRORA Deposit Discovery is located within the expansive Northwest Gossan (“NWG”) Target area located at the northwest end of a possible 15 km mineralized trend that extends southeast toward the GAP and SWT Targets (see Figure 1). The NWG Target is outlined by a 3.7 km 2 Induced Polarization (“IP”) anomaly (>14mV/V) (see Figure 3) with coincident Cu, Au, Mo and Ag anomalies outlined in soils and rocks (see Amarc releases May 2 and July 11, 2024). The 2024 initial drill testing of the NWG Target area focused primarily on an internal zone of higher (>20 mV/V) IP chargeability some 1,500 m long and 500 m wide. Much of the NWG Target area remains unexplored.

“The AuRORA Deposit Discovery has been made through the Amarc team’s depth of knowledge and porphyry copper-gold discovery track record in BC and the Toodoggone region, combined with the support and insight from Freeport, based on its global capabilities as a top-tier copper and gold producer and discoverer. Together, our goal in 2024 was to focus on discovery and we are clearly on the right track with AuRORA. Notably, the AuRORA Deposit Discovery area is only one of eight large scale sulphide mineralized systems clustered along several mineralized trends drilled in 2024 at JOY. These important-scale sulphide systems have been established by district-wide geological, geochemical and geophysical ground IP surveys. Additional results from the 2024 drill program will be forthcoming. We are extremely optimistic about further important progress at JOY,” concluded Nicolson.

In addition to today’s announced drill holes, an additional 33 scout holes were also completed on eight porphyry Cu-Au targets, including at the AuRORA Deposit Discovery, PINE Deposit, Canyon Discovery and at the Twins Deposit Target within the JOY District (see Figure 1). These targets were established through 290 line-km of property wide IP surveying, the collection and analyses of 8,400 soil and 1,500 rock samples, and geological mapping and prospecting.

Figure 2: AuRORA Deposit Discovery: Located in the New Underexplored NWG Target

Figure 4: AuRORA Deposit Discovery Never Previously Drilled and Open to Expansion

Figure 5: AuRORA Deposit Discovery: Drilling Outlines Open-Ended, Near Surface, Continuous, High Grade Cu-Au-Ag Mineralization (Section 7800N)

Table 1: JOY AuRORA Porphyry Cu-Au-Ag Deposit Discovery Section 7800N Mineralized Intervals of Significance

|

Drill Hole |

Incl. |

From (m) |

To |

Int.1,2,3 (m) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

CuEQ4 (%) |

|

JP24057 |

18.00 |

100.00 |

82.00 |

1.24 |

0.38 |

2.5 |

1.08 |

|

|

Incl. |

58.00 |

100.00 |

42.00 |

1.97 |

0.49 |

3.6 |

1.61 |

|

|

120.29 |

190.00 |

69.71 5 |

2.56 |

0.42 |

5.0 |

1.88 |

||

|

Incl. |

120.29 |

166.00 |

45.71 |

3.30 |

0.56 |

6.2 |

2.44 |

|

|

And |

120.29 |

136.00 |

15.71 |

4.54 |

0.84 |

8.6 |

3.42 |

|

|

JP24059 |

24.00 |

295.25 |

271.25 |

0.98 |

0.25 |

1.9 |

0.81 |

|

|

Incl. |

24.00 |

194.50 |

170.50 |

1.32 |

0.34 |

2.6 |

1.09 |

|

|

And |

106.00 |

194.50 |

88.50 |

2.29 |

0.46 |

3.7 |

1.76 |

|

|

Incl. |

211.00 |

239.10 |

28.10 |

0.99 |

0.18 |

1.1 |

0.73 |

|

|

JP24071 |

21.10 |

233.00 |

211.906 |

1.36 |

0.40 |

3.4 |

1.18 |

|

|

Incl. |

104.00 |

212.00 |

108.00 |

2.38 |

0.60 |

5.2 |

1.96 |

|

|

JP24074 |

69.00 |

231.00 |

162.00 |

2.19 |

0.63 |

7.0 |

1.90 |

|

|

Incl. |

84.00 |

231.00 |

147.00 |

2.40 |

0.69 |

7.6 |

2.08 |

|

|

And |

111.00 |

219.00 |

108.00 |

3.09 |

0.82 |

9.0 |

2.59 |

|

|

And |

135.00 |

216.00 |

81.00 |

3.69 |

0.92 |

9.7 |

3.04 |

|

|

JP24076 |

57.00 |

198.00 |

141.007 |

0.73 |

0.18 |

1.3 |

0.60 |

|

|

Incl. |

102.00 |

198.00 |

96.00 |

1.00 |

0.24 |

1.8 |

0.81 |

|

|

And |

129.00 |

180.00 |

51.00 |

1.44 |

0.31 |

2.2 |

1.13 |

|

|

JP24079 |

179.00 |

189.50 |

10.50 |

0.06 |

0.24 |

2.7 |

0.29 |

|

|

341.00 |

400.70 |

59.70 |

0.29 |

0.08 |

1.7 |

0.26 |

||

|

JP24082 |

131.00 |

277.95 |

146.95 |

0.34 |

0.22 |

3.2 |

0.43 |

|

|

Incl. |

161.00 |

277.95 |

116.95 |

0.39 |

0.25 |

3.8 |

0.50 |

|

|

And |

212.00 |

242.00 |

30.00 |

0.84 |

0.54 |

7.2 |

1.06 |

Notes to Table 1:

- Widths reported are drill widths, such that true thicknesses are unknown.

- All assay intervals represent length-weighted averages.

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal process prices of: Cu US$4.00/lb, Au US$1800/oz., and Ag US$24/oz. and conceptual recoveries of: Cu 85%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ% = Cu% + ((Au g/t * (Au recovery / Cu recovery) * (Au $ per oz./31.1034768 / Cu $ per lb. * 22.04623)) + ((Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz./ 31.1034768 / Cu $ per lb. * 22.04623)).

- Drill hole JP24057 interval 166-169 m comprised broken ground, no core was recovered, and it was therefore averaged at zero grade.

- Drill hole JP24071 interval 179-182 m comprised broken ground, no core was recovered, and it was therefore averaged at zero grade.

- Drill hole JP24076 intervals 72-75 m, 78-81 m and 96-102 m comprised broken ground, no core was recovered, and each was therefore averaged at zero grade.

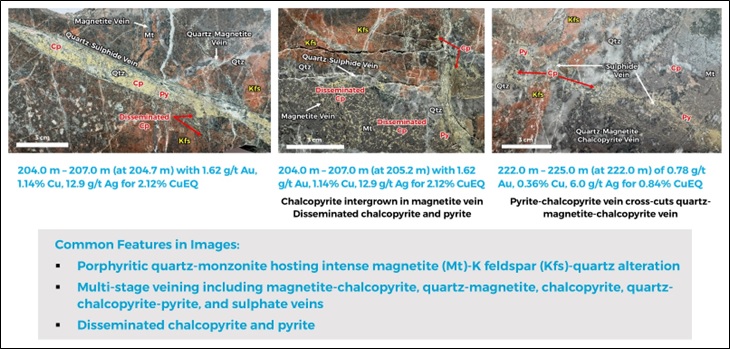

AuRORA Deposit Geological Information – Section 7800N

The geological and hydrothermal characteristics of AuRORA discovery hole JP24057, and other holes along the section, are broadly consistent with generalized models for porphyry Cu-Au deposits in the Kemess Mining District and in the wider Toodoggone Region. East-west cross section 7800N across the AuRORA Deposit Discovery highlights the excellent continuity of the near surface, high grade, Cu-Au-Ag mineralization discovered in hole JP24057, as well as consistent vertical and lateral patterns in the grade, hydrothermal and geological characteristics in the holes along the section (see Figures 4 and 5 and Table 2).

In the upper part of AuRORA, mineralization is hosted by andesitic tuff and in its lower part by quartz-monzonite intrusive rocks. The contact between the volcanic and intrusive rocks is typically masked by intense alteration that coincides with the highest-grade mineralization. High grade mineralization is associated with pervasive quartz-sericite/chlorite-pyrite alteration, which overprints potassic K-feldspar and magnetite alteration. Copper mineralization is mainly chalcopyrite and trace to minor bornite (see Figure 6).

About Amarc Resources Ltd

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of long-life, high-value porphyry Cu-Au mines in BC. By combining high-demand projects with dynamic management, Amarc has created a solid platform to create value from its exploration and development-stage assets.

Amarc is advancing its 100%-owned JOY, DUKE and IKE porphyry Cu±Au Districts located in different prolific porphyry regions of northern, central and southern BC, respectively. Each District represents significant potential for the development of multiple and important-scale, porphyry Cu±Au deposits. Importantly, each of the three districts are located in proximity to industrial infrastructure – including power, highways and rail.

Amarc’s exploration is led by an internationally successful team of experienced geologists specializing in porphyry Cu-Au deposits. Members of this team have been involved in and have tracked porphyry Cu-Au exploration advancements in the Toodoggone region since 1990. Their experience and early recognition of the porphyry potential at the NWG Target in terms of a shallowly overburden covered and underexplored transitional epithermal-porphyry geological setting, led to the discovery of the Au-rich AuRORA porphyry Cu-Au-Ag Deposit.

Freeport-McMoRan Mineral Properties Canada Inc. (“Freeport”), a wholly owned subsidiary of Freeport-McMoRan Inc. at JOY and Boliden Mineral Canada Ltd. (“Boliden”), an entity within the Boliden Group of companies at DUKE, can earn up to a 70% interest in each District through staged investments of $110 million and $90 million, respectively. Together this provides Amarc with potentially up to $200 million in non-share dilutive staged funding for these Districts. In addition, Amarc has completed self-funded drilling at its higher-grade Empress Deposit in the IKE District. Drill results from nine core holes drilled late in 2024 at Empress are being compiled and are expected to be released next month. Amarc is the operator of all programs.

Amarc is associated with HDI, a diversified, global mining company with a 35-year history of porphyry Cu deposit discovery, development and transaction success. Previous and current HDI projects include some of BC’s and the world’s most important porphyry deposits – such as Pebble, Mount Milligan, Southern Star, Kemess South, Kemess North, Gibraltar, Prosperity, Xietongmen, Newtongmen, Florence, Casino, Sisson, Maggie, AuRORA, PINE, IKE and DUKE. From its head office in Vancouver, Canada, HDI applies its unique strengths and capabilities to acquire, develop, operate and monetize mineral projects.

Amarc works closely with local governments, Indigenous groups and stakeholders in order to advance its mineral projects responsibly, and in a manner that contributes to sustainable community and economic development. We pursue early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, we seek to establish mutually beneficial partnerships with Indigenous groups within whose traditional territories our projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc work programs are carefully planned to achieve high levels of environmental and social performance.

Qualified Person

Mark Rebagliati, P.Eng, a Qualified Person (“QP”) as defined by National Instrument 43-101, has reviewed and approved all technical and scientific information related to the JOY Project contained in this news release. Mr. Rebagliati is not independent of the Company.

Quality Assurance/Quality Control Program

Amarc drilled NQv (48.1mm) and HQ (63.5mm) size core in 2024 at the JOY project. All drill core was logged, photographed, and cut in half with a diamond saw. Half core samples from the JOY drilling were sent to ALS Canada Ltd., Kamloops or Langley, Canada, for preparation and to North Vancouver, Canada for analysis. All facilities are ISO/IEC 17025:2017 accredited. At the laboratory, samples were dried, crushed to 70% passing -2mm, and either a 250 g split or 1,000 g split was pulverized to better than 85% passing 75 microns. Samples were analyzed for Au by fire assay fusion of a 30 g sub-sample with an ICP-AES finish, and for 60 elements including Cu, Mo and Ag by a four-acid digestion, multi-element ICP-MS package. Samples with Cu results > 10,000 ppm were reanalyzed by a single element four-acid digestion ICP-AES method for Cu. As part of a comprehensive Quality Assurance/Quality Control (“QAQC”) program, Amarc control samples were inserted in each analytical batch of the core samples at the following rates: standards one in 20 regular samples, in-line replicates one in 20 regular samples and one coarse blank per hole. The control sample results were then checked to ensure proper QAQC.

The QP visited the site to verify location of drill holes, and review the core and logging, sampling and sample shipment processes. He also reviewed and assessed the assay results.

For further details on Amarc Resources Ltd., please visit the Company’s website at www.amarcresources.com or contact Dr. Diane Nicolson, President and CEO, at (604) 684-6365 or within North America at 1-800-667-2114, or Kin Communications, at (604) 684-6730, Email: AHR@kincommunications.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMARC RESOURCES LTD.

Dr. Diane Nicolson

President and CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking and Other Cautionary Information

This news release includes certain statements that may be deemed “forward-looking statements”. All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc’s projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc’s projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc’s annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedarplus.ca.

Table 2: AuRORA Discovery Assay Data by Sample Interval for Drill Holes JP24059 and JP 24074

Hole JP24059

|

Sample |

From (m) |

To (m) |

Int.1,2,3 (m) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

CuEQ4 (%) |

|

732288 |

106.00 |

109.00 |

3.00 |

1.38 |

0.49 |

2.9 |

1.28 |

|

732289 |

109.00 |

112.00 |

3.00 |

1.22 |

0.36 |

2.2 |

1.06 |

|

732291 |

112.00 |

115.00 |

3.00 |

1.44 |

0.52 |

2.9 |

1.34 |

|

732292 |

115.00 |

118.00 |

3.00 |

1.37 |

0.44 |

2.6 |

1.22 |

|

732293 |

118.00 |

121.00 |

3.00 |

1.43 |

0.45 |

3.5 |

1.27 |

|

732294 |

121.00 |

124.00 |

3.00 |

2.12 |

0.59 |

4.3 |

1.80 |

|

732295 |

124.00 |

127.00 |

3.00 |

3.04 |

0.83 |

6.1 |

2.56 |

|

732296 |

127.00 |

129.00 |

2.00 |

2.02 |

0.52 |

5.4 |

1.68 |

|

732297 |

129.00 |

130.90 |

1.90 |

1.74 |

0.73 |

5.0 |

1.73 |

|

732298 |

130.90 |

133.00 |

2.10 |

2.37 |

0.58 |

4.4 |

1.92 |

|

732299 |

133.00 |

136.00 |

3.00 |

2.56 |

0.79 |

4.8 |

2.24 |

|

732300 |

136.00 |

139.00 |

3.00 |

1.92 |

0.51 |

4.1 |

1.60 |

|

732301 |

139.00 |

142.00 |

3.00 |

2.77 |

0.61 |

4.6 |

2.18 |

|

732302 |

142.00 |

145.00 |

3.00 |

3.63 |

0.61 |

4.6 |

2.66 |

|

732303 |

145.00 |

148.00 |

3.00 |

3.87 |

0.62 |

4.6 |

2.80 |

|

732304 |

148.00 |

149.50 |

1.50 |

4.65 |

0.72 |

6.0 |

3.35 |

|

732305 |

149.50 |

151.00 |

1.50 |

4.82 |

0.86 |

6.6 |

3.59 |

|

732306 |

151.00 |

154.00 |

3.00 |

2.85 |

0.72 |

4.7 |

2.34 |

|

732307 |

154.00 |

157.00 |

3.00 |

1.01 |

0.21 |

1.7 |

0.78 |

|

732308 |

157.00 |

160.00 |

3.00 |

2.70 |

0.32 |

2.7 |

1.84 |

|

732309 |

160.00 |

163.00 |

3.00 |

2.78 |

0.31 |

2.6 |

1.87 |

|

732311 |

163.00 |

166.00 |

3.00 |

2.15 |

0.38 |

3.5 |

1.60 |

|

732312 |

166.00 |

169.00 |

3.00 |

2.71 |

0.42 |

3.6 |

1.96 |

|

732313 |

169.00 |

172.00 |

3.00 |

2.06 |

0.37 |

4.0 |

1.54 |

|

732314 |

172.00 |

175.00 |

3.00 |

1.93 |

0.33 |

4.4 |

1.43 |

|

732315 |

175.00 |

178.00 |

3.00 |

1.36 |

0.16 |

2.8 |

0.94 |

|

732316 |

178.00 |

180.30 |

2.30 |

2.54 |

0.27 |

4.6 |

1.72 |

|

732317 |

180.30 |

182.25 |

1.95 |

1.54 |

0.21 |

2.9 |

1.09 |

|

732318 |

182.25 |

184.75 |

2.50 |

4.03 |

0.38 |

4.2 |

2.65 |

|

732319 |

184.75 |

187.00 |

2.25 |

0.90 |

0.19 |

1.8 |

0.70 |

|

732320 |

187.00 |

190.00 |

3.00 |

0.90 |

0.19 |

1.4 |

0.70 |

|

732321 |

190.00 |

192.25 |

2.25 |

3.05 |

0.32 |

1.9 |

2.02 |

|

732322 |

192.25 |

194.50 |

2.25 |

2.99 |

0.31 |

2.5 |

1.99 |

See Table 1 for Notes.

Hole JP24074

|

Sample |

From (m) |

To |

Int.1,2,3 (m) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

CuEQ4 (%) |

|---|---|---|---|---|---|---|---|

|

731140 |

111.00 |

114.00 |

3.00 |

1.00 |

0.65 |

8.1 |

1.26 |

|

731141 |

114.00 |

117.00 |

3.00 |

1.26 |

0.55 |

8.0 |

1.30 |

|

731142 |

117.00 |

120.00 |

3.00 |

0.64 |

0.27 |

4.1 |

0.65 |

|

731143 |

120.00 |

123.00 |

3.00 |

1.48 |

0.49 |

8.1 |

1.36 |

|

731144 |

123.00 |

126.00 |

3.00 |

1.47 |

0.48 |

6.6 |

1.34 |

|

731145 |

126.00 |

129.00 |

3.00 |

1.01 |

0.40 |

4.9 |

1.00 |

|

731146 |

129.00 |

132.00 |

3.00 |

1.59 |

0.59 |

6.3 |

1.51 |

|

731147 |

132.00 |

135.00 |

3.00 |

2.02 |

0.62 |

6.6 |

1.79 |

|

731148 |

135.00 |

138.00 |

3.00 |

1.48 |

0.53 |

5.2 |

1.39 |

|

731149 |

138.00 |

141.00 |

3.00 |

4.01 |

0.84 |

10.5 |

3.14 |

|

731151 |

141.00 |

144.00 |

3.00 |

4.94 |

1.16 |

14.2 |

4.00 |

|

731152 |

144.00 |

147.00 |

3.00 |

4.32 |

0.99 |

8.8 |

3.45 |

|

731153 |

147.00 |

150.00 |

3.00 |

3.02 |

0.78 |

6.8 |

2.50 |

|

731154 |

150.00 |

153.00 |

3.00 |

3.63 |

1.31 |

11.3 |

3.40 |

|

731155 |

153.00 |

156.00 |

3.00 |

5.35 |

1.18 |

9.6 |

4.22 |

|

731156 |

156.00 |

159.00 |

3.00 |

3.33 |

0.98 |

8.0 |

2.89 |

|

731157 |

159.00 |

162.00 |

3.00 |

5.25 |

1.05 |

9.8 |

4.03 |

|

731158 |

162.00 |

165.00 |

3.00 |

3.49 |

0.90 |

10.3 |

2.91 |

|

731159 |

165.00 |

168.00 |

3.00 |

2.47 |

1.14 |

13.8 |

2.60 |

|

731160 |

168.00 |

171.00 |

3.00 |

5.86 |

1.36 |

10.3 |

4.68 |

|

731161 |

171.00 |

174.00 |

3.00 |

4.78 |

0.88 |

9.6 |

3.61 |

|

731162 |

174.00 |

177.00 |

3.00 |

7.73 |

1.28 |

11.1 |

5.65 |

|

731163 |

177.00 |

180.00 |

3.00 |

8.00 |

1.34 |

11.2 |

5.86 |

|

731164 |

180.00 |

183.00 |

3.00 |

6.33 |

0.93 |

8.6 |

4.51 |

|

731165 |

183.00 |

186.00 |

3.00 |

3.52 |

0.75 |

7.2 |

2.75 |

|

731166 |

186.00 |

189.00 |

3.00 |

3.25 |

0.66 |

7.5 |

2.52 |

|

731167 |

189.00 |

192.00 |

3.00 |

2.39 |

0.69 |

7.9 |

2.08 |

|

731168 |

192.00 |

195.00 |

3.00 |

3.84 |

0.57 |

4.6 |

2.74 |

|

731169 |

195.00 |

198.00 |

3.00 |

2.07 |

0.64 |

6.4 |

1.83 |

|

731171 |

198.00 |

201.00 |

3.00 |

1.09 |

0.97 |

11.4 |

1.65 |

|

731172 |

201.00 |

201.70 |

0.70 |

2.05 |

0.65 |

8.0 |

1.84 |

|

731173 |

201.70 |

202.90 |

1.20 |

0.06 |

0.03 |

0.6 |

0.06 |

|

731174 |

202.90 |

204.00 |

1.10 |

2.74 |

0.75 |

8.9 |

2.33 |

|

731175 |

204.00 |

207.00 |

3.00 |

1.62 |

1.14 |

12.9 |

2.12 |

|

731176 |

207.00 |

210.00 |

3.00 |

1.84 |

0.89 |

15.1 |

2.01 |

|

731177 |

210.00 |

213.00 |

3.00 |

2.41 |

0.90 |

15.4 |

2.34 |

|

731178 |

213.00 |

216.00 |

3.00 |

2.06 |

0.61 |

10.0 |

1.82 |

|

731179 |

216.00 |

219.00 |

3.00 |

1.10 |

0.51 |

8.3 |

1.17 |

|

731180 |

219.00 |

222.00 |

3.00 |

0.58 |

0.32 |

6.6 |

0.69 |

|

731181 |

222.00 |

225.00 |

3.00 |

0.78 |

0.36 |

6.0 |

0.84 |

See Table 1 for Notes.

Table 3: AuRORA Drill Hole Information Section N7800

|

Drill Hole |

Easting |

Northing |

Elevation |

Azim (°) |

Dip (°) |

EOH (m) |

|

JP24057 |

622779 |

6347801 |

1368 |

90 |

-70 |

586 |

|

JP24059 |

622776 |

6347801 |

1369 |

270 |

-60 |

427.4 |

|

JP24071 |

622770 |

6347796 |

1370 |

180 |

-60 |

374 |

|

JP24074 |

622920 |

6347799 |

1385 |

90 |

-70 |

315 |

|

JP24076 |

622655 |

6347819 |

1369 |

270 |

-60 |

258 |

|

JP24079 |

623060 |

6347815 |

1422 |

88 |

-60 |

503 |

|

JP24082 |

623059 |

6347815 |

1422 |

0 |

-90 |

311 |

Note: Collar locations are in UTM NAD83, Zone 9N coordinates.

Figure 2: AuRORA Deposit Discovery: Located in the New Underexplored NWG Target

Figure 3: AuRORA Deposit Discovery: Hosted Within the Exciting New NWG Target Area

IP-Chargeability Anomaly Never Previously Drilled

Figure 4: AuRORA Deposit Discovery Never Previously Drilled and Open to Expansion

Figure 5: AuRORA Deposit Discovery: Drilling Outlines Open-Ended, Near Surface, Continuous,

High Grade Cu-Au-Ag Mineralization (Section 7800N)

6 Mining Companies Make Top 20 on 2025 OTCQX Best 50 List

Six mining companies broke the Top 20 rankings in the recently released 2025 OTCQX Best 50, an annual ranking recognizing the 50 top-performing companies traded on the OTCQX Best Market during the previous calendar year.

The rankings evaluate companies based on a combination of one-year total return and average daily dollar volume growth, offering investors insight into companies delivering strong performance across diverse sectors.

The 2025 OTCQX Best 50 features a broad array of US and international firms, with industries ranging from technology and healthcare to mining and financial services. Companies in the resource sectors were well represented on the list, with more than 15 focused on mining and energy placing in the Best 50.

This year, the companies on the list collectively achieved a median total return of 74 percent and a combined trading dollar volume of US$5.85 billion.

Learn about the six mining stocks that made it into the OTCQX Best 50’s top 20 below.

1. American Rare Earths (OTCQX:AMRRY,ASX:ARR)

{“@context”:”http://schema.org”,”@type”:”Corporation”,”name”:”American Rare Earths Limited”,”url”:”https://investingnews.com/stocks/asx-arr/american-rare-earths-limited/”,”description”:”American Rare Earths Ltd is a mining and exploration company. It is focused on the discovery and development of strategic mineral resources.”,”tickerSymbol”:”ASX:ARR”,”sameAs”:[],”image”:”https://investingnews.com/media-library/american-rare-earths-limited.png?id=53152134&width=980″,”logo”:”https://investingnews.com/media-library/american-rare-earths-limited.png?id=53152134&width=210″}

The highest-ranking mining company on the list is American Rare Earths, which came in third place on the OTCQX Best 50 list. Headquartered in Auckland, New Zealand, the company focuses on critical mineral projects that support the global transition to renewable energy and advanced technologies.

Its flagship Halleck Creek rare earths project in Wyoming spans over 2,428 hectares and represents a significant step toward securing domestic US rare earth supply chains. Last February, the company increased the resource estimate at Halleck Creek by 64 percent.

In December, the company’s subsidiary, Wyoming Rare USA, secured a facility at the Western Research Institute in Laramie, Wyoming, backed by a US$7.1 million grant from the state of Wyoming. This January, it was granted a license to conduct test mining at the Cowboy State Mine within the Halleck Creek project.

In addition to Halleck Creek, the company operates the La Paz rare earth project in Arizona and the Searchlight heavy rare earths project in Nevada near the Mountain Pass mine.

2. Luca Mining (OTCQX:LUCMF,TSXV:LUCA)

Luca Mining, which placed fifth on the OTCQX list, is a Canadian mining company with operations centered in Mexico. It operates two flagship assets: the Campo Morado mine in Guerrero state, a polymetallic project processing over 2,500 metric tons of ore per day, and the Tahuehueto project in Durango State, which has entered pre-production with a designed capacity of 1,000 metric tons per day.

Through the first nine months of 2024, Luca produced 40,083 ounces of gold equivalent from a mix of gold, silver, zinc, copper and lead. Just this month, Luca initiated its first exploration drilling campaign at Campo Morado in over a decade, aiming to expand mineral resources and identify untapped zones of potential.

3. Freegold Ventures (OTCQX:FGOVF,TSX:FVL)

{“@context”:”http://schema.org”,”@type”:”Corporation”,”name”:”Freegold Ventures”,”url”:”https://www.freegoldventures.com/”,”description”:”Developing highly prospective gold and copper projects in Alaska”,”tickerSymbol”:”TSX:FVL”,”sameAs”:[“https://twitter.com/FreegoldVen”],”image”:”https://investingnews.com/media-library/freegold-ventures-logo.png?id=52146198&width=980″,”logo”:”https://investingnews.com/media-library/freegold-ventures-logo.png?id=52146198&width=210″}

Freegold Ventures ranked 11th in the 2025 OTCQX Best 50, focuses on gold and copper exploration in Alaska, where it operates the Golden Summit gold and Shorty Creek copper-gold projects.

Golden Summit, located near Fairbanks in the Tintina gold belt, is an advanced-stage gold project and one of North America’s largest undeveloped gold resources following a major resource update in early 2023.

The company’s 2024 drilling program yielded high-grade gold intercepts to the west and southwest at Golden Summit, reinforcing its expansion potential. Results from the program will be used for an updated mineral resource estimate in 2025.

4. Montage Gold (OTCQX:MAUTF,TSXV:MAU)

{“@context”:”http://schema.org”,”@type”:”Corporation”,”name”:”Montage Gold Corp.”,”url”:”https://www.montagegoldcorp.com”,”description”:”Montage Gold Corp is a mineral exploration and development company. It is engaged in the acquisition, exploration and development of mineral properties in Africa. The company’s mineral properties are located in Cote d’Ivoire where it owns four permits and nine permit applications. Its projects include the Morondo Gold Project, the Korokaha Gold Project, and the Bobosso Gold Project.”,”tickerSymbol”:”TSXV:MAU”,”sameAs”:[]}

In 12th place on the Best 50 is Montage Gold. The company is advancing its flagship Koné gold project in Côte d’Ivoire toward becoming a significant African gold producer.

According to Montage, the Koné project stands out as one of Africa’s highest-quality gold assets, with a 16-year mine life, low all-in sustaining costs (AISC) of US$998 per ounce, and an annual production target exceeding 300,000 ounces during its first eight years.

Construction of the Koné project officially commenced in late 2024, with first gold production anticipated by Q2 2027 and supported by over US$900 million in liquidity.

5. Lundin Gold (OTCQX:LUGDF,TSX:LUG)

{“@context”:”http://schema.org”,”@type”:”Corporation”,”name”:”Lundin Gold Inc.”,”url”:”https://www.lundingold.com”,”description”:”Lundin Gold Inc is a Canada based company focused on its Fruta del Norte gold operation and developing its portfolio of mineral concessions in Ecuador. The Fruta del Norte deposit is located within a 150 km long copper-gold metallogenic sub-province located in the Cordillera del Condor region in southeastern Ecuador.”,”tickerSymbol”:”TSX:LUG”,”sameAs”:[],”image”:”https://investingnews.com/media-library/image.gif?id=32225685&width=980″,”logo”:”https://investingnews.com/media-library/image.gif?id=32225685&width=210″}

Lundin Gold, which ranked 14th overall, is a Canadian mining company that owns and operates the Fruta del Norte gold mine in Southeast Ecuador.

This mine, one of the highest-grade operating gold mines globally, has been a key contributor to Lundin’s growth since commencing production in late 2019.

In 2024, Lundin Gold achieved a record annual production of 502,029 ounces of gold from Fruta del Norte, surpassing its guidance of 450,000 to 500,000 ounces. The fourth quarter alone saw production of 135,241 ounces, including 88,834 ounces of concentrate and 46,407 ounces of doré.

6. G2 Goldfields (OTCQX:GUYGF,TSXV:GTWO)

{“@context”:”http://schema.org”,”@type”:”Corporation”,”name”:”G2 Goldfields Inc.”,”url”:”https://www.g2goldfields.com”,”description”:”G2 Goldfields Inc is a Canada-based company engaged in the business of acquiring and exploring mineral properties. The company’s project portfolio includes Sandy Lake Gold Project in Canada, Aremu / Oko Gold Project in Guyana, and Peters Mine in Guyana.”,”tickerSymbol”:”TSXV:GTWO”,”sameAs”:[]}

In 16th place is G2 Goldfields, a Canada-based exploration company with a strong presence in Guyana’s gold-rich regions.

The company holds 100 percent interests in projects located within the Oko Aremu and Puruni districts, including its Oko gold project, advancing its position as a key player in the region’s mining landscape.

Recently, G2 filed an independent technical report for its New Aremu project, highlighting substantial gold mineralization in quartz veins and boulders.

The company has also announced plans to spin out several greenfield assets into a new subsidiary, G3 Goldfields. This initiative aims to sharpen G2’s focus on its core properties while allowing G3 to expand its portfolio with promising gold projects in the Cuyuni and Puruni districts.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Freegold Ventures is a client of the Investing News Network. This article is not paid-for content.

Arafura Pens AU$200 Million Agreement to Fund Nolans Rare Earths Project

Arafura Rare Earths (ASX:ARU,OTC Pink:ARAFF) said on Wednesday (January 15) that it has signed a binding term sheet for its Nolans rare earths project with the National Reconstruction Fund Corporation (NRFC).

The term sheet is for a AU$200 million investment to support the development of Nolans. The money brings total public funding for Nolans to AU$1 billion, with AU$840 million committed by the federal government in March 2024.

The NRFC investment will happen through the issue of unsecured convertible notes, which hold a conversion period of seven years and a non-convertible period of two years. Their total tenor is 15 years.

At the NRFC’s election during the conversion period, the convertible notes will convert into fully paid Arafura shares at a fixed price, which will be set at a level 40 percent higher than the reference price.

The reference price will be based on a future equity raise needed to fund and develop Nolans.

This equity raise is expected to be announced when Arafura makes its final investment decision for Nolans.

“This deal has been months in the making and de-risks the equity funding required for the development of Nolans,” said Arafura Managing Director Darryl Cuzzubbo, adding that it highlights the project’s strategic importance.

Located 135 kilometres north of Alice Springs in Northern Territory, the Nolans project is positioned to become a major supplier of neodymium and praseodymium to the high-performance permanent magnet market.

Arafura said the project benefits from its location and proximity to transport, water and energy infrastructure.

“Rare earth minerals are strategically important resources that are crucial to modern economies and the global transition to net zero,” commented NRFC Chairman Martijn Wilder AM.

“Arafura’s Nolans Project demonstrates the enormous contribution that Australia can make to the global supply of rare earth minerals and the considerable opportunities for Australia to add value to the raw materials that it mines.”

The issue of the convertible notes is still subject to certain conditions, including finalisation and long-term documentation between Arafura and the NRFC, and shareholder approval.

Arafura’s share price ended the week up just over 25 percent, closing at AU$0.14 on the ASX.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

CleanTech Lithium

Investor Insight

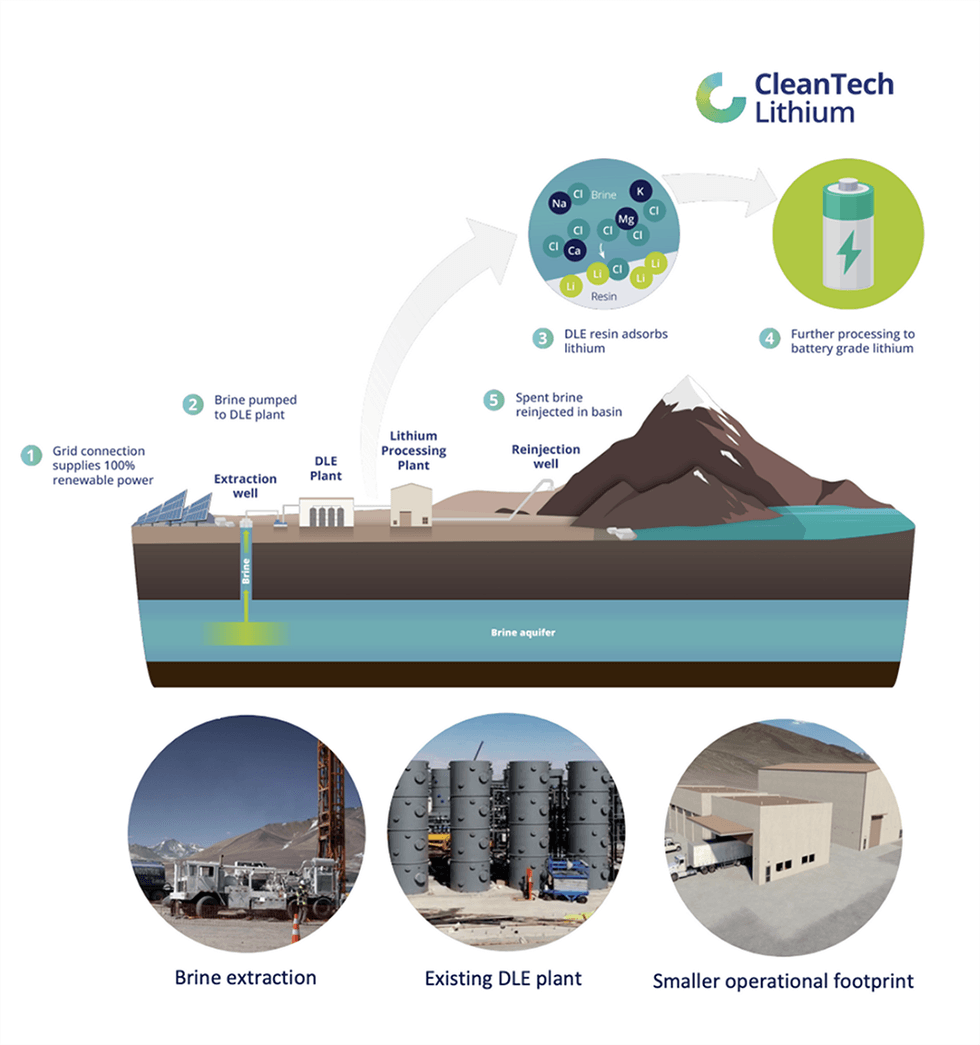

Executing a well-defined project development strategy for its lithium assets and advancing Direct Lithium Extraction (DLE), CleanTech Lithium is poised to become a key player in an expanding batteries market.

Overview

CleanTech Lithium (AIM:CTL,FWB:T2N) is a resource exploration and development company with four lithium assets with an estimated 2.72 million tons (Mt) of lithium carbonate equivalent (LCE) in Chile, a world-renowned mining-friendly jurisdiction. The company aims to be a leading supplier of ‘green lithium’ to the electric vehicle (EV) market, leveraging direct lithium extraction (DLE) – a low-impact, low-carbon and low-water method of extracting lithium from brine.

Lithium demand is soaring as a result of a rapidly expanding EV market. One study estimates the world needs 2 billion EVs on the road to meet global net-zero goals. Yet, the gap between supply and demand continues to widen. As the world races to secure new supplies of critical minerals, Chile has emerged as an ideal investment jurisdiction with mining-friendly regulations and a skilled local workforce to drive towards a clean green economy. Chile is already the biggest supplier of copper and second largest supplier of lithium.

With an experienced team in natural resources, CleanTech Lithium holds itself accountable to a responsible ESG-led approach, a critical advantage for governments and major car manufacturers looking to secure a cleaner supply chain.

Laguna Verde is at pre-feasibility study stage targeted to be in ramp-up production from 2027. Laguna Verde has a JORC resource estimate of 1.8 Mt of lithium carbonate equivalent (LCE) while Viento Andino boasts 0.92 Mt LCE, each supporting 20,000 tons per annum (tpa) production with a 30-year and 12-year mine life, respectively. The latest drilling programme at Laguna Verde finished in June 2024, results from which will be used to convert resources into reserves.

The lead project, Laguna Verde, will be developed first, after which Veinto Andino will follow suit using the design and experience gained from Laguna Verde, as the company works towards its goal of becoming a significant green lithium producer serving the EV market.

The Company is carrying out the necessary environmental impact assessments in partnership with the local communities. The indigenous communities will provide valuable data that will be included in the assessments. The Company has signed agreements with the three of core communities to support the project development.

The company also has two prospective exploration assets – the Llamara project and Salar de Atacama/Arenas Blancas project. Llamara project is a greenfield asset in the Antofagasta region and is around 600 kilometers north of Laguna Verde and Veinto Andino. The project is located in the Pampa del Tamarugal basin, one of the largest basins in the Lithium Triangle.

Salar de Atacama/Arenas Blancas comprises 140 licenses covering 377 sq km in the Salar de Atacama basin, one of the leading lithium-producing regions in the world with proven mineable deposits of 9.2 Mt.

CleanTech Lithium is committed to an ESG-led approach to its strategy and supporting its downstream partners looking to secure a cleaner supply chain. In line with this, the company plans to use renewable energy and the eco-friendly DLE process across its projects. DLE is considered an efficient option for lithium brine extraction that makes the least environmental impact, with no use of evaporation ponds, no carbon-intensive processes and reduced levels of water consumption. In recognition, Chile’s government plans to prioritize DLE for all new lithium projects in the country.

CleanTech Lithium’s pilot DLE plant in Copiapó was commissioned in the first quarter of 2024. To date, the company has completed the first stage of production from the DLE pilot plant producing an initial volume of 88 cubic metres of concentrated eluate – the lithium carbonate equivalent (LCE) of approximately one tonne over an operating period of 384 hours with 14 cycles. Results show the DLE adsorbent achieved a lithium recovery rate of approximately 95 percent from the brine, with total recovery (adsorption plus desorption) achieving approximately 88 percent. The Company’s downstream conversion process is successfully producing pilot-scale samples of lithium carbonate . As of January 2025, the Company is producing lithium carbonate from Laguna Verde concentrated eluate at the downstream pilot plant – recently proven to be high purity (99.78%). Click for highlights video.

CTL’s experienced management team, with expertise throughout the natural resources industry, leads the company toward its goal of producing green lithium for the EV market. Expertise includes geology, lithium extraction engineering and corporate administration.

Company Highlights

- CleanTech Lithium is a lithium exploration and development company with four notable lithium projects in Chile and a combined total resource of 2.72 million tonnes JORC estimate of lithium carbonate equivalent.

- Chile is one of the biggest producers of lithium carbonate in the world and the Chilean Government has prioritized innovative technologies such as DLE for new project development

- The Company leverages DLE, an efficient method for extracting lithium brine that aims to minimize environmental impact, reduce production time and costs, resulting in high-purity, battery-grade lithium carbonate

- The Company is targeting a dual-listing on the ASX in Q1 2025.

- CleanTech Lithium’s flagship project, Laguna Verde is at the Pre-Feasibility Stage, once completed, the Company looks to start substantive conversations with strategic partners.

- The Company has an operational DLE pilot plant in Copiapó, Chile producing an initial volume of 88 cubic meters of concentrated eluate, which is the lithium carbonate equivalent (LCE) of approx. one tonne, proving the Company’s capacity to produce battery-grade lithium with low impurities from its Laguna Verde brine project.

- In January 2025, the Company announced to the market the production of high purity lithium carbonate (99.78%)

- The Board consists of the former CEO of Collahuasi, the largest copper mine in the world, having held senior roles at Rio Tinto and BHP. In-country experience developing major commercial projects runs throughout the team.

- Recently appointed Australian native Tony Esplin as CEO Designate and acts as a consultant until the proposed ASX listing. Mr Esplin’s priority is to take Laguna Verde Project into the development and commercial production phase – previously Newmont’s Suriname Merian GM and director. The US$800m Project was brought to commercial production on time and under budget.

- CleanTech Lithium’s operations are underpinned by an established ESG-focused approach – a critical priority for governments introducing regulations that require a cleaner supply chain to reach net-zero targets.

Key Projects

Laguna Verde Lithium Project

The 217 sq km Laguna Verde project features a sq km hypersaline lake at the low point of the basin with a large sub-surface aquifer ideal for DLE. Laguna Verde is the company’s most advanced asset.

Project Highlights:

- Prolific JORC-compliant Resource Estimate: As of July 2023, the asset has a JORC-compliant resource estimate of 1.8 Mt of LCE at a grade of 200 mg/L lithium.

- Environmentally Friendly Extraction: The company’s asset is amenable to DLE. Instead of sending lithium brine to evaporation ponds, DLE uses a unique process where resin extracts lithium from brine, and then re-injects the brine back into the aquifer, with minimal depletion of the resources. The DLE process reduces the impact on environment, water consumption levels and production time compared with evaporation ponds and hard-rock mining methods.

- DLE Pilot Plant: The pilot DLE plant in Copiapó, commissioned in the first quarter of 2024, has produced an initial volume of 88 cubic metres of concentrated eluate, which is the lithium carbonate equivalent (LCE) of approximately one tonne further confirming the company’s capacity to produce battery-grade lithium with low impurities from its Laguna Verde brine project.

- Scoping Study: Scoping study completed in January 2023 indicated a production of 20,000 tons per annum LCE and an operational life of 30 years. Highlights of the study also includes:

- Total revenues of US$6.3 billion

- IRR of 45.1 percent and post-tax NPV8 of US$1.8 billion

- Net cash flow of US$215 million

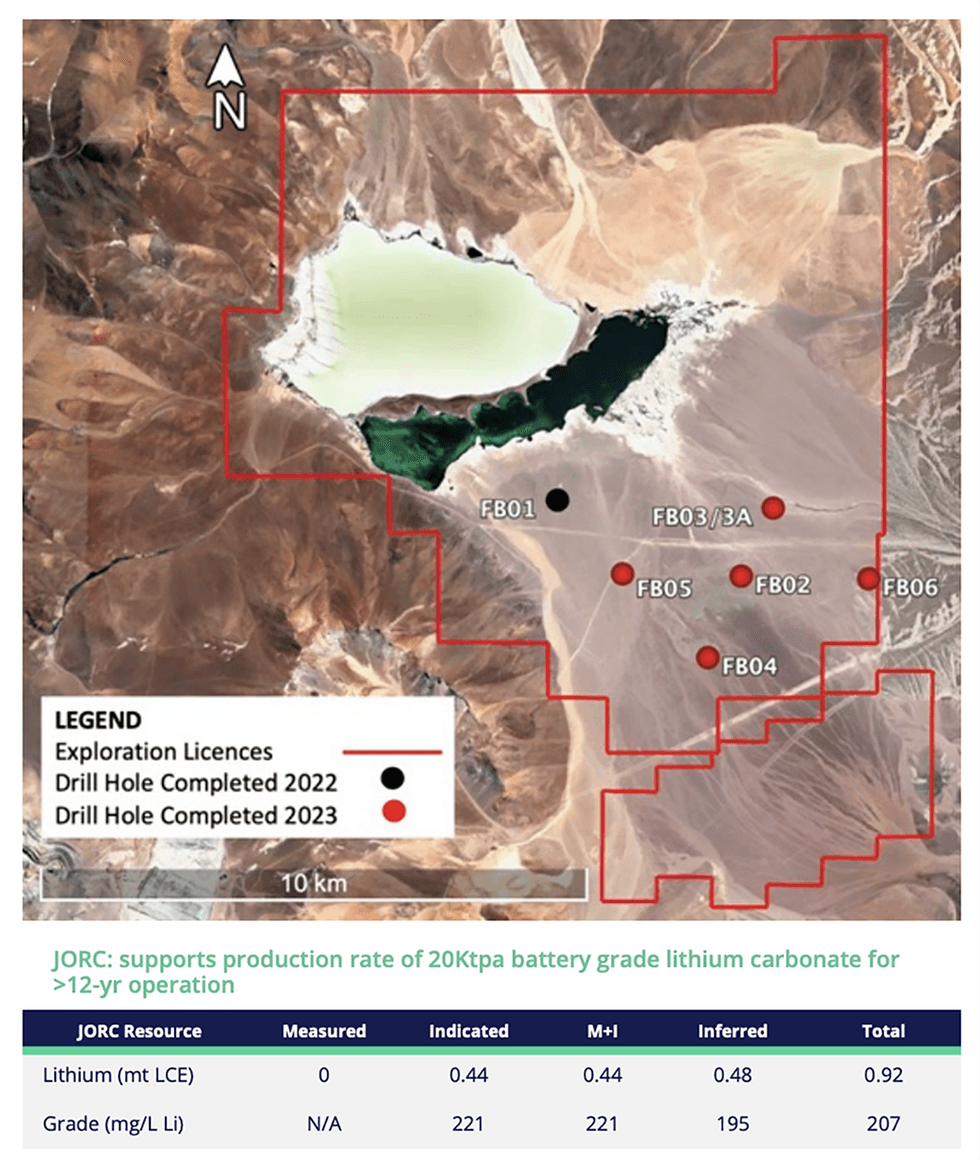

Viento Andino Lithium Project

CleanTech Lithium’s second-most advanced asset covers 127 square kilometers and is located within 100 km of Laguna Verde, with a current resource estimate of 0.92 Mt of LCE, including an indicated resource of 0.44 Mt LCE. The company’s planned second drill campaign aims to extend known deposits further.

Project Highlights:

- 2022 Lithium Discovery: Recently completed brine samples from the initial drill campaign indicate an average lithium grade of 305 mg/L.

- JORC-compliant Estimate: The inferred resource estimate was recently upgraded from 0.5 Mt to 0.92 Mt of LCE at an average grade of 207 mg/L lithium, which now includes 0.44 million tonnes at an average grade of 221 mg/L lithium in the indicated category.

- Scoping Study: A scoping study was completed in September 2023 indicating a production of up to 20,000 tons per annum LCE for an operational life of more than 12 years. Other highlights include:

- Net revenues of US$2.5 billion

- IRR of 43.5 percent and post-tax NPV 8 of US$1.1 billion

- Additional Drilling: Once drilling at Laguna Verde is completed in 2024, CleanTech Lithium plans to commence further drilling at Viento Andino for a potential resource upgrade.

Llamara Lithium Project

The Llamara project is one of the largest greenfield basins in the Lithium Triangle, covering 605 square kilometers in the Pampa del Tamarugal, one of the largest basins in the Lithium Triangle. Historical exploration results indicate blue-sky potential, prompting the company to pursue additional exploration.

Project Highlights:

- Promising Historical Exploration: The asset has never been drilled; however, salt crust surface samples indicate up to 3,100 parts per million lithium. Additionally, historical geophysics lines indicate a large hypersaline aquifer. Both of these exploration results indicate potential for significant future discoveries.

- Close Proximity to Existing Operations: The Llamara project is near other known deposits:

- Atacama (SQM / Albemarle): 18,100 square kilometers

- Hombre (Muerto Livent): 4,000 square kilometers

- Pampa del Tamarugal (CleanTech): 17,150 square kilometers

Arenas Blancas

The project comprises 140 licences covering 377 sq km in the Salar de Atacama basin, a known lithium region with proven mineable deposits of 9.2 Mt and home to two of the world’s leading battery-grade lithium producers SQM and Albermarle. Following the granting of the exploration licences in 2024, the Cleantech Lithium is designing a work programme for the project

The Board

Steve Kesler – Executive Chairman

Steve Kesler has 45 years of executive and board roles experience in the mining sector across all major capital markets including AIM. Direct lithium experience as CEO/director of European Lithium and Chile experience with Escondida and as the first CEO of Collahuasi, previously held senior roles at Rio Tinto and BHP.

Anthony Esplin – Chief Executive Officer

Anthony Esplin is an Australian national who has over 30 years’ experience in the mining industry. He has held senior executive and board level positions primarily with tier one gold and base metals producers, including with Newmont Corporation, which consistently ranked among the leading miners on the Dow Jones Sustainability World Index.

He has significant experience in managing large-scale emerging markets assets, including in Peru, Mexico, Suriname, Indonesia, Australia and Papua New Guinea. Most recently COO at Discovery Silver Corporation, a TSX-listed company with development projects in Mexico. Market cap over C$730 million. Prior post as MD Barrick Nuigini.

Esplin worked and lived for over 12 years in Latin America and is fluent in Spanish. Esplin started under a consultancy contract in November 2024, visited the team in Chile and will take full-time role on completion of ASX listing. Australian resident to develop Australian investor base.

Gordon Stein – Chief Financial Officer

Gordon Stein is a commercial CFO with over 30 years of expertise in the energy, natural resources and other sectors in both executive and non-executive director roles. As a chartered accountant, he has worked with start-ups to major companies, including board roles of six LSE companies.

Maha Daoudi – Independent Non-executive Director

Maha Daoudi has more than 20 years of experience holding several Board and senior-level positions across commodities, energy transition, finance and tech-related industries, including a senior role with leading commodity trader, Trafigura. Daoudi holds expertise in offtake agreements, developing international alliances and forming strategic partnerships.

Tommy McKeith – Independent Non-executive Director

Tommy McKeith is an experienced public company director and geologist with over 30 years of mining company leadership, corporate development, project development and exploration experience. He’s held roles in an international mining company and across several ASX-listed mining companies. McKeith currently serves as non-executive director of Evolution Mining and as non-executive chairman of Arrow Minerals. Having worked in bulk, base and precious metals across numerous jurisdictions, including operations in Canada, Africa, South America and Australia, McKeith brings strategic insights to CTL with a strong focus on value creation.

Jonathan Morley-Kirk – Senior Independent Non-executive Director

Jonathan Morley-Kirk brings 30 years of experience, including 17 years in non-executive director roles with expertise in financial controls, audit, remuneration, capital raisings and taxation/structuring.

Radisson Mining Resources: Advancing High-grade Gold Exploration in Quebec

Radisson Mining Resources (TSXV:RDS,OTCQB:RMRDF) is a gold exploration company unlocking the value of its 100 percent owned O’Brien gold project. Located in the Abitibi Greenstone Belt along the prolific Larder-Lake-Cadillac Break in Quebec, Canada, the O’Brien gold project hosts the highest-grade, past-producing mine along the Cadillac Break. Radisson Mining Resources leverages its extensive drilling campaigns, high-grade historical production, and experienced management team to create value for shareholders and stakeholders.

With world-class assets, robust exploration programs, and experienced leadership, Radisson is well-positioned to deliver value to its shareholders.

The O’Brien gold project is in the Abitibi region of northwestern Quebec, along the Larder-Lake-Cadillac Break, and encompasses the historic O’Brien mine, which produced 587,121 ounces of gold at an average grade of 15.25 grams per ton (g/t) between 1926 and 1957. The company has planned a 22,000-metre drilling program to expand known mineralization below existing resources.

Company Highlights

- Flagship O’Brien Gold Project: Hosts the highest-grade, past-producing mine along the Cadillac Break, with significant resource expansion potential.

- Located in tier-one mining district amongst numerous world-class producers

- Experienced Leadership: A seasoned management team and board with a proven track record in mining exploration and development.

- Commitment to Sustainability: Prioritizes environmental stewardship and community engagement in all exploration activities.

This Radisson Mining Resources profile is part of a paid investor education campaign.*

Click here to connect with Radisson Mining Resources (TSXV:RDS) to receive an Investor Presentation