Uncategorized

Open-source DeepSeek-R1 uses pure reinforcement learning to match OpenAI o1 — at 95% less cost

Sci-fi author Alan Dean Foster moves into gaming with Pomme studio deal for Midworld — exclusive

Hamilton raises $1.7M to tokenize real-world assets on Bitcoin

Lithium Discovery Extended with Exceptional 86.9-Metre Intercept at Red Mountain, USA

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to report assay results from the second of two holes from its inaugural diamond drilling campaign at the 100%-owned Red Mountain Lithium Project in Nevada, USA. Drill-hole RMDD002 has returned an outstanding thick intersection of some of the highest-grade lithium mineralisation seen to date at the Project, intersecting:

- 86.9m @ 1,470ppm Li / 0.78% Lithium Carbonate Equivalent1 (LCE) from 18.3m, including an internal high-grade zone grading 32.1m @ 2,050ppm Li / 1.09% LCE from 46.2m

Key Highlights

- Strong lithium mineralisation returned in assays for drill- hole RMDD002, which intersected:

- 86.9m @ 1,470ppm Li from 18.3m, including 32.1m of high-grade mineralisation @ 2,050ppm Li from 46.2m.

- RMDD002 marks the thickest intercept recorded to date at Red Mountain.

- Mineralisation successfully extended 375m north of previous northernmost intersections in holes RMRC002 & 003.

- Lithium mineralisation remains open down-dip to the east and along strike to the north.

- Outstanding results strenghten the foundation for a maiden Mineral Resource Estimate in 2025.

The identification of thick, lithium mineralisation in the northernmost drill-hole at Red Mountain highlights the immense scale of the project, with strong lithium mineralisation now intersected in all drill-holes now spanning a north-south strike extent of over 5km and surface sample geochemistry indicating further potential to the north, south and west of the current drilled extents7, 9 (Figure 4).

Of particular significance in hole RMDD002 is the presence of an internal 32.1m zone of very high-grade lithium mineralisation averaging 2,050ppm Li. The identification of substantially higher-grade lithium mineralisation in this hole, as well as that in the previously announced diamond drill hole RMDD001, indicates strong potential for further high-grade zones to be discovered at Red Mountain.

With all results for the recent diamond drilling now received, the Company is finalising geological mapping ahead of planning and permitting for the next round of drilling at the Project, which will be conducted at the earliest opportunity in the 2025 field season.

Astute Chairman, Tony Leibowitz, said:

“Like all great discoveries, Red Mountain continues to grow and improve the more we drill. The manifest scale and high tenor of mineralisation are testament to Red Mountain being one of the most important recent US lithium discoveries. This drill hole is the latest in a succession of thirteen, all of which intersected strong lithium mineralisation, establishing a solid foundation for a maiden mineral resource estimate to be advanced rapidly in 2025.”

Background

Located in central-eastern Nevada (Figure 5), the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2. Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 5) such as Lithium Americas’ (NYSE: LAC) 62.1Mt LCE Thacker Pass Project3, American Battery Technology Corporation’s (OTCMKTS: ABML) 15.8Mt LCE Tonopah Flats deposit4 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project5.

Astute has completed substantial surface sampling campaigns at Red Mountain, which indicate widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock with some exceptional grades of up to 4,150ppm Li2,8 (Figure 4).

The Company’s maiden drill campaign at Red Mountain comprised 11 RC drill holes for 1,518m over a 4.6km strike length. This campaign was highly successful with strong lithium mineralisation intersected in every hole drilled9. Two diamond drill holes have been drilled at the project.

Scoping leachability testwork on mineralised material from Red Mountain indicates high leachability of lithium of up to 98%, varying with temperature, acid strength and leaching duration10.

Other attractive Project characteristics include the presence of outcropping claystone host-rocks and close proximity to infrastructure, including the Project being immediately adjacent to the Grand Army of the Republic Highway (Route 6), which links the regional mining towns of Ely and Tonopah.

Results

Hole RMDD002 successfully intersected an 86.9m thick zone of lithium mineralised clay-bearing mudstone, sandstone, tuff and limestone, from 18.3m to 105.2m down-hole. The best grades were developed in the most clay-rich zones, which exhibit a desiccated and cracked appearance in drill core once dry (Figure 2). An internal very high-grade zone of 32.1m graded 2,050ppm Li, with a maximum single sample grade of 3,850ppm Li from 59.4-61.5m (195-201.7ft), which is the drill sample with the highest lithium grade achieved to date at the project.

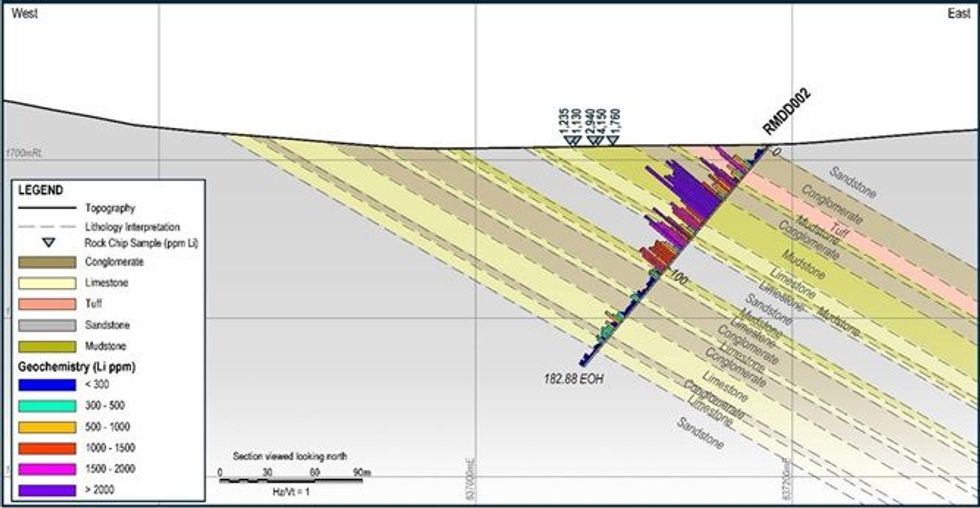

Figure 1. RMDD002 interpretative cross section, lithium geochemistry and (50-110m off-section) rock chip samples

Interpretation

The two northernmost holes drilled as part of the maiden Red Mountain RC drilling campaign, RMRC002 and RMRC003, intersected thin zones of near-surface lithium mineralisation. It was interpreted at the time that these two holes ‘clipped’ the edge of a zone of lithium bearing clay-rich rocks that was likely to thicken towards the east (see ‘open’ arrow in Figure 3)9. RMDD002 was designed to test this interpretation and, in addition, extend the mineralisation 375m further north beneath an extrapolated zone of strong rock chip sample results (Figure 1).

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Vital’s optimized MRE delivers 56% increase in Measured + Indicated resources for Tardiff rare earth deposit

Vital Metals Limited (ASX: VML) (“Vital”, “Vital Metals” or “the Company”) is pleased to report an updated Mineral Resource estimate (“MRE”) for the Tardiff Upper Zone (“Tardiff”), part of the Nechalacho Rare Earths Project (the “Project”), located in Northwest Territories (NWT), Canada.

Highlights:

- New Tardiff MRE total resource tonnage (across all categories) of 192.7 million tonnes at 1.3% total rare earth oxide (TREO), containing 2.5Mt TREO.

- Tardiff is estimated to contain 636,000 tonnes of NdPr (neodymium oxide + praseodymium oxide).

- Incorporating all the latest drilling data this new estimate, compared to the April 2024 MRE, delivers:

- 70% increase in reported tonnes in the Indicated Resource category;

- 56% increase in reported tonnes in Measured + Indicated Resource categories;

- 2% increase in contained NdPr;

- Niobium (Nb2O5), hosted within the same geological formations hosting the rare earth mineralisation, reported for the first time.

- Current MRE is reported above a 0.7% TREO cutoff grade instead of a metal equivalent value previously used.

- Vital is using the updated Tardiff MRE as the basis for a Scoping Study to examine the size and scalability of future production scenarios. This is expected in the coming weeks.

The current MRE follows Vital’s completion of resource definition drilling program at Tardiff in 2023, totalling 74 holes for 6,664m, which returned high-grade results up to 8% TREO.

The current MRE features a total resource tonnage (across all categories) of 192.7Mt grading 1.3% TREO and 0.3% Nb2O5, containing 2.52Mt TREO including 636,000t of NdPr.

Vital Managing Director and CEO Lisa Riley said: “Our updated MRE for the Tardiff deposit shows increased confidence in the deposit, with a 70% increase in the Indicated Resource tonnages and a 56% increase in the Measured + Indicated Resource tonnages compared to our April 2024 historical MRE, while our Inferred Resource tonnages have decreased by more than 20%. While our overall totals of contained TREO and NdPr have only slightly increased on the April 2024 historical MRE, based on the drilling we completed in 2023, we now have more confidence that this is a truer representation of what this deposit holds.

“The current MRE is the final piece awaited for inclusion in our Tardiff Scoping Study, which is now due for delivery in the coming weeks.”

Vital VP Exploration Natalie Pietrzak-Renaud: “The positive changes to the current MRE compared to the April 2024 historical MRE is largely based on the inclusion of the 2023 drill results, the 2024 metallurgical test results we obtained from our 2023 collected composite Tardiff sample, and the carefully considered metrics we used as inputs. Our approach is to establish outputs that are realistic pathways for project development. With the work we completed on the MRE and the forthcoming Scoping Study, we have, and continue, to build a solid foundation of data and knowledge to advance our project.”

The Tardiff MRE is reported within an optimized open-pit shell using Studio NPVS from the Datamine Suite. The optimized pit shell was generated using a 45° maximum final pit wall, and a 150m RL lower pit limit.

Tardiff contains rare earth element (“REE”) and Niobium mineralisation hosted within a nepheline syenite intrusion. Recent metallurgical test work indicates strong potential to produce neodymium oxide (Nd2O3) and praseodymium oxide (Pr6O11), which are light rare earth oxides (LREO) with magnetic properties and are in demand due to their use in technologies such as high-strength magnets, aircraft engines, and various industrial and electronic applications. The recent metallurgical test work also indicates an opportunity to further investigate and advance the potential opportunity to recover niobium minerals from Tardiff ore. Niobium is in demand due to its low oxidation point and relatively high melting point. It is used as an alloy in aeronautic engines, electronic applications (due to its superconducting properties) and as an additive to lithium-ion batteries to enhance battery life.

The current MRE represents a significant increase in reported tonnes in the Indicated Mineral Resource category in comparison to the historical MRE completed in April 2024 and a decrease in reported tonnes in the Inferred Mineral Resource category. The current MRE is also reported above a 0.7% TREO cutoff grade instead of a metal equivalent value as previously used.

Click here for the full ASX Release

This article includes content from Vital Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Cerro Leon drill results

Unico Silver Limited (“USL” or the “Company”) is pleased to announce further assay results from ongoing drilling at the Cerro Leon project, located in the Santa Cruz province of Argentina. The current drill program at Cerro Leon commenced October 2024 and is anticipated to continue through to the end of Q1 2025.

HIGHLIGHTS

- Phase 1 Reverse Circulation (RC) drilling comprised 56 holes for 4847m (completed Dec 2024).

- Assay results for 37 holes totalling 316Gm received for the CSS, Archen-Chala and Tranquilo prospects. Assay results for a further 10 holes totalling G38m are pending.

- Significant silver equivalent (AgEq1) assay results include:

- CSS (Outside MRE) (PR031-24)

- 2m at 482gpt AgEq from 42m, and

- 15m at 1G8gpt AgEq from 51m

- Chala (Outside MRE) (PR035-24)

- 10m at 651gpt AgEq from 5m, inc.

- 3m at 1G36gpt AgEq from 7m

- Archen (Outside MRE)(PR041-24)

- 17m at 42Ggpt AgEq from 95m, inc.

- 7m at 767gpt AgEq from 95m (PR042-24)

- 13m at 287gpt AgEq from 63m

- Tranquilo (Infill)(PR044-24)

- 20m at 328gpt AgEq from 21m, inc.

- 5m at G2Ggpt AgEq from 23m

- CSS (Outside MRE) (PR031-24)

- Phase 2 Diamond Drilling (10,000m) commenced mid-January 2025 with two rigs on site.

Managing Director, Todd Williams: “Drilling at Cerro Leon continues to return significant mineralisation within multiple structures that fall outside of the current Mineral Resource, including the Karina, CSS, and Archen-Chala prospects.

At Archen, drilling has returned an exceptional hole of 17m at 423gpt silver equivalent from 32m downhole depth, the highest to date for the prospect. At Chala, individual silver assay of 3134gpt silver confirm shallow high-grade silver mineralisation.

We now have 2 diamond drill rigs on site at Cerro Leon to complete a further 10,000m of drilling with a focus on expanding mineralisation at all prospects as well as ongoing regional exploration”

Click here for the full ASX Release

This article includes content from Unico Silver Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Greenland Tanbreez Project Maiden Drill Results

After consultation with ASX, European Lithium Ltd (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) is now releasing the 1st drill results from the Tanbreez Project (7.5% owned by EUR), that was previously announced by Critical Metals Corp on the NASDAQ on the 26th of November 2024 and the 9th of December 2024.

European Lithium Limited is pleased to announce that it has received the results for the first out of sixteen diamond drill holes from its confirmation drilling program at the Tanbreez Project in Greenland containing high-grade rare-earth and rare metal elements.

The drill program executed in September-October 2024 comprised sixteen holes with samples from the first hole having now been received back from the laboratory.

The Tanbreez mineralization is contained within a highly fractionated Zr-Nb-Ta- REE, including HREE, in the southern part of the Ilimaussaq intrusive complex in South Greenland. The Ilimaussaq intrusion is possibly the most differentiated deposit known globally to date, covering a potential area of approximately18 km long and 8 km wide, and of significant depth, that covers a portion of the Tanbreez tenement.

The commodities are hosted in the mineral eudialyte being concentrated in the kakortokite rock layer at the floor of the exposed intrusion. The kakortokite sequence is outcropping over an area of approximately 5.0 km by 2.5 km and has a total thickness of 270 m.

The assays from the first drill hole confirm a significant 40 m wide intersection from surface of high- grade rare-earth oxide averaging 4,722.51 ppm TREO (including 26.96% averaged heavy rare earth” HREO”), 1.82% ZrO2 “zircon oxide”, 130.92 ppm Ta2O “tantalum pentoxide”, 1852.22 ppm Nb2O5 “niobium pentoxide”, 393.68 ppm HfO2 “hafnium oxide” and 101.67 ppm Ga2O3 “gallium oxide” (See Appendix 1 Sample and assay sheet and Appendix 2 Drill hole collars)

Commenting on the assay results, Tony Sage, Executive Chairman of the Company, said:

”I am pleased to report the outstanding assay results from the first hole confirming the high-grade, high-tonnage and high-quality potential that Tanbreez brings to EUR and Critical Metals Corp. The company is pleased to announce that its first confirmation drill hole has yielded the high-grade percentage of light earth and heavy rare earth ratios with strong tantalum, niobium, and gallium results. We are excited by the scale of the thick source rock only 40 meters from the surface containing the mineralized high-grade intersection within the first drill hole”.

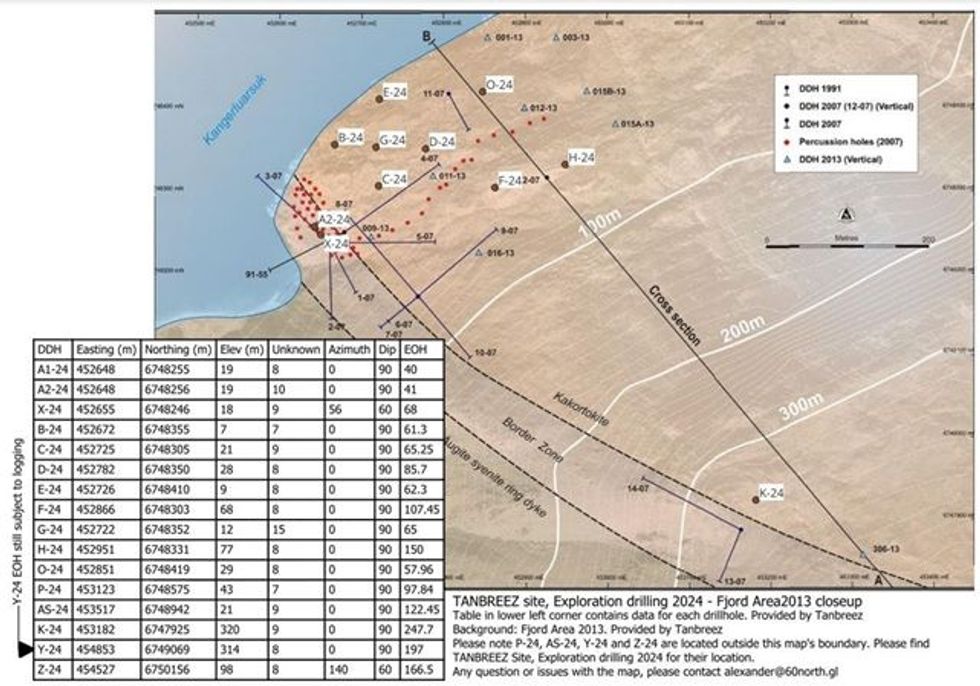

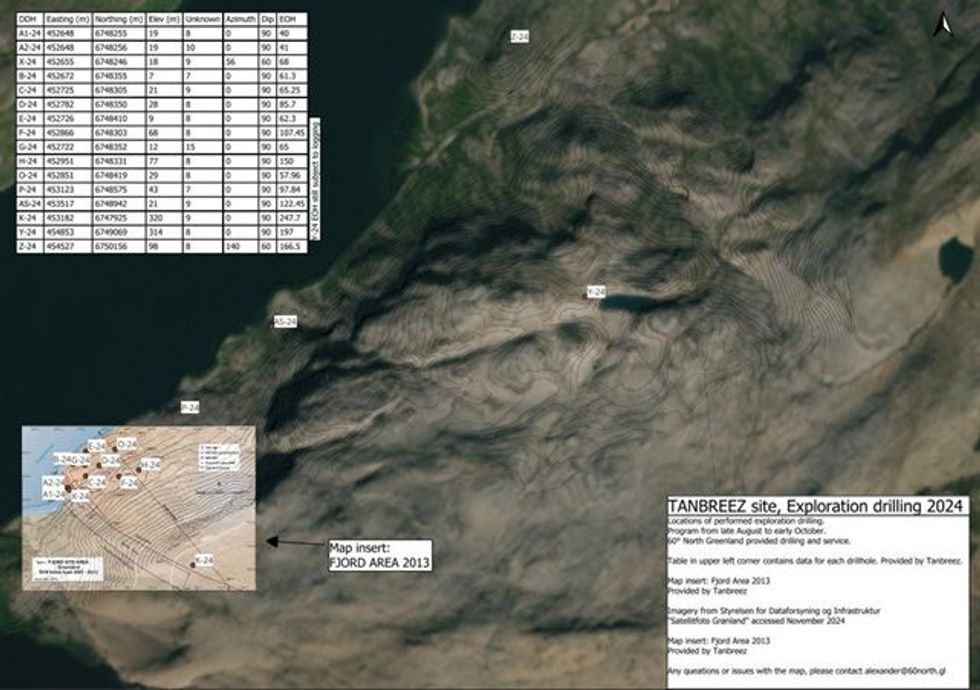

Figure 1: Exploration Drilling maps for the program 2024

Photo 1. Drill rig commences operations at the Tanbreez Project in Greenland.

About European Lithium

European Lithium Limited is an exploration and development stage mining company focused mainly on lithium in Austria, Ireland, Ukraine, and Australia.

European Lithium currently holds 66,416,641 (74.34%) ordinary shares in Critical Metals. Based on the closing share price of Critical Metals being US$8.50 per share as of 17 January 2025, the Company’s current investment in Critical Metals is valued at US$564,541,448 (A$908,911,732) noting that this valuation is subject to fluctuation in the share price of Critical Metals.

For more information, please visit https://europeanlithium.com.

This announcement has been approved for release on ASX by the Board of Directors.

About CRML

Critical Metals Corp. is a leading mining development company focused on critical metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its initial flagship asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable building block in an expanding geostrategic critical metals portfolio. In addition, Critical Metals owns a 20% interest in prospective Austrian mineral projects previously held by European Lithium and recently entered into an agreement to acquire a 92.5% controlling interest in the Tanbreez Greenland Rare Earth Mine (refer ASX announcement 11 June 2024 and 19 June 2024).

Click here for the full ASX Release

This article includes content from European Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Mortgage rates are at the highest level in nearly 8 months. So why are some people refinancing?

PEP-11 Update

MEC Resources Limited (“MEC” or the “Company”) (ASX:MMR) highlights the following information in relation to its 37.95% investee company, Advent Energy Ltd (“Advent”).

The PEP 11 Joint Venture comprising Advent as to 85% and Bounty Oil and Gas Limited (ASX:BUY) as to 15% announce that they have on 17 January 2025 been given notice by the National Offshore Petroleum Titles Administrator (“NOPTA”) that the Joint Authority has refused the Joint Venture Applications made on 23 January 2020 and 17 March 2021.

The PEP-11 permit will continue in force for a period of 2 months from 17 January 2025.

The Joint Venture has statutory legal rights to seek a review of the decisions referred to in the notice under the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and is obtaining legal advice on such a review process.

David Breeze (Managing Director) authorised the release of this announcement to the market.

Click here for the full ASX Release

This article includes content from MEC Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.