ACME Lithium Inc. (CSE: ACME) (OTCQB: ACLHF) (the “Company”, or “ACME”) is pleased to announce that it has signed a purchase agreement for a 90% interest in 31 unpatented lode mining claims comprising the Cimarron Gold Project (“Project”) in Nye County, Nevada from Crestview Exploration Inc. (CSE: CRS) (“CRS”). The Project is a high grade, highly prospective exploration opportunity with a drill-indicated historic gold resource, and a second target area with mineralized drill intercepts that remain open in several directions.

ACME’s 90% interest in the Project will be acquired for aggregate consideration of US$149,000 in cash and 1,000,000 Shares (collectively the “Purchase Price”), delivered as follows:

- ACME has paid CRS the sum of US$124,000 and will issue 500,000 Shares on closing; and

- ACME will pay to CRS an additional US$25,000 and deliver an additional 500,000 Shares within six months of closing.

Upon payment of the Purchase Price in full, ACME will own a 90% interest in the Project, and CRS will own a 10% interest in the Project. Thereafter, ACME will be responsible for all exploration and development costs of the Project up to and until such time as it has received a Preliminary Economic Assessment pertaining to all or any part of the Project (the “Trigger Date”). Until the Trigger Date, ACME will have full discretion as to operations involving the Project, including any disposition thereof.

After the Trigger Date a joint venture will then be formed between ACME and CRS and an accompanying definitive agreement governing the same will be entered into by the Parties for further ownership and development of the Project (the “Joint Venture”), which agreement will include the following basic terms:

- Initial ownership will be held 90% by ACME and 10% by CRS;

- Each party will be responsible for its pro-rata share of expenses from and after the Trigger Date;

- ACME’s deemed capital contributions to the Joint Venture as of the Trigger Date (“ACME’s Contributions”) will be the aggregate amount it has paid toward the Purchase Price hereunder together with all costs and expenditures subsequently incurred toward exploration and development of the Project (with an amount equal to 10% thereof as administrative costs); and CRS’s deemed capital contributions as of the Trigger Date will be an amount calculated as: ACME’s Contributions / 0.9 – ACME’s Contributions;

- ACME will be the operator of the Project; and will be solely responsible for determining work programs and budgets, and will continue to have full discretion as to operations involving the Project, including any disposition thereof;

- Following the Trigger Date, any failure of a party to contribute its pro-rata share of expenses will result in dilution of such party’s interest; and

- At any time, ACME may acquire one-half of CRS’s interest, being 5% in the Joint Venture (to hold a 95% interest) for USD $500,000.

- The 31 claims are subject to a 2.5% net smelter royalty (NSR) being retained by Nevada Select Royalty Inc. on production from (i) 13 claims and any property within a one mile area of interest; and (ii) 18 claims staked by Crestview.

THE PROJECT

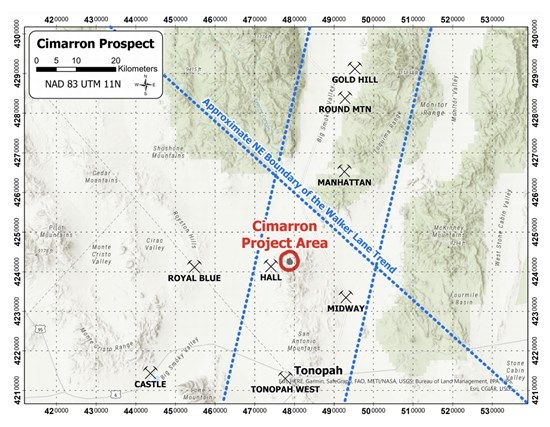

Located at the north end of the San Antonio Mountains in the historic San Antonio (Cimarron) Mining District, the Project is approximately eighteen miles north of Tonopah in Nye County, Nevada. It comprises 31 unpatented lode mining claims near the historic San Antonio Mine workings and immediately adjacent ground. The prospect has drill ready targets, subject to permitting, and offers a significant opportunity to establish a NI43-101 compliant gold resource.

Regionally, the Project is at the intersection of two prominent gold trends: the Walker-Lane trend which runs approximately NW and hosts a number of mines including Bullfrog, Goldfield, and Rawhide; and an approximately NNE trend of gold mines including Manhattan, Gold Hill, and Kinross’s “world-class” Round Mountain, which is located 28 miles away, and recorded over 15 million ounces of gold as of 2021.

Project Highlights:

- The Project includes an extensive historic record of drill results (190 holes), with high grade intercepts which included 11 meters of 4.46 g/t, 23 meters of 4.49 g/t and 46 meters of 3.94 g/t

- Past drilling outlined a historic gold resource starting at surface of approximately 50,000 ounces (1987 non NI43-101 compliant)

- The Project has good access near infrastructure and has a number of drill sites already built

- Mineral intercepts remain open in several directions

- The target is a shallow, low sulfidation oxide gold system with strong structural control.

Figure 1: Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7776/248039_c381706c14213bf2_002full.jpg

Exploration by both major and junior mining companies from 1980 through 2004, including Newmont and Echo Bay, identified gold mineralization in three discrete areas in the immediate Cimarron Mine area.

Sampling of surface outcrops and underground adits by previous explorers reported gold assays from quartz-adularia-quartz veining as high as 107 g/t and 30.2 g/t (3.12 and 0.88 oz/ton, respectively). Table 1 lists examples of high-grade assays collected by the various mining groups (Bullion River Gold Corp., Feb. 2004).

Table 1: Historic High Grade Rock Chip Samples

(Bullion River Gold Corp. Fact Sheet, 2004)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7776/248039_c381706c14213bf2_003full.jpg

Drill testing by Newmont, Budge Mining Ltd, Echo Bay, and Romarco demonstrated continuity of lower grade gold mineralization in three discrete mineralized areas at Cimarron, as shown in Table 1 and tabulated in Table 2 (resources non-compliant NI43-101). Higher grade gold intercepts were not uncommon or restricted to any particular explorer.

Table 2: Selected Drill Intercepts in Resource and Target Areas

(Bullion River Gold Corp. Fact Sheet, 2004)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7776/248039_c381706c14213bf2_004full.jpg

Echo Bay estimated a total gold resource in 1987 of over 50,000 ounces of gold within a block of about 1,500,000 tons of material in the West, East and Central Zones combined.

Table 3 Historic Resource Estimate*

* (polygonal calculation – A.F. Budge (Mining) Ltd. – 1986)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7776/248039_c381706c14213bf2_005full.jpg

This resource is not considered to be compliant with NI 43-101 standards. Additional drilling with application of proper standards and check assays would be required to verify this historical estimate. A qualified person has not done sufficient work to classify the estimate as a current mineral resource or mineral reserve. ACME is not treating this historical estimate as a current mineral resource or mineral reserve.

In 2021, Crestview drilled 4 diamond core holes in the known resource area. All of the holes intercepted anomalous mineralization. SA-01 and SA-03 were drilled approximately 200 meters apart and each intercepted significant zones of gold mineralization which may represent a wide area of oxide, heap-leachable gold mineralization starting at or near surface.

Table 4: Summary of 2021 Drilling Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7776/248039_c381706c14213bf2_006full.jpg

Cimarron represents a high quality early-stage exploration project with a drill-indicated historic resource and a target area with mineralized drill intercepts that remain open in several directions.

CORPORATE UPDATE

ACME intends to complete a consolidation of its authorized and issued common shares on the basis of one (1) post-consolidated common share for each three (3) pre-consolidation common shares (the “Consolidation”).

On a pre-Consolidation basis, the Company currently has 77,972,727 common shares issued and outstanding. Following the Consolidation the Company expects to have approximately 25,990,909 post-Consolidation common shares issued and outstanding. No fractional common shares will be issued because of the Consolidation. Any fractional common share resulting from the Consolidation will be rounded up in the case of a fractional interest that is one-half (1/2) of a common share or greater, or rounded down in case of a fractional interest that is less than one half (1/2) of a common share, and no cash consideration will be paid in respect of any fractional common share rounded down to the nearest whole common share.

All outstanding stock options and share purchase warrants of the Company will also be adjusted by the Consolidation ratio and the respective exercise prices of outstanding options and share purchase warrants will be adjusted accordingly.

The Company believes that the Consolidation will provide the Company with greater flexibility for the development of its business and the growth of the Company, including financing arrangements.

In conjunction with the Consolidation, the Company will be adopting a new name subject to the approval of the CSE.

The Consolidation and name change are subject to the approval of the Canadian Securities Exchange (CSE). In accordance with the Company’s Articles, neither the Consolidation nor the name change will require shareholder approval. The record date and effective date of the Consolidation and name change, and the new CUSIP and ISIN numbers, will be disclosed in a subsequent news release.

ACME Lithium intends to complete a private placement financing of up to CAD$800,000. The CEO of ACME has loaned the Company CAD$180,000 to complete the Cimarron transaction which will be repaid from the proceeds of the financing.

ACME will retain its current lithium property interests for future development, and will focus in the near term on the advancement of the Cimarron Gold Project.

Qualified Person

Scientific and technical information contained in this document has been reviewed and approved by Bill Feyerabend CPG who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About ACME Lithium Inc.

ACME Lithium is a mineral exploration company focused on acquiring, exploring, and developing battery and precious metal projects in partnership with leading technology and commodity companies in North America. ACME is advancing and developing a lithium brine resource at Clayton and Fish Lake Valley, Nevada and has entered into a strategic exploration agreement with leading partner at a group of projects in the pegmatite region of Shatford, Birse and Cat-Euclid Lakes in southeastern Manitoba.

On behalf of the Board of Directors

Steve Hanson

Chief Executive Officer, President, and Director

Telephone: (604) 564-9045

info@acmelithium.com

Neither the CSE nor its regulations service providers accept responsibility for the adequacy or accuracy of this news release. This news release contains certain statements which may constitute forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur and in this news release include but are not limited to the attributes of, timing for and expected benefits to be derived from exploration, drilling or development at ACME’s project properties. Information inferred from the interpretation of drilling, sampling and other technical results may also be deemed to be forward-looking statements, as it constitutes a prediction of what might be found to be present when and if a project is actually developed. There is no assurance that (i) the acquisition of the Cimarron Project will close on the terms outlined above, or at all; (ii) all of the conditions required to close the acquisition will be satisfied; (iii) the concurrent private placement will be completed; or (iv) that CSE approval to the acquisition will be received. ACME’s project location adjacent to or nearby lithium projects does not guarantee exploration success or that mineral resources or reserves will be defined on ACME’s properties. Exploration, development, and activities conducted by regional companies provide assistance and additional data for exploration work being completed by ACME. These forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements, including, without limitation: risks related to fluctuations in metal prices; uncertainties related to raising sufficient financing to fund the planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company’s properties; risk of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; the risk of environmental contamination or damage resulting from the Company’s operations and other risks and uncertainties. Any forward-looking statement speaks only as of the date it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Unless otherwise indicated, the market and industry data contained herein is based upon information from industry and other publications and the knowledge and experience of management. While we believe that this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. We have not independently verified any of the data from third-party sources referred to in this news release or ascertained the underlying assumptions relied upon by such sources. All technical and scientific disclosure pertaining to our mineral property interests in this news release have been reviewed by a Qualified Person, meaning an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association.

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. WIRE SERVICES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248039