(TheNewswire)

TORONTO TheNewswire – April 07, 2025 Noble Mineral Exploration Inc. (” Noble ” or the ” Company “) (TSXV: NOB) (OTCQB: NLPXF) is pleased to report that t he News Release issued today giving an Exploration and Corporate Update for Homeland Nickel in which Noble has a significant shareholding was issued today the contents of which are below. This all relates to the White House announcing immediate measures to be introduced to significantly increase the US production of lithium, nickel, copper, and rare earths, with an eye to increased production, the creation of jobs and, significantly, the reduction of US reliance on foreign nations.

“Homeland Nickel Provides Exploration and Corporate Update

Toronto, Ontario – April 07, 2025 – Homeland Nickel Inc. (” Homeland Nickel ” or the ” Company “) (TSX-V: SHL, OTC: SRCGF) is pleased to provide an exploration update on its 30% owned Great Burnt Copper and South Pond Gold Properties that are in joint venture with Benton Resources Inc. (“Benton”) as well as its majority-owned nickel properties located in Southern Oregon.

Great Burnt Copper, Newfoundland

Benton continues to intersect high-grade copper within the Great Burnt Main Zone and has discovered a second parallel zone (the Footwall Zone) reporting higher grades of gold. For example, hole GB-24-49 intersected 22.0 metres of 7.47% copper (Cu) at 220 metres (m) downhole within the Main Zone and 9.5 m of 0.35% Cu and 0.94 g/t gold (Au) starting at 425 m downhole within the Footwall Zone. Significant intersections from the 2023-2024 exploration programs by Benton into the Great Burnt Main Zone are summarized in Table 1. Based on a long section (Figure 1) the Main Zone has been extended along strike by 400 m and remains open down plunge to the south. The newly discovered Footwall Zone is also open.

-

GB-23-02: 13.00 m of 8.31% Cu, incl 3.00 m of 12.80% Cu

-

GB-23-04: 26.87 m of 7.18% Cu, incl 11.16 m of 10.28% Cu

-

GB-23-07: 12.30 m of 7.20% Cu, incl 7.00 m 10.60% Cu

-

GB-23-12: 25.42 m of 5.51% Cu, incl 1.00 m of 8.77% Cu, 82.00g/t Ag, 4.43g/t Au

-

GB-23-15: 22.59 m of 5.03% Cu, incl 0.50 m of 20.00% Cu

-

GB-23-16: 13.67 m of 5.80% Cu, incl 1.00 m of 20.60% Cu

-

GB-23-18: 8.17 m of 4.22% Cu, incl 7.05 m of 4.11% Cu

-

GB-23-21: 24.00 m of 5.81% Cu, incl 7.00 m of 11.47% Cu

-

GB-23-22: 21.68 m of 3.59% Cu, incl 2.00 m of 15.3% Cu

-

GB-24-23: 7.00 m of 2.02% Cu, incl 4.00 m of 3.01% Cu

-

GB-24-32: 11.29 m of 3.10% Cu, incl 6.63 m of 5.57% Cu

-

GB-24-33: 20.92 m of 2.26% Cu, incl 2.98 m of 4.17% Cu

-

GB-24-37: 18.10 m of 1.99% Cu, incl 4.50 m of 7.24% Cu

-

GB-24-40: 3.59 m of 3.47% Cu, incl 1.00 m of 4.52% Cu

-

GB-24-43: 3.73 m of 3.22% Cu

-

GB-24-45: 22.8 m of 1.23% Cu, incl 3.8 m of 2.21% Cu

-

GB-24-49: 22.0 m of 7.47% Cu, incl 15.0 m of 10.02% Cu

Note: True widths are estimated to be 70% of the above reported core lengths

Table 1 – Significant 2024 drill intersections into the Great Burnt Main Zone.

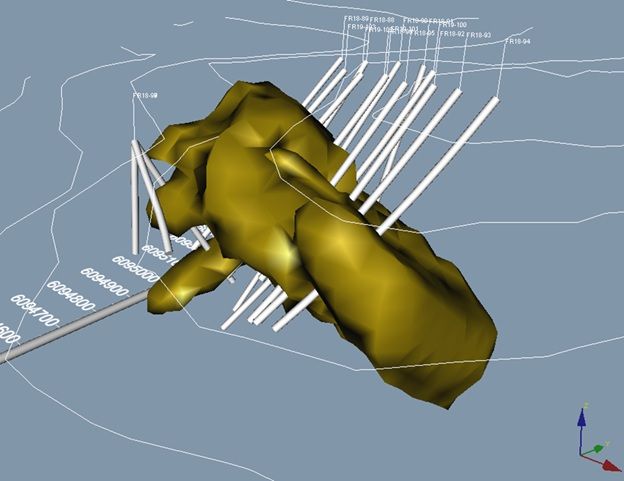

Click Image To View Full Size

Figure 1 – Long section of the Great Burnt (Main) Copper Zone.

South Pond Gold, Newfoundland

Benton conducted a drill program during 2024 encountering thick sections of gold mineralization including 54.50 m of 1.88 g/t Au in hole SP-24-32. Drilling will continue in 2025 with a 15,000 m program planned to expand the shallow mineralization at depth and along strike. Significant intersections are summarized in Table 2 with the assays from three drillholes still pending.

Note: Actual widths of the mineralization are unknown currently

Table 2 – Core length intersections of gold in South Pond Gold Zone.

Red Flat Property, Oregon

Previous exploration at Red Flat in 2007-2008 identified a historical nickel resource of 10.4 Mt at 0.84% Ni of measured and indicated plus 8.3 Mt at 0.80% Ni of inferred for a total of 317 million pounds of contained nickel using a 0.7% Ni-cutoff (AJR Consulting Inc., 2009). The resource is not compliant with NI 43-101 standards as it was not published prior to the property being acquired by Homeland Nickel.

During July 2024, Homeland Nickel visited the property with the Forest Service to review road access and to locate up to 50 sonic drillhole locations for a future exploration program. The property is road accessible across its entire length via a well-maintained gravel road with several unmaintained trails extending across the property to provide excellent overall access. Of historical significance was the presence of several large trenches (see Figure 2) that are thought to have been excavated during the 1950s by the United States Government (possibly the United States Geological Survey) where nickel laterite was exposed for vertical thicknesses up to 15 ft.

A total of forty-four (44) sonic drillhole locations were spotted and photographed and a subsequent Plan of Operation has been submitted to the Forest Service for approval. The purpose of this drill program is to determine the vertical extent of the nickel laterite along both a north-south and east-west corridor in an area with good road access. A bulk sample program is also planned whereby Homeland Nickel will excavate approximately 2,000 pounds of nickel laterite across the various exposed trenches using pickaxes and shovels to minimize the amount of surface disturbance. This material will be subject to mineralogy and metallurgy reviews as well as to determine if the nickel can be removed in-situ.

Cleopatra Property, Oregon

Cleopatra has a historical resource (not NI 43-101 compliant) of 19.803 Mt of 0.94% Ni in the measured and indicated categories as well as 19.671 Mt of 0.92% Ni in the inferred category for a total of 733 million pounds of contained nickel. The Company visited the property in 2024 and discovered that while the property could be accessed directly by four-wheel drive truck, access within the property was mostly limited to quad-runners. Homeland Nickel has proposed a sonic-hole program consisting of up to 16 shallow holes each drilled to a maximum depth of 50 feet. A Plan of Operation was submitted to the US Forest Service in August 2024 for approval.

Eight Dollar Mountain, Oregon

The Eight Dollar Mountain Property (“Eight Dollar”) is located west of the town of Selma, Oregon and is directly accessible by road. Nickel laterite is evident at surface across much of the property. A sampling program is scheduled for 2025 to obtain several undisturbed samples of nickel laterite for assaying (approximately 500 g per sample). Historic exploration at Eight Dollar has confirmed nickel laterite over a very wide area of variable grade. Homeland Nickel staked 115 mining claims in 2024 totalling 2,376 ac and has a 100% interest in the property.

Shamrock Property, Oregon

The Shamrock Property (“Shamrock”) consists of 40 mining claims totalling 758 ac, and is located 20 miles northwest of Medford, Oregon. Access is via a local gravel road extending into the property from a paved highway to within a few hundred meters of the historical workings and was visited by Homeland Nickel in August 2024. An exploration program at Shamrock is planned for 2025 to relocate the historical workings and sample local outcrops. The property was explored in 1952-53 and a bulk sample of 200-lb was removed which assayed 1.3% Ni, 1.1% Cu and 0.03 oz/t Pt. High-grade manganese was also removed and processed with assays returning 23.1-32.3% Mn. Shamrock is considered a high-grade nickel sulphide prospect, 100% owned by Homeland Nickel.

Corporate Update

Homeland Nickel continues to own a significant amount of Canada Nickel Company Inc. (TSXV: CNC) and Benton (TSXV: BEX) shares. With the recent announcement by Benton of a lithium spin-out (Vinland Lithium Inc., see Benton’s news release dated January 16, 2025) and dividend of shares to existing Benton shareholders, Homeland Nickel will benefit from its share holding of 12,682,000 BEX common shares, approximately 6.5% of Benton’s issued common shares. These spin-out shares will be held by the Company for investment purposes.

The Company has submitted a Plan of Operation for both Red Flat and Cleopatra to the US Forest Service and is expecting for a mid-spring 2025 field program. As part of the Plan of Operation, Homeland Nickel must show that its mining claims have been in good standing since 2014 and that each mining claim to be explored has prior indication of economic minerals present prior to a 2015 withdraw order which now limits exploration to existing staked prospects.

Click Image To View Full Size

Figure 2 – Excavated trench at Red Flat revealing nickel laterite at surface.

Qualified Person

Stephen J. Balch, P.Geo. (ON), the Company’s President and CEO and a “Qualified Person” under National Instrument 43-101, has reviewed and approved the technical content of this press release.

About Homeland Nickel

Homeland Nickel is a Canadian-based mineral exploration company focused on critical metal resources with nickel projects in Oregon, United States and copper and gold projects in Newfoundland, Canada. The Company holds a significant portfolio of mining securities including 2.692 million shares of Canada Nickel Company Inc. (TSX-V: CNC), 9.960 million shares of Noble Mineral Exploration Inc. (TSX-V: NOB), 12.682 million shares of Benton Resources Inc. (TSX-V: BEX) and 2.761 million shares of Magna Terra Minerals Inc. (TSX-V: MTT). Homeland Nickel’s common shares trade on the TSX Venture Exchange under the symbol “SHL.” More detailed information can be found on the Company’s website at:

http://www.homelandnickel.com

Cautionary Statement

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

This news release contains statements that constitute “forward-looking statements.” Forward-looking statements are statements that are not historical facts and include, but are not limited to, disclosure regarding possible events, that are based on assumptions and courses of action, and in certain cases, can be identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur, or the negative forms of any of these words and other similar expressions. Forward-looking statements include statements related to future plans for the Company, and other forward-looking information. Forward-looking statements are based on various assumptions including with respect to the anticipated actions of securities regulators, stock exchanges, and government entities, management plans and timelines, as well as results of operations, performance, business prospects and opportunities. Although the forward-looking statements contained in this news release are based upon what the management of the Company believes are reasonable assumptions on the date of this news release, such assumptions may prove to be incorrect. Forward-looking statements involve known and unknown risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether such results will be achieved. A number of factors could cause actual results, performance or achievements to differ materially from the results discussed in the forward-looking statements, including, but not limited to: an inability to develop and successfully implement exploration strategies; general business, economic, competitive, political and social uncertainties; the lack of available capital; impact of the evolving situation in Ukraine on the business of the Company; and other risks detailed from time-to-time in the Company’s ongoing filings with securities regulatory authorities, which filings can be found at www.sedarplus.ca. The Company cannot assure readers that actual results will be consistent with these forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements in this press release. These forward-looking statements are made as of the date of this news release and the Company disclaims any intent or obligation to update any forward-looking statement, whether because of new information, future events or otherwise, unless otherwise required by law.”

A bout Noble Mineral Exploration Inc.

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company, which has holdings of securities in Canada Nickel Company Inc., Homeland Nickel Inc., East Timmins Nickel Inc.(20%), and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario.

Noble holds mineral and/or exploration rights in ~70,000ha in Northern Ontario, ~14,000ha elsewhere in Quebec and Newfoundland, upon which it plans to generate option/joint venture exploration programs .

Noble holds mineral rights and/or exploration rights in ~18,000 hectares in the Timmins-Cochrane areas of Northern Ontario known as Project 81, ~2,215 hectares in Thomas Twp/Timmins, as well as an additional 20% interest in ~38,700 hectares in the Timmins area and ~175 hectares of mining claims in Central Newfoundland. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. Noble also holds ~4,600 hectares in the Nagagami Carbonatite Complex and its ~3,200 hectares in the Boulder Project both near Hearst, Ontario, as well as ~3,700 hectares in the Buckingham Graphite Property, ~10,152 hectares in the Havre St Pierre Nickel, Copper, PGM property, and ~1,573 hectares in the Cere-Villebon Nickel, Copper, PGM property, ~569 hectare Uranium/Rare Earth property (Chateau) and a ~461 hectare Uranium/Molybdenum property (Taser North), all of which are in the province of Quebec.

Noble’s common shares trade on the TSX Venture Exchange under the symbol “NOB.”

More detailed information on Noble is available on the website at www.noblemineralexploration.com .

Cautionary Statement Concerning Forward-Looking Statements

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company’s plans and expectations. These plans, expectations, risks, and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise .

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2025 TheNewswire – All rights reserved.