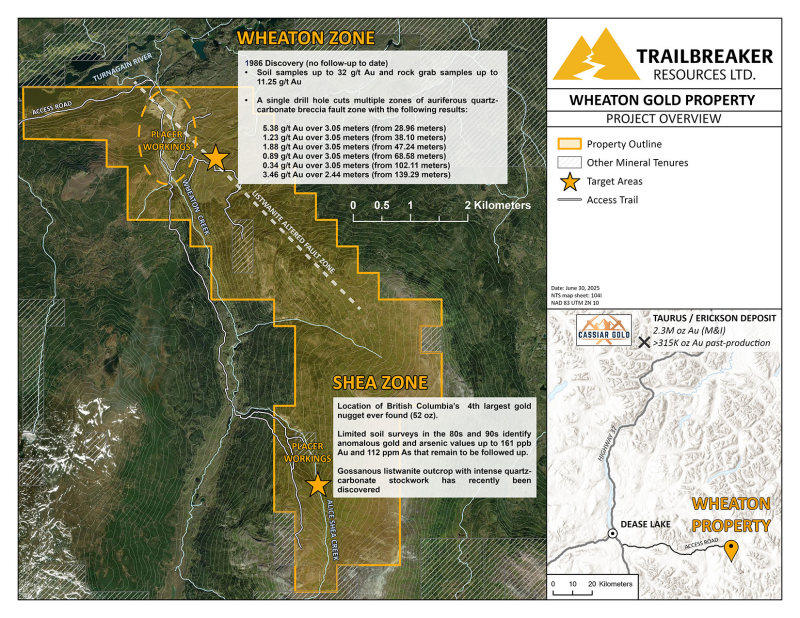

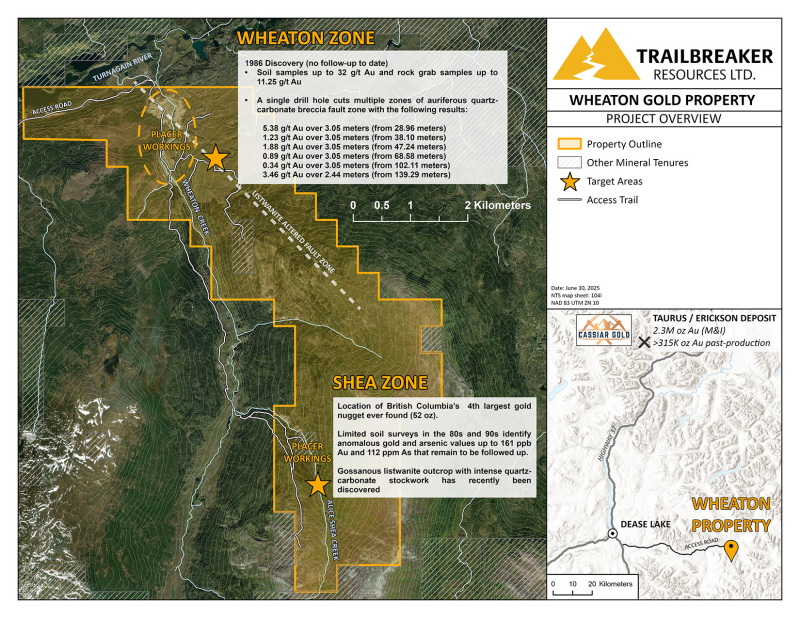

Trailbreaker Resources Ltd. (TBK.V) (“Trailbreaker” or “the Company”) is pleased to announce the acquisition of the Wheaton Gold property, an orogenic gold prospect located 60 km east of the Village of Dease Lake, British Columbia (BC). The property covers the headwaters of multiple placer gold-bearing creeks, including Alice Shea Creek, source of the famous 52 troy oz ‘Turnagain nugget’.

Highlights of the Wheaton Gold Property

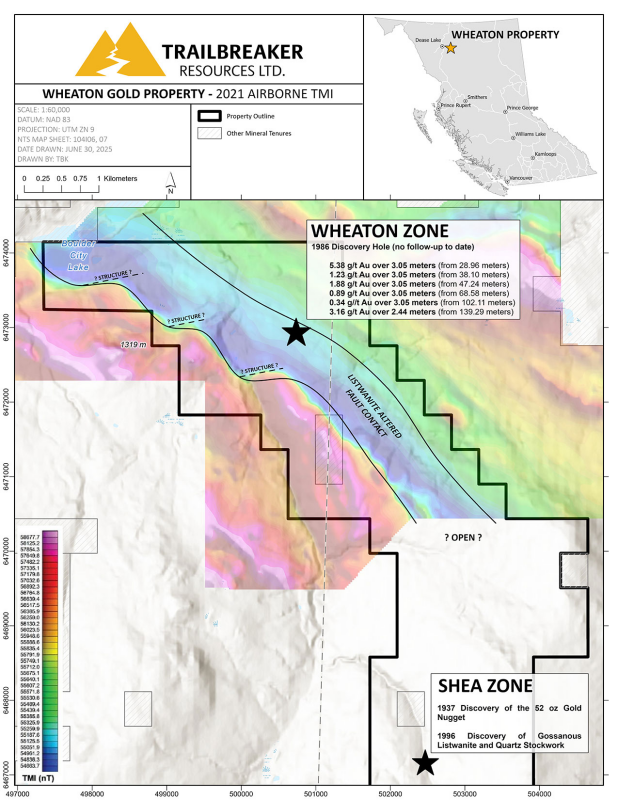

- 2,223 hectares in size, covering roughly 2 km x 9 km (Figure 1).

- Located 60 km east of Dease Lake, BC, with extensive truck and ATV trail access throughout the claims, servicing historic and current placer mining operations.

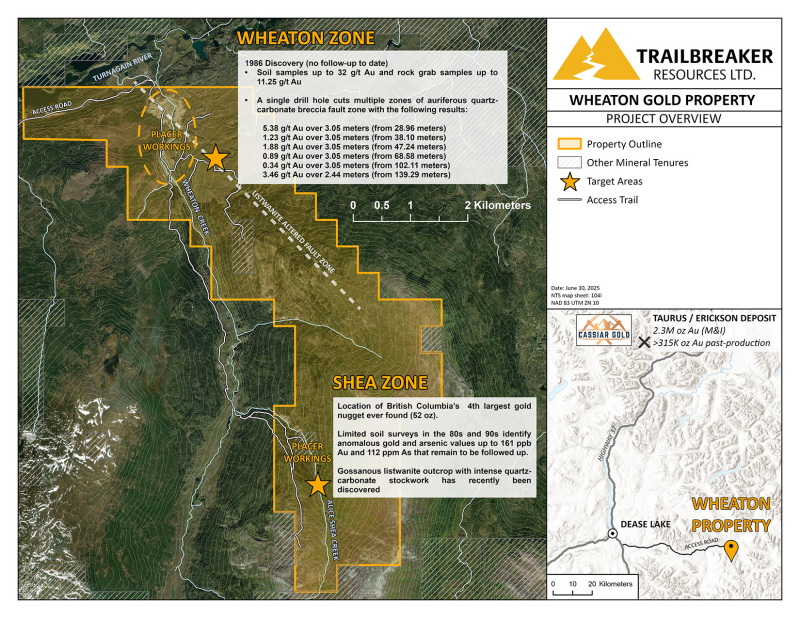

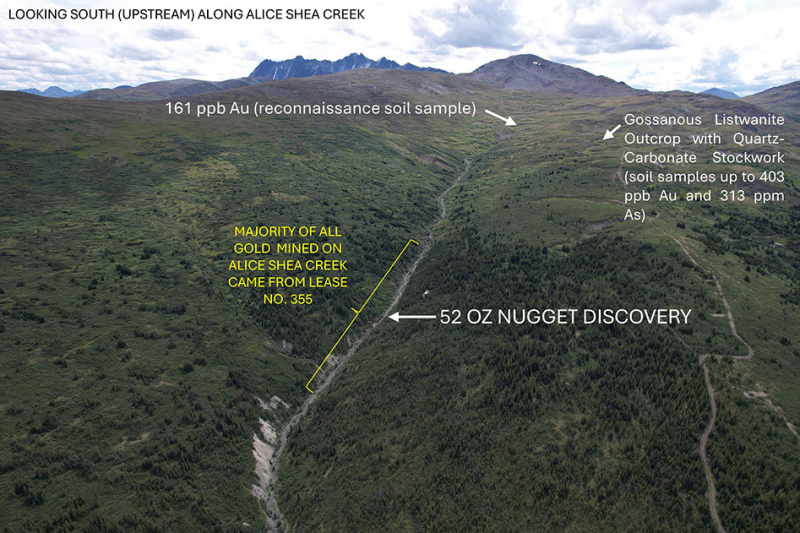

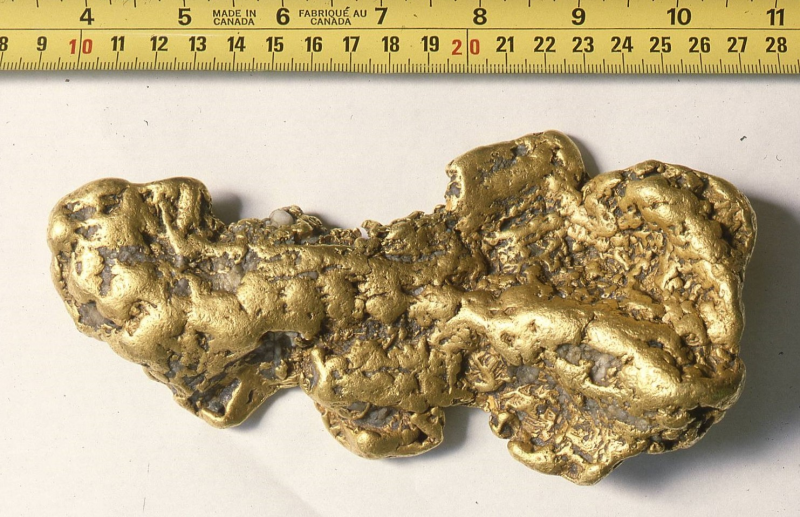

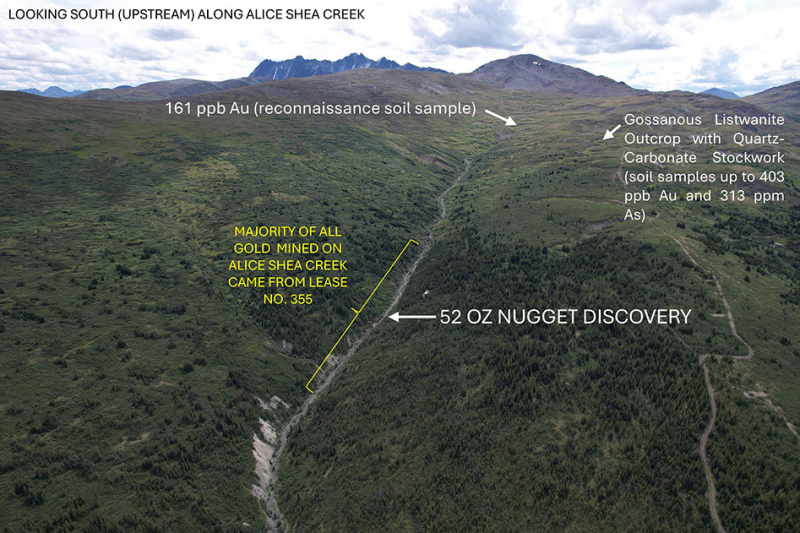

- Covers the headwaters of the placer gold-bearing Wheaton and Alice Shea creeks, which are famous as the source of some of BC’s coarsest gold nuggets. This includes the fourth largest nugget ever found in BC, the ‘Turnagain nugget’, weighing 52 oz gold (Au) (Figure 2)

- The project represents one of BC’s most underexplored placer gold districts, with very limited hardrock exploration work done to date.

- A three-hole, 304.7-meter diamond drill program completed in 1986 yielded numerous gold intercepts, including 5.38 g/t Au over 3.05 m (from 28.96m depth)

- Historic gold-in-soil values up to 32.3 g/t Au, and historic rock grab samples up to 11.25 g/t Au, have been returned.

Daithi Mac Gearailt, CEO of Trailbreaker, commented: “We are excited to add the Wheaton Gold property to our portfolio of gold and copper exploration projects. Now that the claims have been consolidated, this is a great opportunity to explore the area of a historic discovery hole that has yet to receive follow-up exploration. This is one of the few placer districts left in BC where a hardrock source of the placer gold has yet to be found. We are currently designing a robust exploration program and will be providing updates as soon as they are available.”

Location and Access

The 2,223-hectare Wheaton Gold property is located approximately 60 kilometers east-southeast of the Village of Dease Lake in northwestern British Columbia and can be accessed by all-terrain vehicles utilizing the Boulder Mine Road. The property can also be accessed by float plane chartered from Dease Lake to Boulder City Lake. Historic placer mining trails provide good vehicle access to much of the property.

Giga Metals Corporation has proposed a major road and transmission line to its advance-stage Turnagain nickel-cobalt deposit, located 10 km to the east. This would bisect the northern end of the Wheaton Gold property, further bolstering the potential economic viability of the area.

Click Image To View Full Size

Figure 1: Location of the Wheaton Gold property with historic exploration highlights.

Placer Mining History

Placer gold was first discovered at the mouth of Wheaton Creek (formerly Boulder Creek) in 1932 and shortly afterwards on Alice Shea Creek, a small tributary of Wheaton Creek. The Wheaton-Shea placer camp marked the last major placer gold discovery in BC, with a total of 7,756 oz of placer gold mined from Wheaton Creek between 1932 and 1945, and a total of 331 oz Au mined from Alice Shea between 1936 and 1940. Alice Shea Creek produced the coarsest placer gold in the drainage, with one nugget weighing over 52 oz (the Turnagain nugget, Figure 2) and numerous nuggets weighing from 1 to 16 oz. Modern-day placer mining continues to this day at the mouth of Wheaton Creek, with over 20,000 oz of placer gold estimated to be recovered to date.

Click Image To View Full Size

Figure 2: The 52 oz Turnagain nugget, discovered in Alice Shea Creek in 19371.

Hardrock Exploration History

Wheaton Zone

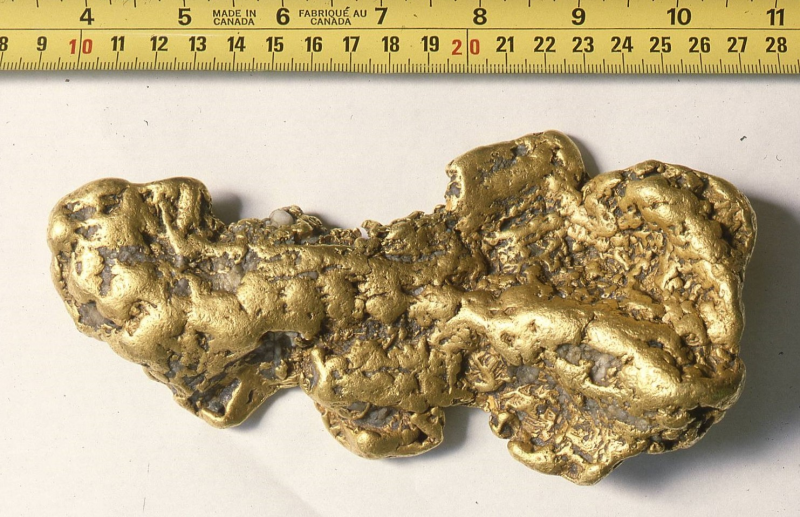

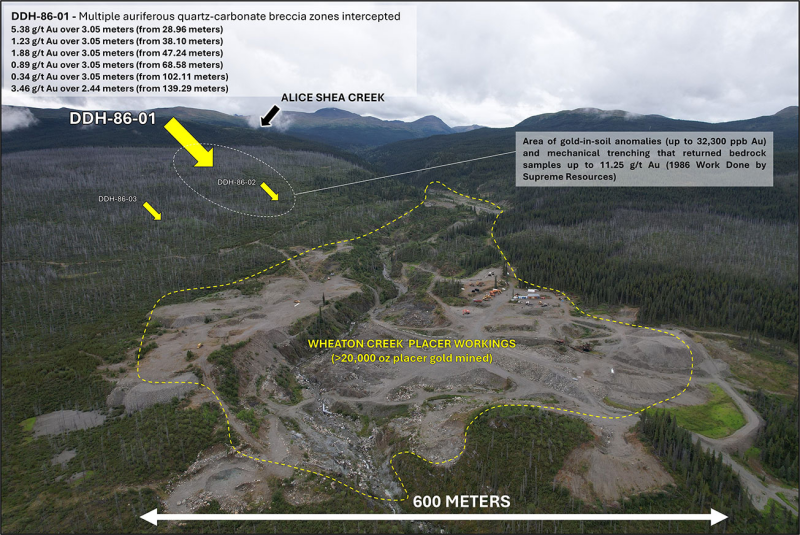

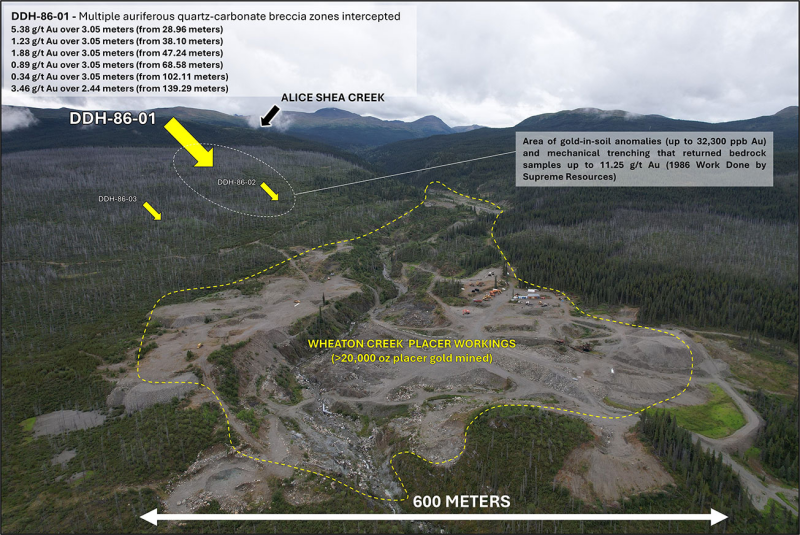

The northern portion of the property, covering the present-day placer operations near the mouth of Wheaton Creek, has seen the least amount of hardrock exploration within the property, having undergone only one documented significant program, completed in 1986 by Supreme Resources (Supreme). That year, Supreme conducted a soil geochemical survey followed by a mechanical trenching program which returned very encouraging results, and identified strongly anomalous gold-in-soil values up to 32,300 ppb Au. Trenching within these soil anomalies returned rock gab samples up to 11.25 g/t Au. During the same year, Supreme tested this zone with 3 shallow diamond drill holes totaling 304.7 meters (Figure 3). However, only limited follow-up work in the last 39 years has been documented.

Hole DDH-86-01, the first of the 1986 program, encountered several gold-enriched intervals associated with fault-controlled quartz-carbonate breccia, including:

- 5.38 g/t Au over 3.05 meters (from 28.96 meters)

- 1.23 g/t Au over 3.05 meters (from 38.10 meters)

- 1.88 g/t Au over 3.05 meters (from 47.24 meters)

- 0.89 g/t Au over 3.05 meters (from 68.58 meters)

- 0.34 g/t Au over 3.05 meters (from 102.11 meters)

- 3.46 g/t Au over 2.44 meters (from 139.29 meters)

The other two holes underwent very limited sampling, with only two samples taken from DDH-86-02 and one from DDH-86-03, all returning trace gold values.

This work by Supreme resulted in the first and only discovery of hardrock gold mineralization that could be linked to the source of the rich placer gold deposits along the lower portion of Wheaton Creek.

Click Image To View Full Size

Figure 3: Location of the 1986 diamond drill program above Wheaton Creek.

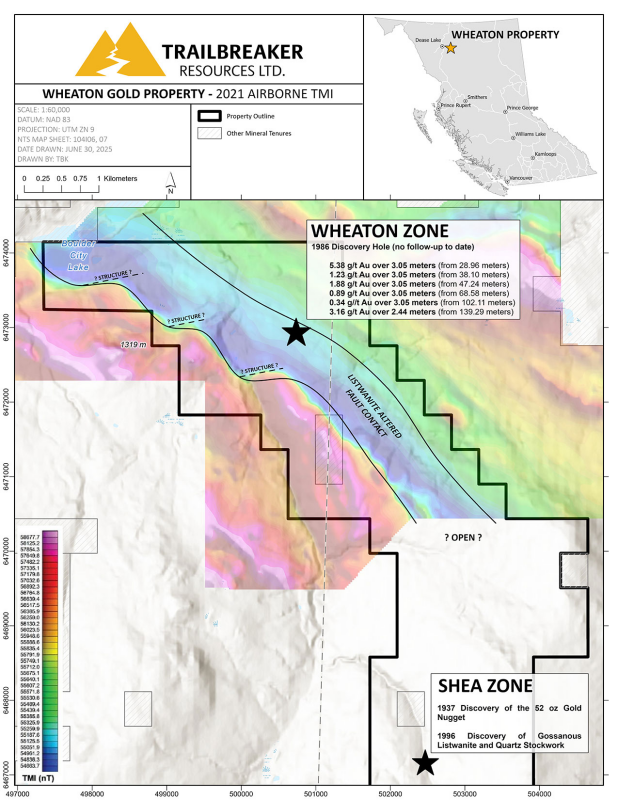

Pacific Bay Minerals, a junior mining company, held the ground from 2015 to 2024 but conducted very limited exploration. Much of Pacific Bay’s efforts were focused on mining jade boulders rather than on hardrock gold exploration. Their most significant work included a 2021 property-wide airborne magnetic survey that defined an open-ended NW-SE trending linear magnetic low feature that correlates with the 1986 discovery hole by Supreme. This is interpreted to potentially represent a listwanite-altered fault zone (Figure 4). Listwanite and listwanitic alteration is extensively documented around Alice Shea Creek (expanded upon below).

This survey provided several new exploration targets which have not been tested to date. Several east-west trending offsets occurring near the Wheaton zone may represent potential structures associated with gold mineralization.

Click Image To View Full Size

Figure 4: The 2021 airborne magnetic survey completed by Pacific Bay Minerals displays a significant NW-SE trending magnetic low which is interpreted to be a listwanite-altered fault zone. The 1986 drilling is located on the margin of this zone.

Shea Zone

The Shea zone is located along the headwaters of Alice Shea creek, close to the discovery area of the 52 oz Turnagain gold nugget. The nugget was discovered in the upper extent of the drainage, narrowing the search for the hardrock source.

The majority of the exploration work done at the Shea zone was done from 1985 to 1996, with several junior mining companies conducting small-scale exploration surveys. This includes companies such as Powder Ridge Resources, Imperial Metals, Goldbank Ventures, and Loumic Resources.

Loumic Resources’ 1996 exploration program was the most robust, comprising 196 soil samples and 191 meters of mechanized trenching4. Reconnaissance soil sampling identified several anomalous gold-arsenic (As) zones (up to 161 ppb Au & 112 ppm As) that have yet to receive follow-up exploration (Figure 5). Furthermore, trenching, targeting gossanous float immediately upslope from the location of the 52 oz gold nugget, revealed a listwanite outcrop containing intense quartz stockwork and disseminated pyrite. Only trace gold values were returned; however, the mineralization and alteration are textbook markers for orogenic gold deposits. This marked the last significant gold exploration program occurring on the Shea zone.

In 2011, First Point Minerals Corp was the last junior mining company to work the property; however, they focused on nickel mineralization rather than gold. Gold analysis for rock grab samples during the 2011 program utilized a 4 g/t detection limit, much higher than fire assay detection limits commonly used.

Click Image To View Full Size

Figure 5: Historic hardrock exploration along Alice Shea Creek, with the approximate location of the discovery of the 52 oz Turnagain nugget.

Geology, Deposit Model, and Mineralization

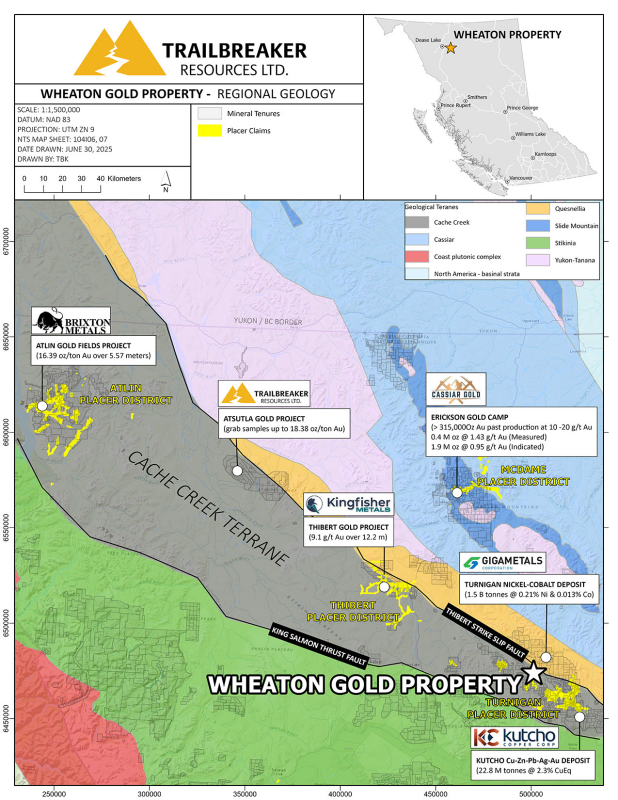

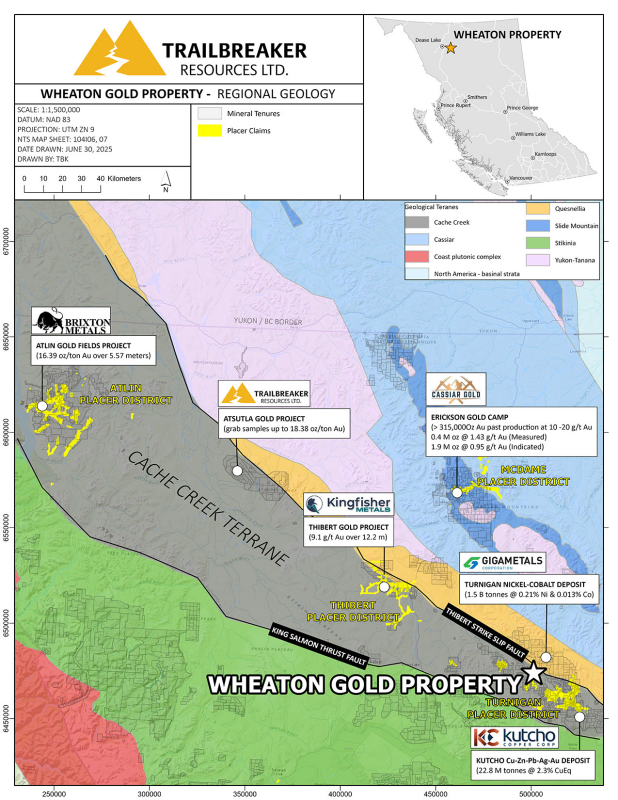

The Wheaton Gold property is underlain by northwest-trending, complexly folded and faulted ultramafic rocks of the oceanic Cache Creek terrane, and by metasedimentary rocks of the Kedahda Formation (Figure 6).

The northern portion of the Wheaton Gold property covers fault-bounded metasedimentary rocks of the Mississippian to Triassic Kedahda formation which include heterolithic argillite with wispy silt laminae, thinly bedded sandstone, and rare discontinuous limestone beds. This Kedahda sedimentary package is separated from the ultramafic rocks (peridotite, dunite, pyroxenite) of the Cache Creek terrane by a northwest-southeast trending thrust fault.

Click Image To View Full Size

Figure 6: Regional geology and neighbouring projects of the Wheaton Gold property.

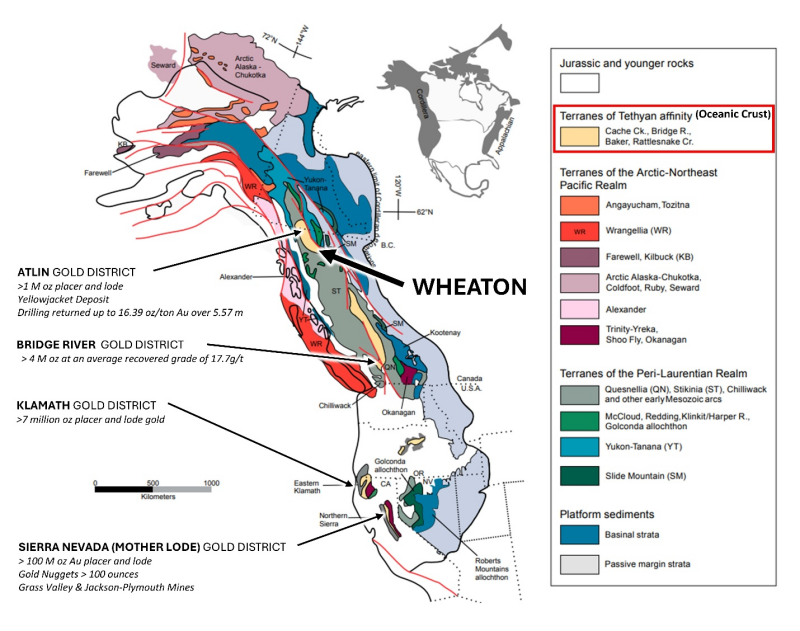

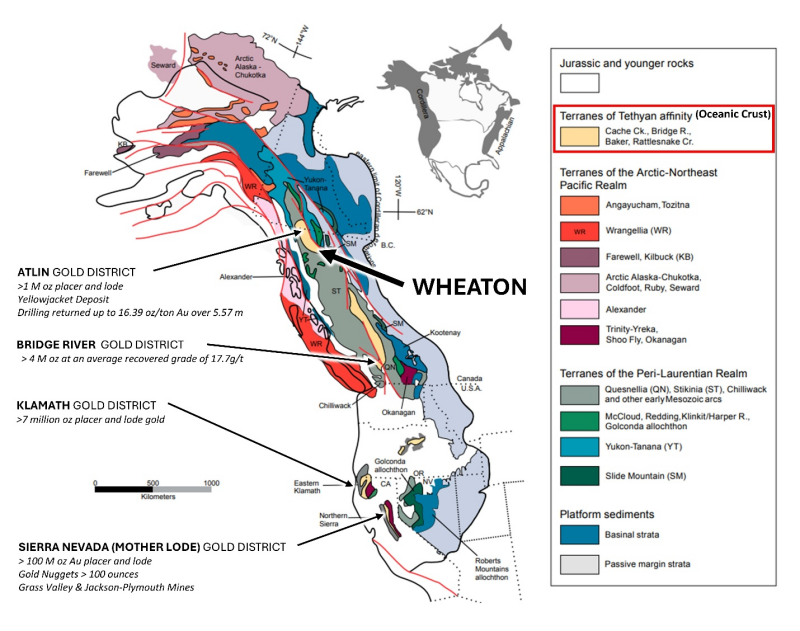

The Wheaton Gold property demonstrates potential for orogenic “motherlode-style” Au-bearing quartz vein deposits, such as the past-producing 4.2 Moz Bralorne-Pioneer mine in the Bridge Lake Gold Camp, southwestern British Columbia, and the world-famous Sierra Nevada mining district in California which produced over 100 Moz of placer and hardrock ‘lode’ gold (Figure 7). The Wheaton Gold property is analogous to these deposits, as all are hosted by oceanic crust accreted onto ancestral North America and spatially associated with significant coarse placer gold deposits. Furthermore, the lode gold deposits at both the Bridge Lake and Sierra Nevada gold districts are associated with listwanitic alteration of peridotites, quartz veining, and major fault structures, all of which have also been mapped in the Wheaton property area.

Click Image To View Full Size

Figure 7: Orogenic lode gold camps along the Cordillera (modified from Nelson et al., 20135).

There have been no major orogenic lode gold deposits delineated to date within the northern Cache Creek terrane. However, several large placer gold camps have been established, commonly accompanied by hardrock showings and small gold deposits indicating potential sources of the rich surficial placers. Nearby examples of orogenic gold showings within the oceanic Cache Creek terrane include the Yellowjacket deposit (130,000 tonnes grading 5.8 g/t Au) situated in the Atlin Goldfields, and the Keystone Showing (historic drill intercepts include 9.1 g/t Au over 12.2 m within a quartz porphyry setting) in the Thibert placer district. Both of these are associated with quartz veining and listwanitic alteration.

The Erickson gold camp, ~100 km to the north-northwest, is not hosted by the Cache Creek terrane, but is surrounded by the McDame Creek coarse surficial placer gold deposits, where the second-largest placer gold nugget ever recorded in BC, weighing 72 oz, was discovered. At Erickson, which comprises several past-producing gold mines, lode gold is characterised by quartz veins hosted by listwanite. Average grades ranged from 10-20 g/t Au for a total of 315,000 oz Au mined historically. The Erickson camp includes the Taurus deposit, currently owned and being advanced by Cassiar Gold Corp., which has delineated an indicated resource of 0.4 Moz Au and an additional inferred resource of 1.9 Moz Au6.

Placer miners have reported that many of the placer gold nuggets recovered from the Peacock workings of Wheaton Creek, which directly drains the area of drill hole DDH-86-01, contain inclusions of altered pyroxene and serpentine, and that some gold nuggets are still fused to quartz fragments. These observations by the placer miners further suggest the placer gold in Wheaton Creek has a nearby source.

Terms of the Option Agreement

On July 1st, 2025 (the “Effective Date”), Trailbreaker signed an option agreement (the “Agreement”) with Cordilleran Properties (the “Optionee”) of Kamloops, BC. Subject to the approval of the TSX Venture Exchange, Trailbreaker has the option to acquire a 100% interest in the Wheaton Gold property by completing the following:

-

-

-

- (a)paying to the Optionee $10,000 on the Effective Date;

- (b)paying to the Optionee $10,000 on or before the first anniversary of the Effective Date;

- (c)paying to the Optionee $15,000 on or before the second anniversary of the Effective Date;

- (d)paying to the Optionee $25,000 or issuing to the Optionee $25,000 worth of Trailbreaker common shares (“Shares”) on or before the third anniversary of the Effective Date;

- (e)paying to the Optionee $75,000 or issuing to the Optionee $75,000 worth of Shares on or before the fourth anniversary of the Effective Date; and

- (f)completing $1,000,000 of expenditures on or before the fifth anniversary of the Effective Date.

Upon completion of the Agreement, Trailbreaker will obtain a 100% interest in the property and the Optionee will retain a total 2.0% Net Smelter Return (NSR) royalty, which may be brought down to 0.5% through a cash payment of $1,500,000 to the Optionee.

References

- Alice Shea Creek BC minfile

https://minfile.gov.bc.ca/Summary.aspx?minfilno=104I%20%20005

- Cukor, V. 1987. Diamond Drill Report for Supreme Resources on the Jed Claims.

https://apps.nrs.gov.bc.ca/pub/aris/Detail/16332

- Pacific Bay Minerals’ September 16, 2019 news release

https://www.pacificbayminerals.com/news/wheaton-creek-property

- Livgard, E. 1997. Exploration Report 1996. The Mt Shea Claim Group, for Loumic Resources

https://apps.nrs.gov.bc.ca/pub/aris/Detail/24891

- Nelson, J.L., Colpron, M., and Israel, S., 2013, The Cordillera of British Columbia, Yukon, and Alaska: Tectonics and metallogeny, in Colpron, M., Bissig, T., Rusk, B.G., and Thompson, J.F.H., eds., Tectonics, Metallogeny, and Discovery: The North American Cordillera and Similar Accretionary Settings: Society of Economic Geologists Special Publication 17, p. 53–109.

- Cassiar Gold website

https://cassiargold.com/projects/cassiar-gold-project/cassiar-gold-project/

About Trailbreaker Resources

Trailbreaker Resources is a mining exploration company focused primarily on mining-friendly British Columbia and Yukon Territory, Canada. Trailbreaker is committed to continuous exploration and research, allowing maintenance of a portfolio of quality mineral properties which in turn provides value for shareholders. The company has an experienced management team with a proven track record as explorers and developers throughout the Yukon Territory, British Columbia, Alaska and Nevada.

ON BEHALF OF THE BOARD

Daithi Mac Gearailt

President and Chief Executive Officer

Carl Schulze, P. Geo., Consulting Geologist with Aurora Geosciences Ltd, is a qualified person as defined by National Instrument 43-101 for Trailbreaker’s BC and Yukon exploration projects, and has reviewed and approved the technical information in this release.

Other

For new information about the Company’s projects, please visit Trailbreaker’s website at TrailbreakerResources.com and sign up to receive news. For further information, follow Trailbreaker’s tweets at Twitter.com/TrailbreakerLtd, use the ‘Contact’ section of our website, or contact us at (604) 681-1820 or at info@trailbreakerresources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; expectations regarding future exploration and drilling programs and receipt of related permitting. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “anticipates”, “expects”, “understanding”, “has agreed to” or variations of such words and phrases or statements that certain actions, events or results “would”, “occur” or “be achieved”. Although Trailbreaker has attempted to identify important factors that could affect Trailbreaker and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. In making the forward-looking statements in this news release, if any, Trailbreaker has applied several material assumptions, including the assumption that general business and economic conditions will not change in a materially adverse manner. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Trailbreaker does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Source