(TheNewswire)

VANCOUVER, BRITISH COLUMBIA, March 18, 2025 TheNewswire – (TSXV: PINN, OTC: NRGOF, Frankfurt: X6C) Pinnacle Silver and Gold Corp. (” Pinnacle ” or the ” Company “) is pleased to provide further details on the preliminary underground sampling program that was conducted as part of the due diligence work on the recently acquired high-grade gold-silver El Potrero property in Durango, Mexico (see Pinnacle news releases dated February 24 and 25, 2025). The Company also announces that Phase I field work has commenced on the project.

Preliminary sampling of mineralized veins containing grey-black ginguro bands (very fine grained silver-gold mineralization) in the Pinos Cuates Mine returned an arithmetic average from four chip channel samples (see Table 1 below) of 8.04 g/t gold (Au) and 146 g/t silver (Ag) (9.70 g/t Au Equivalent or 853 g/t Ag Equivalent 1 ), consistent with the historic production grades reported verbally by the vendors, and the historic resource estimate of 45,561 tonnes at 8.0 g/t Au and 186 g/t Ag (10.1 g/t Au Eq or 890 g/t Ag Eq 1 ). These resources are historical in nature and Pinnacle is not treating these estimates as current mineral resources as a qualified person on behalf of Pinnacle has not done sufficient work to classify them as current mineral resources.

Table 1: Mineralized Samples from the Pinos Cuates Mine

|

Sample Length (metres) |

Gold (g/t) |

Silver (g/t) |

Gold Equivalent (g/t) 1 |

Silver Equivalent (g/t) 1 |

|

0.9 |

9.32 |

254 |

12.21 |

1,074 |

|

0.8 |

8.21 |

153 |

9.95 |

875 |

|

1.4 |

7.92 |

63 |

8.64 |

760 |

|

0.3 |

6.71 |

113 |

7.99 |

703 |

1 Gold and silver equivalents calculated using a gold:silver price ratio of 88 (i.e. 88 g/t silver = 1 g/t gold). The metal prices used to determine the 88:1 ratio are the closing spot prices in New York on March 14, 2025: US$2,983.30/oz gold and US$33.765/oz silver.

“Having just recently closed the acquisition of the staged option on the Potrero Property, we are wasting no time in ‘hitting the ground running’ on this exciting project,” stated Robert Archer, Pinnacle’s President & CEO. “Not only did our due diligence sampling confirm the high-grade nature of the gold-silver mineralization, but the historic workings stretching over a 500 metre strike length and the absence of any drilling or other modern exploration implies significant potential for resource development on a strong epithermal vein system. Furthermore, we will immediately commence cleaning the processing plant in order to put together a budget and schedule to make it operational once again.”

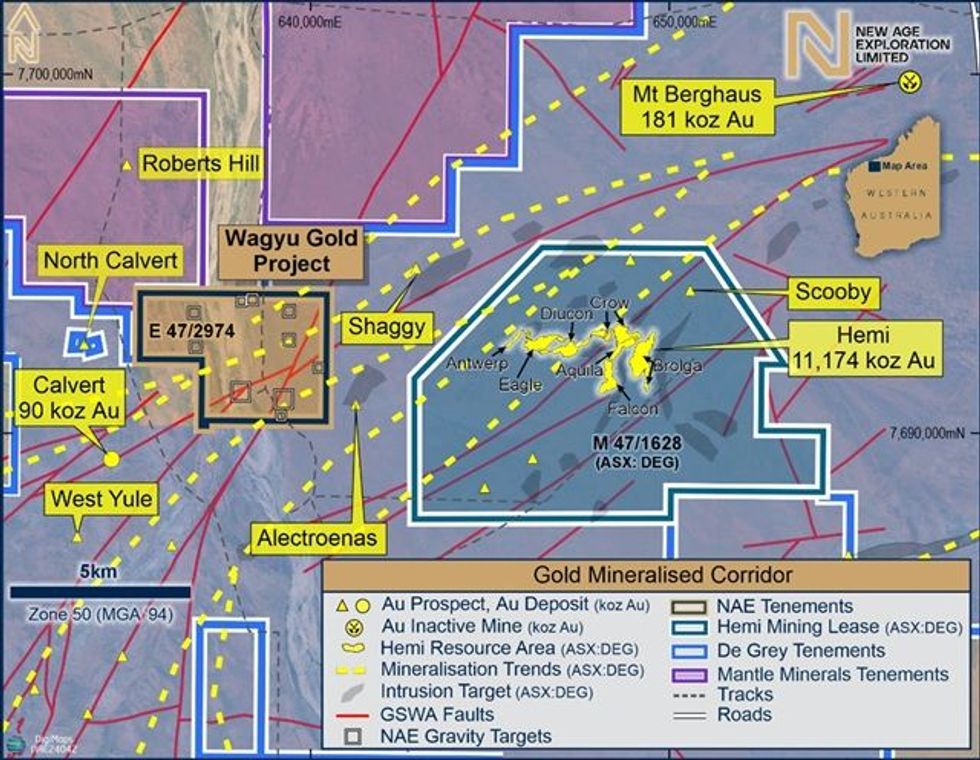

As part of Pinnacle’s due diligence on the property, non-systematic sampling of the main exposed structures in underground workings at the Dos de Mayo, Pinos Cuates and La Dura historic mines was undertaken during two visits in October and December of 2024 (see Figure 1). The lack of any detailed surface or underground maps and the general inaccessibility of most of the old stopes containing the mineralization underground led to the non-systematic nature of the sampling. Vein exposures underground were typically less than two metres, thereby limiting the width of the veins that could be sampled. As such, professional mining contractors are being brought in to render these areas safe for a more systematic sampling program.

Figure 1: Longitudinal section, looking southwest, of underground workings and vein projections at the Potrero Project.

Assays from the first visit indicated that the vein system is clearly gold- and silver-bearing, while the second visit allowed for the more precise identification of mineralized zones within the veins, particularly in the Pinos Cuates workings where an ‘upper’ level, approximately 10 metres above the previous visit, was examined and sampled, yielding the results in Table 1 above. Values in the 35 underground samples ranged from 0.047 to 9.32 g/t Au and

Following the cleaning of the underground workings, the vein system will be surveyed, mapped and systematically sampled in order to determine the structural controls on gold-silver mineralization as the highest grades tend to occur in ‘shoots’. Once these are better defined, a diamond drilling program can be planned to systematically test these areas for continuity. As no drilling has been conducted previously, the vein system is open in all directions.

While the underground workings are being rehabilitated, surface mapping will get underway to trace out the vein system and gain a better understanding of the geological setting. Initially, this work will focus on the area above the historic mines then work out along strike to the northwest and southeast. From observations made during the due diligence period, the veins appear to splay along strike and several parallel veins exist both on the property and on neighbouring ground, suggesting that the system may be more extensive than initially realized.

Given the importance of structure in these types of vein systems, a LiDAR (Light Detection and Ranging) survey is being planned for the entire property. LiDAR is a remote-sensing and laser technology that ‘sees’ through overburden and maps out the rock subsurface in a way that allows for the interpretation of structural features that can be important in controlling gold-silver mineralization. This interpretation will also be used in the planning of upcoming drill programs.

Roads on the property are being rehabilitated and the campsite will be cleaned and rebuilt. In due course, discussions will be held with the federal electrical commission to extend the power line to the plant site, a distance of only about three kilometres.

QA/QC

The assay results contained in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Pinnacle has implemented industry standard practices for sample preparation, security and analysis given the stage of the Project. This has included common industry QA/QC procedures to monitor the quality of the assay database, including inserting certified reference material samples and blank samples into sample batches on a predetermined frequency basis.

Non-systematic chip channel sampling was completed across the exposed mineralized structures using a hammer and maul. The protocol for sample lengths established that they were not longer than two metres or shorter than 0.3 metres. The veins tend to be steeply dipping to vertical, and so these samples are reasonably close to representing the true widths of the structures. Samples were collected along the structural strike or oblique to the main structural trend.

All samples were bagged in pre-numbered plastic bags; each bag had a numbered tag inside and were tied off with adhesive tape and then bulk bagged in rice bags in batches not to exceed 40 kg. They were then numbered, and batch bags were tied off with plastic ties and delivered directly to the SGS laboratory facility in Durango, Mexico for preparation and analysis. The lab is accredited to ISO/IEC 17025:2017. All Samples were delivered in person by the contract geologist who conducted the sampling under the supervision of the QP.

SGS sample preparation code G_PRP89 including weight determination, crushing, drying, splitting, and pulverizing was used following industry best practices where all samples were crushed to 75% less than 2 mm, riffle split off 250 g, pulverized split to >85% passing 75 microns (μm). All samples were analyzed for gold using code GA_FAA30V5 with a Fire Assay determination on 30g samples with an Atomic Absorption Spectography finish. An ICP-OES analysis package (Inductively Coupled Plasma – Optical Emission Spectrometry) including 33 elements and 4-acid digestion was performed (code GE_ICP40Q12) to determine Ag, Zn, Pb, Cu and other elements.

Qualified Person

Mr. Jorge Ortega, P. Geo, a Qualified Person, and independent from Pinnacle, as defined by National Instrument 43-101, and the author of the NI 43-101 Technical Report for the Potrero Project, has reviewed, verified and approved for disclosure the technical information contained in this news release.

About the Potrero Property

El Potrero is located in the prolific Sierra Madre Occidental of western Mexico and lies within 35 kilometres of four operating mines, including the 4,000 tonnes per day (tpd) Ciénega Mine (Fresnillo), the 1,000 tpd Tahuehueto Mine (Luca Mining) and the 250 tpd Topia Mine (Guanajuato Silver).

High-grade gold-silver mineralization occurs in a low sulphidation epithermal breccia vein system hosted within andesites of the Lower Volcanic Series and has three historic mines along a 500 metre strike length. A historic resource based upon underground sampling of those three mines is reported to consist of 45,561 tonnes at 8.0 g/t gold and 186 g/t silver. The property has been in private hands for almost 40 years and has never been drilled or explored by modern methods, leaving significant exploration potential.

A 100 tpd plant on site can be refurbished / rebuilt and historic underground mine workings rehabilitated at relatively low cost in order to achieve near-term production once permits are in place. The property is road accessible with a power line within three kilometres. Surface rights over the plant and mine area are privately owned (no community issues).

Pinnacle will earn an initial 50% interest immediately upon commencing production. The goal would then be to generate sufficient cash flow with which to further develop the project and increase the Company’s ownership to 100% subject to a 2% NSR. If successful, this approach would be less dilutive for shareholders than relying on the still challenging equity markets to finance the growth of the Company.

About Pinnacle Silver and Gold Corp.

Pinnacle is focused on district-scale exploration for precious metals in the Americas. The addition of the high-grade Potrero gold-silver project in Mexico’s Sierra Madre Belt complements the Company’s project portfolio and provides the potential for near-term production . In the prolific Red Lake District of northwestern Ontario, the Company owns a 100% interest in the past-producing, high-grade Argosy Gold Mine and the adjacent North Birch Project with an eight-kilometre-long target horizon . With a seasoned, highly successful management team and quality projects, Pinnacle Silver and Gold is committed to building long -term , sustainable value for shareholders.

Signed: “Robert A. Archer”

President & CEO

For further information contact :

Email: info@pinnaclesilverandgold.com

Tel.: +1 (877) 271-5886 ext. 110

Website: www.pinnaclesilverandgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release .

Copyright (c) 2025 TheNewswire – All rights reserved.

News Provided by TheNewsWire via QuoteMedia