Metal Bank (MBK:AU) has announced MBK Delivers Significant Increase to Livingstone Au Resource

Metal Bank (MBK:AU) has announced MBK Delivers Significant Increase to Livingstone Au Resource

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to announce that Strike Drilling has mobilised to site with a Schramm T450 rig, and Reverse Circulation (RC) drilling has begun as of Sunday, 16 March 2025.

HIGHLIGHTS

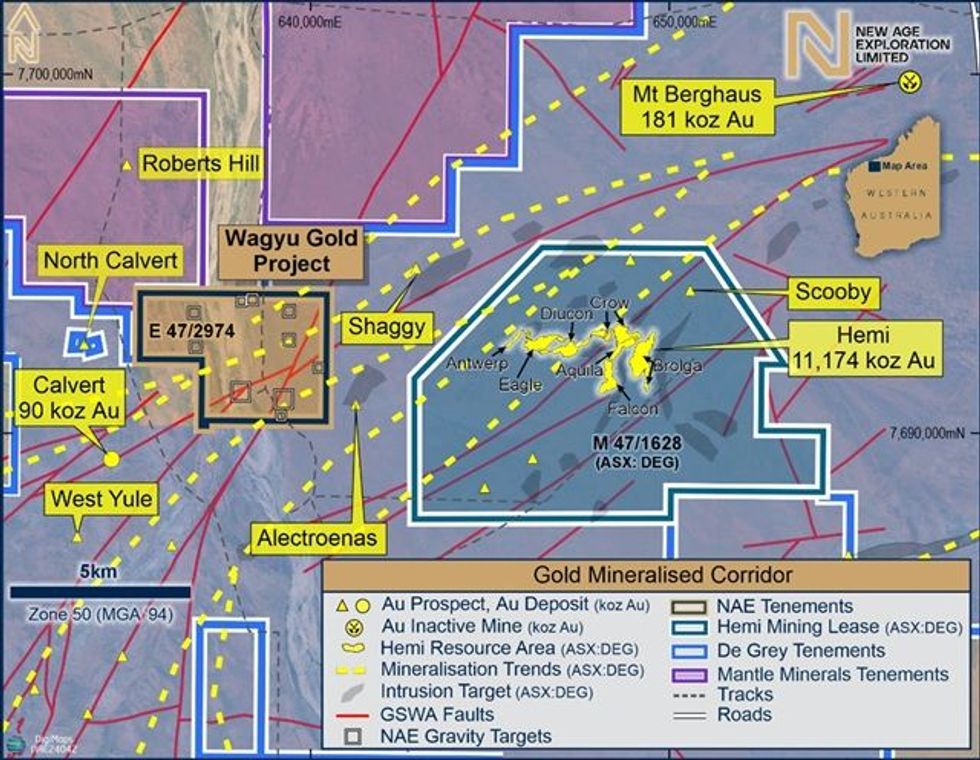

The Wagyu Gold Project, located within a fast-emerging gold mineralised corridor, represents a highly prospective Gold opportunity ~9km within the same mineralised trend as De Grey Mining’s (ASX:DEG) Hemi Gold Deposit containing ~11.2 Moz1 (refer to Figure 1) in the Central Pilbara.

NAE Executive Director Joshua Wellisch commented:

“The commencement of RC drilling marks an important milestone in advancing the Wagyu Gold Project. The support of Strike Drilling, who has agreed to take 50% of their payment in equity, is a strong endorsement of the project’s potential. We are eager to test these high-priority targets and further define the extent of gold mineralisation.”

This 3,000m RC drill program is the next step in NAE’s systematic exploration strategy at Wagyu, following promising results from recent geophysical surveys (refer ASX Announcement 11 March 2025) and Phase 2 Air Core (AC) drilling, which confirmed multiple high-grade gold intercepts including 15.6g/t gold over 1m (refer ASX Announcement 17 February 2025). The program will test five high-priority gravity targets on the eastern side of the project area, with particular emphasis on Gravity Targets 1 & 10 (Figure 2), following up on the significant gold mineralisation (>1g/t) identified in the AC drilling (Figure 3).

Figure 1: Location Map showing NAE’s Wagyu Gold Project (E47/2974) in the Gold Mineralisation Corridor shared with De Grey’s significant gold Mineral Resources, including Hemi, Mt Berghaus and Calvert.

The Hemi Gold Mineral Resource was last updated by De Grey Mining on 14 November 20241. The estimate is for 264Mt @ 1.3g/t Au for 11.2Moz, which can be broken down into 13Mt @ 1.4g/t for 0.6Moz, 149Mt @ 1.3g/t Au Indicated for 6.3 Moz, and 103Mt @ 1.3g/t Au for 4.3 Moz Inferred.

NAE confirms that it is not aware of any new information or data that materially affects the information included in De Grey’s reported Mineral Resources referenced in this market announcement. To NAE’s full knowledge, all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed.

The previous AC drilling drilled to the top of fresh rock only, and this RC program will test for primary mineralisation in fresh rock below and adjacent to the oxide mineralisation identified in late 2024. RC drilling is also intended to outline better the boundaries, nature, and extent of mineralised intrusions identified from geophysics and AC drilling.

The RC drilling campaign is scheduled for completion within four weeks, with assay results expected between late April and May 2025.

Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Astral Resources NL (ASX: AAR) (Astral or the Company) refers to its off market takeover bid to acquire all of the ordinary shares of Maximus Resources Limited (ASX:MXR) (Maximus) (Offer) it does not already own on the basis of one (1) Astral share for every two (2) Maximus shares held pursuant to the Bidder’s Statement dated 3 February 2025 (Bidder’s Statement). The Offer is unconditional and will close at 7pm (AEDT) on Friday, 21 March 2025 (unless further extended).

HIGHLIGHTS

Offer declared best and final as to consideration

Astral declares its Offer of 1 Astral share for every 2 Maximus shares best and final as to consideration. There will be no increase in the number of Astral shares offered under the Offer.

Accelerated payment terms

On 24 February 2025, Astral announced that payment terms for validly accepting Maximus shareholders had been accelerated such that Maximus shareholders who have yet to validly accept the Offer will be issued their Astral Shares within 10 Business Days of their acceptance being processed in accordance with the terms of the Offer.

Minority Maximus shareholders – Liquidity and valuation risk

Maximus shareholders who do not accept the Offer prior to its close will not receive the consideration under the Offer, unless Astral is entitled to proceed to compulsory acquisition (in which case they will receive the consideration, but at a later date than if they accepted the Offer).

Maximus shareholders should be aware that, if Astral is NOT entitled to proceed to compulsory acquisition (e.g. if Astral does not acquire more than 90% voting power in Maximus), and Maximus continues to be listed on the ASX following the Offer, then the decrease in the number of Maximus shares available for trading may have a material adverse impact on their liquidity and valuation. Furthermore, depending on the level of acceptances received and other considerations, Maximus may apply to de-list from the ASX, in which case it may become more difficult and expensive for Maximus shareholders to sell their shares.

Click here for the full ASX Release

This article includes content from Astral Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Cyprium Metals presents a compelling investment opportunity as a near-term copper producer with a well-defined strategy to generate early cash flow while scaling up production. The company’s brownfield assets, strategic partnerships, and disciplined capital management position it as an undervalued player in Australia’s growing copper market.

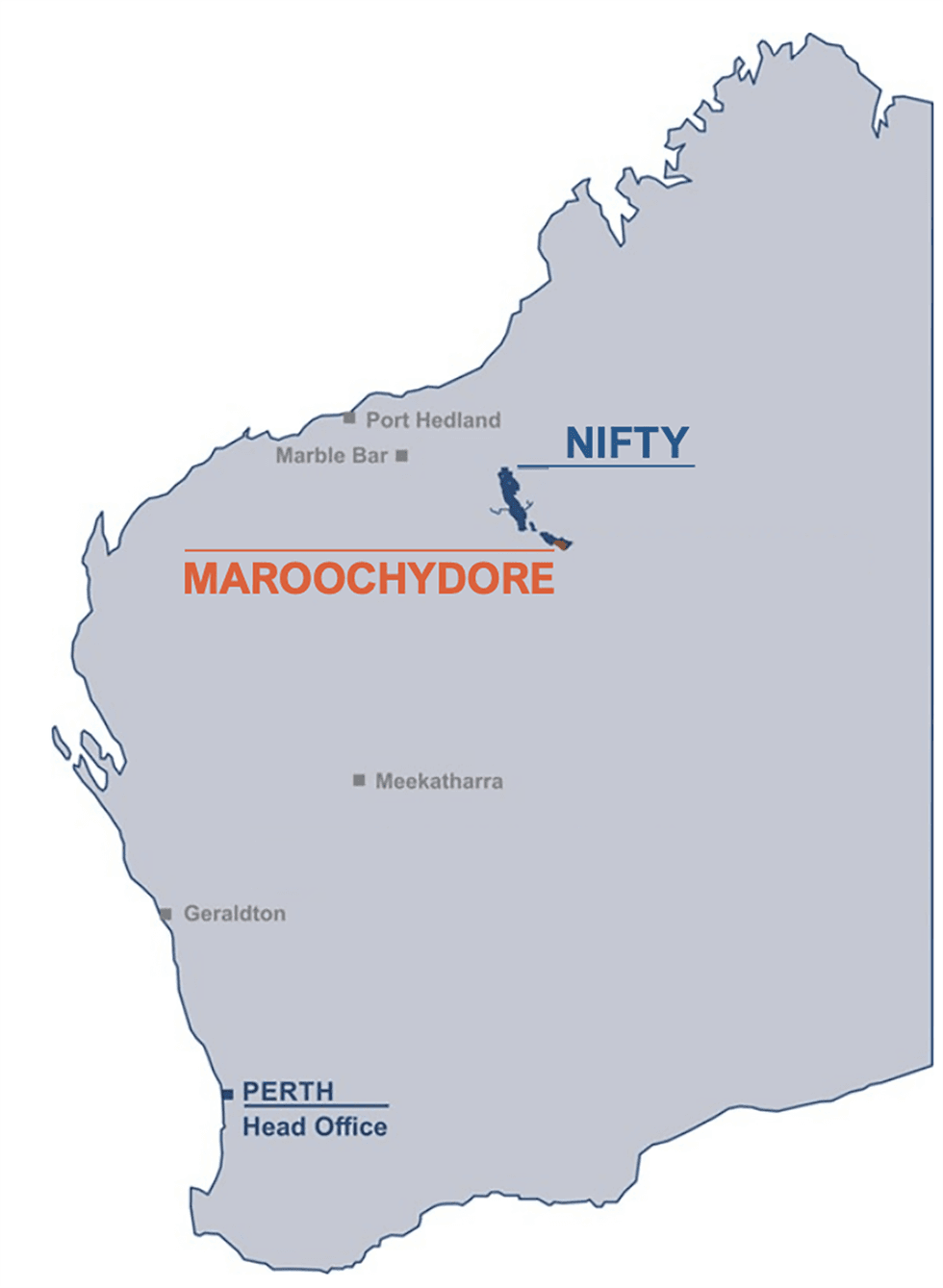

Cyprium Metals (ASX:CYM,OTC:CYPMF) is an Australian copper-focused exploration and development company dedicated to reviving brownfield assets with a clear path to production. The company’s primary focus is on the redevelopment of the Nifty copper complex, a historically productive copper mine in Western Australia, positioned for near-term production and long-term growth.

Nifty’s robust resource base, combined with strategic partnerships and a disciplined execution strategy, provides Cyprium with a strong foundation for scaling copper production. Advancing towards full copper production is the next strategic step, with plans to produce over 38,000 tons per annum through both cathode and concentrate production.

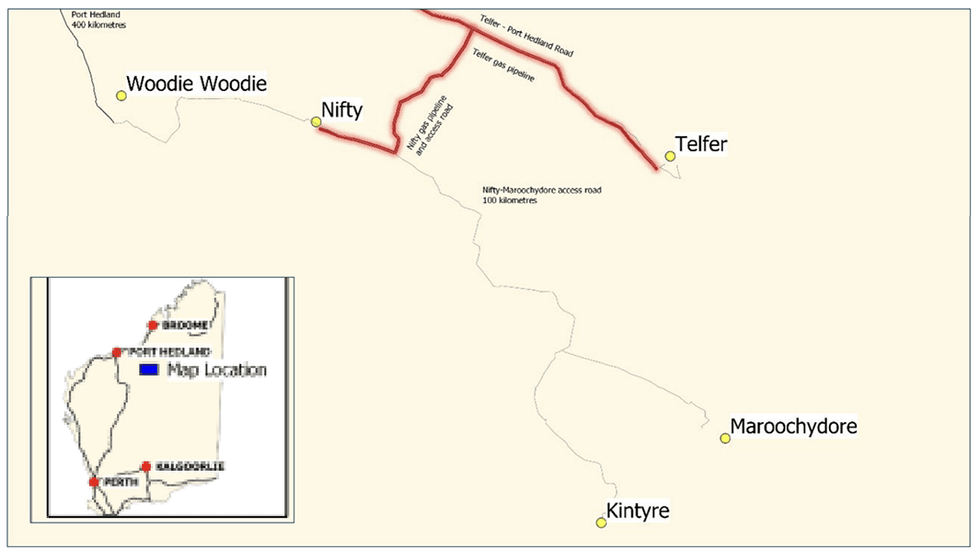

The company is also advancing the Maroochydore copper-cobalt project, located 70 km from Nifty, which further strengthens its asset portfolio in Paterson Province.

By prioritizing capital efficiency, operational excellence and commercial partnerships, Cyprium aims to deliver sustained value to shareholders while addressing the growing demand for copper in the global energy transition. Cyprium Metals is guided by a seasoned leadership team with deep experience in mine development, corporate strategy, and financial execution.

The Nifty copper mine is Cyprium’s flagship project, boasting a well-defined resource and established infrastructure that significantly reduces the capital intensity of restarting operations. With a resource base of 1.04 million tons of contained copper, the project offers a 20+ year mine life with brownfield expansion opportunities.

A key advantage of Nifty is the near-term revenue potential from reprocessing 91,000 tons of copper in existing heap leach pads. Macmahon Holdings is leading the bankable feasibility study execution. The company is also working in collaboration with strategic partner Glencore to secure offtake agreements and financial support.

The production strategy involves an initial focus on heap leach processing, followed by a full-scale restart of open-pit mining and concentrator operations with plans to produce over 38,000 tons per annum through both cathode and concentrate production. The asset is projected to generate AU$4 billion EBITDA over its lifecycle, with a five-year payback period.

The Maroochydore copper-cobalt project is positioned as Cyprium’s next growth asset, complementing Nifty and enhancing the company’s regional production capacity. This asset holds a resource base of 712,000 tons of copper, with recently updated mineral resource estimates confirming further expansion potential. Located just 70 km from Nifty, Maroochydore benefits from shared infrastructure and operational synergies, strengthening its strategic value within Cyprium’s portfolio.

Matt Fifield is a proven leader in corporate turnarounds and resource development, instrumental in repositioning Cyprium as a growth-focused copper producer. He is the managing director of Pacific Road Capital, a leading resource investment firm that has managed over $1 billion in funds raised to develop and enhance resource companies around the world. Fifield has participated in over $10 billion of capital raising and M&A transactions across his career and is a leading voice on responsible resource investing. He is a frequent speaker and contributor around issues of sustainable development practices.

Colin Mackey has extensive experience in mine operations and development, overseeing the Nifty restart strategy. A mining engineer by background, Mackey has worked with Goldfields, BHP and Theiss, before joining Rio Tinto in 2003, where he led the construction, development and operational improvement of multiple mining operations within the company’s portfolio. His most recent role was as managing director of Jadar and European operations for Rio Tinto. Mackey is a member of the Institute of Materials, Minerals and Mining and the Australian Institute of Company Directors.

Louis Chait is the former CFO of Glencore Copper, bringing deep financial and commercial expertise. He is a highly experienced corporate executive with more than 25 years’ experience in the global resources industry, having worked across senior business development and finance positions at Xstrata and Guildford Coal. He brings extensive commercial experience and skills in establishing successful, highly efficient operations in multiple jurisdictions. Chait is a member of Chartered Accountants, Australia and New Zealand.

Manu Triverdi is a chartered accountant and a CPA with 16 years of experience in financial and business strategies, controllership, compliance and leadership across various industries covering mining, power generation and retail, hospitality, commodities trading and education. Trivedi previously worked as group financial controller for tungsten miner Masan Resources, and has held other senior finance positions for mining projects in South Africa.

Peter van Luyt is a geologist with 30 years’ experience in mining, development and exploration geology. He commenced his career as a mine geologist working in gold mines. Since 2004, he has been a contract and consultant geologist specialising in the development of and exploration for base metals and gold projects in Australia, Papua New Guinea and Canada.