Rua Gold Inc. (TSXV: RUA) (OTCQB: NZAUF) (WKN: A40QYC) (“Rua Gold” or the “Company”) is pleased to advise the commencement of drilling at the Cumberland gold camp drill target. This builds upon the integration of the VRIFY AI targeting and ranking process with RUA’s extensive geological database, as well as the consolidation of the Reefton Goldfield – an orogenic gold and antimony belt on the South Island of New Zealand.

Highlights:

-

The geological team have defined an initial drill program for 6 holes of depths ranging from 70m to 150m to be drilled from the first pad to define the structure of the Gallant lode.

-

Targets are following up on high grade historical intercepts that are at very shallow depths ranging from 30m to 60m.

-

Subsequent drilling will then systematically test the remainder of the Cumberland gold camp targeting the 7 historic mines in a 2.2km long north-northwest trending zone of quartz veins and shearing.

-

Historical drilling targeting the Gallant structure drilled 20.7m of quartz with individual 1m assays ranging from 0.15g/t gold to 1911g/t gold (60oz/t) using screen fire assay method.

-

Re-assaying the historical core using photon assay methods confirms the very high grade and nuggety nature of the gold mineralization.

-

Averaging the two sets of core assays confirm a 20.7m intersection assaying 62.2 g/t (2 oz/t) gold.

-

Modelling of the observed quartz veins and gold mineralisation intercepts interprets an 8m true width of the vein.

-

Initial drilling targets a 600m zone from the Gallant to the Sir Francis Drake historical workings (see figure 3 below), where quartz veins can be traced on surface in folded structurally complex greywacke-argillite host rocks.

-

The Cumberland structural zone has emerged as a standout target from the early stages of the Company application of the VRIFY AI tool.

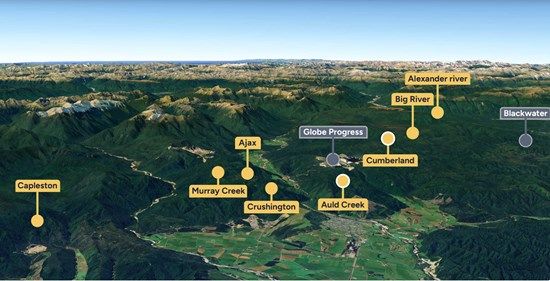

Rua Gold has completed drilling of the Victoria lode within the Murray Creek mine camp and is now focusing on the Cumberland gold camp, a historic site located 3km south of Globe-Progress Mine. The Globe-Progress Mine has a rich history of production, with over 1 million ounces of gold produced (424,000 ounces prior to 1950 and an additional 665,000 ounces produced between 2007 and 2015 under OceanaGold).

Simon Henderson, COO of Rua Gold, commented, “The Gallant prospect represents the first VRIFY target to be drilled in 2025. With a history of compelling high-grade gold, it lies in structurally complex steeply folded sequence of rocks, is traceable on surface over 600m, and remains largely untested along strike and at depth. Located just 3km south of a major road and accessible via a 4WD track, Gallant has logistical simplicity for exploration and potential development.”

Figure 1: Overview of the Reefton Goldfield

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/247207_769b0b6694fce921_007full.jpg

THE PLAN

Based on the extensive surface exploration work and historical drilling, the Gallant lode in the Cumberland gold camp stands out as an exceptional high-grade target. Abandoned without rigorous testing following the completion of the Globe-Progress mining, it features quartz veins outcropping on surface within an envelope of strong gold-arsenic anomalism.

The Gallant lode has several exploratory holes drilled by OceanaGold 15 years ago, on a well-defined quartz vein at shallow depth (Table 1 in the appendix; Figure 2). The Company has re-assayed the historical core using photon assay methods, which confirmed the very high grade and nuggety nature of gold mineralization. Averaging the two sets of core assays confirms a 20.7 m intersection assaying 62.2 g/t (2oz/t) gold, with a modelled true width of 8m. Core orientation clearly demonstrates that this intersection drilled down the quartz reef exaggerating its width but provides for a compelling and prospective target for immediate follow-up.

Figure 2: Gallant Cross Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/247207_769b0b6694fce921_008full.jpg

THE HISTORY

The Cumberland gold camp comprises 7 historic mines in a 2 km long north-northwest trending zone of quartz veins and shearing. Historic production totaled 21,740oz gold at an average recovered grade of 26.1 g/t (see appendices).

Figure 3: Map showing Cumberland historic mine camp

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/247207_769b0b6694fce921_009full.jpg

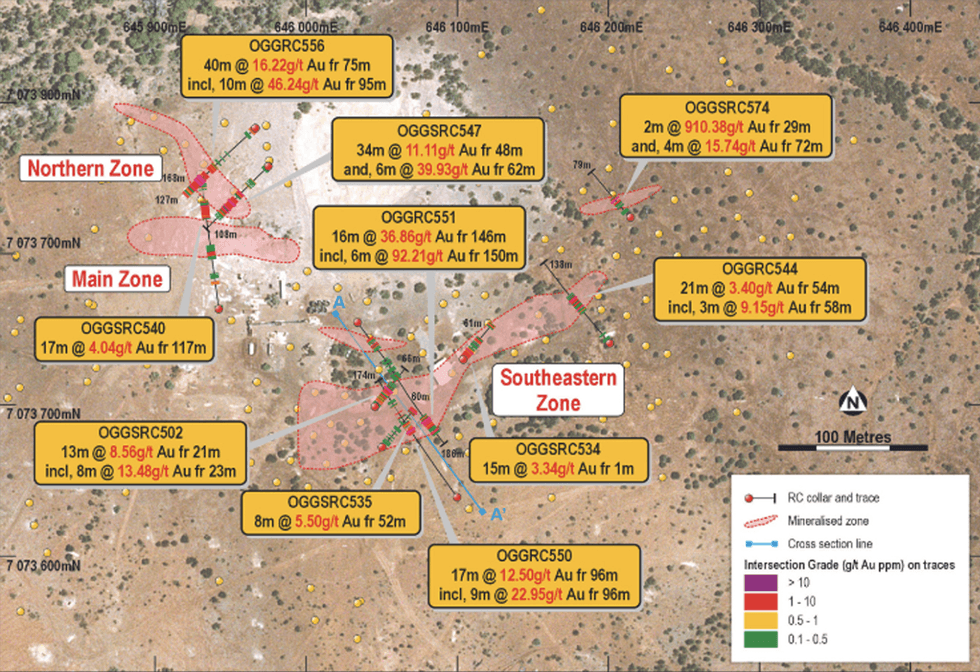

VRIFY’S AI PLATFORM

The Company has partnered with VRIFY to onboard VRIFY’s AI-assisted mineral discovery platform to accelerate discovery, reduce costs and further de-risk exploration.

In conjunction with the consolidation of the Reefton Goldfield in November 2024, the Company implemented the VRIFY AI tool. Early in the AI training phase, Cumberland was identified as a standout target. The VRIFY team has assimilated geochemistry, drilling and geophysical data on an unprecedented scale and accuracy over the whole district, processing over 84GB of data, +170,000 data points, actively informing our 2025 drill targets for quicker project advancement and de-risking our work programs.

Rua Gold‘s data, unlocked through VRIFY’s Al-assisted mineral discovery platform. This AI-assisted data synthesis enabled Rua Gold to actively and effectively rank its 2025 drill targets, accelerating its project advancement and de-risking its work programs in a matter of minutes, a process that would have taken months, if performed manually.

ACCELERATED DISCOVERY

Rua Gold inherited thousands of data points from historic activity on its multiple mine sites and exploration work with the Reefton Goldfields. The ability to rapidly mine this existing data for new insights and targets, while incorporating recent work, provided real-time feedback through VRIFY’s platform to inform drilling programs.

SCALABILITY and COST SAVINGS

Rua Gold is just beginning and is confident that VRIFY will continue to add value by allowing for the analysis of larger datasets without increasing costs linearly.

HIGHER ACCURACY

VRIFY’s proprietary Al model reduces human error and identifies patterns that manual review might miss, increasing discovery potential.

Figure 4: VRIFY AI hotspot identification showing Cumberland-Gallant Prospect

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/247207_769b0b6694fce921_011full.jpg

QAQC HISTORIC DRILLING (MR 5093)

Rua Gold is treating the drill results as historic.

The QP has verified the data disclosed, including drill collar location, sampling and analytical information contained in the written disclosure,

-

Data was verified by examination of remaining core in the core-box; confirming intervals, core splitting and interval handling procedures and logged core descriptions matched original core logging.

-

Verified the core sampling and assay procedures by examining and confirming from the original assay certificates of SGS and ALS laboratories that the sample numbers recorded matched the sample intervals logged.

-

Verified from original assay certificates stated blanks and certified standards and duplicates were used and reported, and where deviations outside 2 standard deviations assays have been repeated.

-

Verified that suitable assay methodology for coarse gold was used by both laboratories SGS Reefton method FASC30T(screen fire assay) and ALS method Au-SCR22AA (screen fire assay).

-

The QP has verified in the zone of exceptionally high-grade gold values that gold is clearly visible in veinlets within a significant quartz vein.

The QAQC summarized from the OceanaGold report is as follows:

“Diamond drill samples were generally taken over 1 m intervals and cut in half. Half the core was then sent to SGS or ALS. Some of the significant reef samples were analyzed at the ALS laboratory in Townsville for rapid processing and the rest were analyzed at the SGS laboratory in Westport. Due to the large amount of quartz reef drilled in the first part of the program, a screen fire technique was introduced at SGS (FAS30T).

ALS Townsville preformed 1 kg screen fire assays (Au-SCR22AA) along with a standard fire assay procedure (Au-AA26). Diamond core submissions included at the minimum one blank and two certified standards and at least two lab duplicates taken after coarse crushing of the sample. If both standard assays from the same hole returned assay values outside two standard deviations of the actual value, the laboratory was requested to re-assay the job. Assays from dispatches RD131025.1 and RD131106.1 showed significant deviation from standards and checks. These two batches were re-assayed (RD131025.1R and RD131106.1R respectively).

All assay data was imported into the Reefton project acQuire database directly from laboratory reports.”

Source: Anderson, T., 2014. MP 41164 Globe Progress annual technical report – 2014, OceanaGold Ltd; NZP&M, Ministry of Business, Innovation & Employment (MBIE), New Zealand. Unpublished Mineral Report MR5093.

PHOTON ASSAYING

Samples were analyzed by PhotonAssay at ALS Perth, Australia (ALS code Au-PA01), which has a detection range of 0.03-350 ppm Au. PhotonAssay analysis works by bombarding samples with high-energy X-rays which excite atomic nuclei that produce gamma rays at signature energies, allowing for gold detection. This method has a fast turnaround time and is non-destructive, allowing the preservation of the entire whole-core and unlimited repeat testing. Samples were submitted with certified reference material (CRM) from OREAS into the sample stream every 5 samples.

ALS Perth is independent to Rua Gold and its quality management systems framework is accredited to ISO/IEC 17025:2005 or certified to ISO 9001:2015 standards.

The QP satisfactorily verified all data used in this disclosure.

Grant of Deferred Share Units

The Company also announces that it has granted an aggregate of 161,980 deferred share units (“DSUs”) to non-executive directors of the Company at a deemed price of $0.61 per DSU under the Company’s Deferred Share Unit Plan adopted on April 17, 2024. The DSUs are subject to a one-year vesting period and entitle the holder to receive one Common Share at the time the holder ceases to be a director of the Company.

New Marketing Agreement with Baystreet.ca Media Corp

The Company has entered into a Services Agreement dated April 1, 2025 (the “Bay Street Media Agreement”) with Baystreet.ca Media Corp pursuant to which Baystreet.ca Media Corp has agreed to provide article distribution and full site coverage services to the Company. Pursuant to the terms of the Bay Street Media Agreement, such marketing services are to be provided over a 3-month period, for a fee of $45,000 plus applicable taxes. Baystreet.ca Media Corp is a full-service marketing agency based in Vancouver, BC, and is headed by Brady Allan. Baystreet.ca Media Corp provides digital marketing awareness via advertising through its fully owned platform BayStreet.ca, which includes both video and written content coverage of Canadian small-cap stories. As of the date hereof, to the Company’s knowledge, Baystreet.ca Media Corp (including its directors and officers) does not own any securities of the Company and has an arm’s-length relationship with the Company. Under the Bay Street Media Agreement, the Company will not issue any securities to Baystreet.ca Media Corp. as compensation for its marketing service.

ABOUT Rua Gold

Rua Gold is an exploration company, strategically focused on New Zealand. With decades of expertise, our team has successfully taken major discoveries into producing world-class mines across multiple continents. The team is now focused on maximizing the asset potential of RUA’s two highly prospective high-grade gold projects.

The Company controls the Reefton Gold District as the dominant landholder in the Reefton Goldfield on New Zealand’s South Island with over 120,000 hectares of tenements, in a district that historically produced over 2 million ounces of gold grading between 9 and 50 grams per tonne.

The Company’s Glamorgan Project solidifies Rua Gold‘s position as a leading high-grade gold explorer on New Zealand’s North Island. This highly prospective project is located within the North Islands’ Hauraki district, a region that has produced an impressive 15 million ounces of gold and 60 million ounces of silver. Glamorgan is adjacent to OceanaGold Corporation’s biggest gold mining project, WKP.

For further information, please refer to the Company’s disclosure record on SEDAR+ at www.sedarplus.ca.

Technical Information

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical disclosure contained herein.

Rua Gold Contact

Robert Eckford

Chief Executive Officer

Email: reckford@RUAGOLD.com

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur and specifically include statements regarding: the Company’s strategies, expectations, planned operations or future actions; and the effects and benefits of the Transaction. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company’s control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia-Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavorable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and reference should also be made to the Company’s short form base shelf prospectus dated July 11, 2024, and the documents incorporated by reference therein, filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

APPENDICIES

Table 1: Gallant 001 Re-assay table

| Au (g/t) | ||||||

| Sample No | From | To | Interval | ALS 2025 (Photon) |

Original Assay (Screen fire ) |

Average Two methods |

| GAL01001 | 30.6 | 32 | 1.3 | 2.2 | 3.16 | 2.68 |

| GAL01002 | 32 | 33 | 1 | 0.97 | 1.37 | 1.17 |

| GAL01003 | 33 | 34 | 1 | 0.32 | 1.9 | 1.11 |

| GAL01004 | 34 | 35 | 1 | 0.11 | 3.32 | 1.715 |

| GAL01005 | 35 | 36 | 1 | 0.02 | 0.01 | |

| GAL01006 | 36 | 37 | 1 | 0.01 | 0.01 | |

| GAL01007 | 37 | 38 | 1 | 2.66 | 3.38 | 3.02 |

| GAL01008 | 38 | 39 | 1 | 21.17 | 23.4 | 22.285 |

| GAL01009 | 39 | 40 | 1 | 0.33 | 0.5 | 0.415 |

| GAL01010 | 40 | 41 | 1 | 0.26 | 0.46 | 0.36 |

| GAL01011 | 41 | 42 | 1 | 1.98 | 6.31 | 4.145 |

| GAL01012 | 42 | 43 | 1 | 0.27 | 0.97 | 0.62 |

| GAL01013 | 43 | 44 | 1 | 0.43 | 1.73 | 1.08 |

| GAL01014 | 44 | 45 | 1 | 0.04 | 3.53 | 1.785 |

| GAL01015 | 45 | 46 | 1 | 1.8 | 0.54 | 1.17 |

| GAL01016 | 46 | 47 | 1 | 2.75 | 6.81 | 4.78 |

| GAL01017 | 47 | 48 | 1 | 426 | 1910 | 1168 |

| GAL01018 | 48 | 49 | 1 | 46.12 | 30 | 38.06 |

| GAL01019 | 49 | 50 | 0.7 | 5.2 | 4.68 | 4.94 |

| GAL01020 | 50 | 51 | 1 | 28.46 | 1.49 | 14.975 |

| GAL01021 | 51 | 52 | 1 | 7.14 | 6.77 | 6.955 |

| GAL01022 | 52 | 53 | 1 | 8.15 | 6.98 | 7.565 |

| GAL01023 | 53 | 54 | 1 | 1.15 | 0.87 | 1.01 |

| GAL01024 | 54 | 55 | 1 | 0.19 | 0.11 | 0.15 |

| GAL01025 | 55 | 56 | 1 | 0.38 | 0.53 | 0.455 |

| GAL01026 | 56 | 57 | 1 | 3.41 | 2.14 | 2.775 |

| GAL01027 | 57 | 58 | 1 | 2.96 | 2.28 | 2.62 |

| GAL01028 | 58 | 59 | 1 | 0.46 | 0.24 | 0.35 |

| GAL01029 | 59 | 60.2 | 0.5 | 0.41 | 0.52 | 0.465 |

Note: true width of vein: 8m.

Table 2: Historic Production Cumberland Camp (Barry, 1993)

| Lode | Tonnes | Production (Au oz) |

Recovered grade (oz/t) | Recovered grade (g/t) |

| Scotia | 604 | 1,283 | 2.1 | 66.1 |

| Gallant | 2,378 | 759 | 0.3 | 9.9 |

| Sir Francis Drake-Happy Valley | 17,261 | 5,810 | 0.3 | 10.5 |

| Cumberland | 14,120 | 13,629 | 1.0 | 30.0 |

| Exchange-Industry | 519 | 260 | 0.5 | 15.6 |

Source: Barry, J.M., 1993. The History and Mineral Resources of the Reefton Goldfield. Ministry of Commerce Resource Information Report No. 15.

Table 3: Collar for GAL001, historic drill hole.

| Drill hole | Easting (NZTM) | Northing (NZTM) | Elevation (RL) | End depth | Azimuth | Dip |

| GAL001 | 1508726 | 5327981 | 628 | 123.7 | 293° | -70° |

Projection: New Zealand Transverse Mercator (NZTM) 2000.

Reference for historical grades and production:

Barry, J.M., 1993. The History and Mineral Resources of the Reefton Goldfield. Ministry of Commerce Resource Information Report No. 15.

Reference for Gallant assay results:

Anderson, T., 2014. MP 41164 Globe Progress annual technical report – 2014, OceanaGold Ltd; NZP&M, Ministry of Business, Innovation & Employment (MBIE), New Zealand. Unpublished Mineral Report MR5093.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/247207

News Provided by Newsfile via QuoteMedia