Sun Summit Minerals Corp. (TSXV: SMN) (OTCQB: SMREF) (“Sun Summit” or the “Company”) is pleased to announce that it has filed an independent technical report (the “Technical Report”) with a mineral resource estimate (MRE) as described more fully in the Technical Report and the Company’s news release dated February 26, 2025.

The Technical Report titled “2025 Mineral Resource Estimate for the Buck Main Deposit NI 43-101 Technical Report”, dated April 2, 2025 (effective date of January 28, 2025), has been prepared by Moose Mountain Technical Services, and is available on the Company’s Website (https://sunsummitminerals.com/investors/presentations-downloads/) and on SEDAR+ (www.sedarplus.ca) under Sun Summit’s issuer profile.

Highlights:

- Inferred Mineral Resources at Buck Main are estimated to include 820,400 oz AuEq1 (775,500 oz gold and 8,435,000 oz silver) at a grade of 0.489 g/t AuEq1 (0.462 g/t Au, 5.0 g/t Ag) contained within 52.2 Mt.

- Indicated Mineral Resources at Buck Main are estimated to include 19,100 gold equivalent ounces1 (oz AuEq) (18,300 oz gold and 158,000 oz silver) at a grade of 0.519 g/t gold equivalent1 (g/t AuEq) (0.496 g/t Au, 4.3 g/t Ag) contained within 1.15 million tonnes (Mt).

- The near-surface Mineral Resource at Buck Main is constrained within an optimized open-pit shell using a 0.25 g/t AuEq cutoff, ensuring reasonable prospects for economic extraction.

- Additional upside at Buck Main as the deposit remains open for expansion in most directions and at depth.

- Effective discovery with average drill costs of CAD $18 per ounce of AuEq included in the MRE.

Notes:

1. Gold Equivalent (AuEq) grade is based on AuEq = Au + 0.0053*Ag (see notes to Table 1 below)

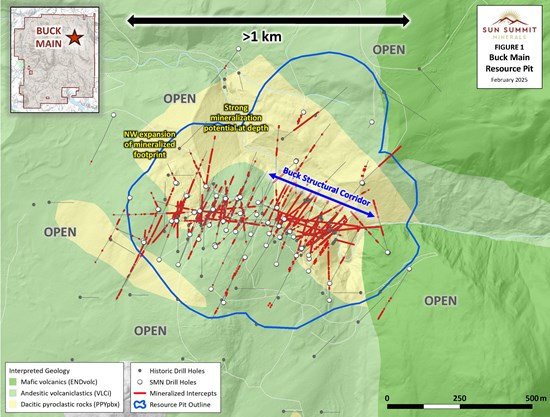

The Buck MRE is centered on the Buck Main deposit, 12 km south of Houston, BC. The road accessible deposit comprises a broad, 800 metre striking zone of intermediate-sulfidation epithermal-related gold-silver mineralization hosted in intermediate to felsic volcanics and intrusions. The MRE is based on 42,440 metres of drilling in 161 holes, of which 34,386 metres in 98 holes were completed by Sun Summit between 2020 and 2023 (Figures 1 and 2, Table 3).

Buck Main Mineral Resource Estimate

Table 1. Summary of Indicated and Inferred Mineral Resources for the Buck Main deposit

| Class |

AuEq

Cutoff |

In Situ Tonnage and Grade |

AuEq

Metal |

Au

Metal |

Ag

Metal

|

| Tonnage |

AuEq |

Au |

Ag |

NSR |

| (gpt) |

(ktonnes) |

(gpt) |

(gpt) |

(gpt) |

($CDN) |

(kOz) |

(kOz) |

(kOz) |

| Indicated |

0.25 |

1,148 |

0.519 |

0.496 |

4.3 |

40.40 |

19.1 |

18.3 |

158 |

| Inferred |

0.25 |

52,224 |

0.489 |

0.462 |

5.0 |

38.04 |

820.4 |

775.5 |

8,435 |

Notes to the 2025 Resource Table:

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines, as required National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”)

- The base case Mineral Resource has been confined by “reasonable prospects of eventual economic extraction” shape using the following assumptions:

- Metal prices of US$2250/oz Gold, US$26/oz Silver

- Metallurgical recovery of 79% Gold and 38% Silver

- Payable metal of 95% Silver, 99% Gold in dore

- Forex of 0.72 $US:$CDN

- Offsite costs (transport, smelter treatment and refining) of CDN$8.50/oz Gold and CDN$0.25/oz Silver.

- Processing Costs of CDN$12/tonne milled and General & Administrative (G&A) costs of CDN$ 2.50/ tonne milled

- Mining cost of CDN$2.56 / tonne for mineralized material and CDN$2.50/tonne for waste

- 45-degree pit slopes

- The 120% price case pit shell is used for the confining shape

- The resulting net smelter return (NSR) for the purpose of the AuEq calculation = Au*CDN$98.60/g*79% recovery rate + Ag*CDN$1.08/g*38% recovery rate

- The resulting AuEq = Au + 0.0053*Ag

- Numbers may not add due to rounding

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the estimated mineral resources will be converted into mineral reserves.

The Mineral Resources for the Buck Main deposit have been estimated using a 0.25 g/t AuEq cutoff determined using assumptions listed in the footnotes of Table 1. These assumptions satisfy the requirements of reasonable prospects for eventual economic extraction. Table 2 shows cutoff sensitivities at different grades.

Table 2. Buck Main deposit cutoff sensitivities

| Class |

AuEq

Cutoff

(gpt) |

In Situ Tonnage and Grade |

AuEq

Metal

(kOz) |

Au

Metal

(kOz) |

Ag

Metal

(kOz) |

Tonnage

(ktonnes) |

AuEq

(gpt) |

Au

(gpt) |

Ag

(gpt) |

NSR

($CDN) |

| Indicated |

0.2 |

1,604 |

0.435 |

0.414 |

3.9 |

33.85 |

22.4 |

21.3 |

203 |

| 0.25 |

1,148 |

0.519 |

0.496 |

4.3 |

40.40 |

19.1 |

18.3 |

158 |

| 0.3 |

852 |

0.605 |

0.580 |

4.6 |

47.09 |

16.6 |

15.9 |

126 |

| 0.35 |

645 |

0.695 |

0.669 |

5.0 |

54.12 |

14.4 |

13.9 |

103 |

| 0.4 |

494 |

0.793 |

0.765 |

5.4 |

61.76 |

12.6 |

12.1 |

85 |

| 0.5 |

317 |

0.989 |

0.957 |

6.0 |

76.99 |

10.1 |

9.8 |

61 |

| 1 |

91 |

1.783 |

1.743 |

7.5 |

138.87 |

5.2 |

5.1 |

22 |

| Inferred |

0.2 |

70,847 |

0.419 |

0.394 |

4.7 |

32.60 |

953.5 |

897.2 |

10,617 |

| 0.25 |

52,224 |

0.489 |

0.462 |

5.0 |

38.04 |

820.4 |

775.5 |

8,435 |

| 0.3 |

39,248 |

0.560 |

0.532 |

5.3 |

43.60 |

706.5 |

670.9 |

6,721 |

| 0.35 |

30,088 |

0.632 |

0.602 |

5.6 |

49.21 |

611.3 |

582.5 |

5,419 |

| 0.4 |

23,644 |

0.703 |

0.671 |

5.9 |

54.71 |

534.0 |

510.3 |

4,477 |

| 0.5 |

15,697 |

0.833 |

0.800 |

6.3 |

64.87 |

420.4 |

403.6 |

3,171 |

| 1 |

3,126 |

1.485 |

1.440 |

8.5 |

115.64 |

149.2 |

144.7 |

857 |

Table 3. Drill data used in the Mineral Resources Estimate

| Year |

Total

Number of

DHs |

Total

Depth

(m) |

Length

Assayed

(m) |

Total %

Assayed

(m) |

Number of

DHs within

Domains |

Assayed

Within

Modelled

Domains

(m) |

% Assayed

within the

Domains |

| Total |

161 |

42,440 |

39,737 |

94% |

123 |

27,034 |

99% |

Figure 1: Buck Main Drilling and Resource Pit Outline

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/247455_b4b1af61746b7add_001full.jpg

Figure 2: Buck Main 3D View of Resource Constraining Pit showing AuEq blocks above 0.2 g/t

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/247455_b4b1af61746b7add_002full.jpg

Discovery Metrics

Sun Summit has efficiently delineated the Buck Main deposit with a total drilling cost of approximately CAD$18 per AuEq ounce included in the MRE. Since 2020, the Company has completed 98 drill holes at Buck Main, totaling over 36,400 meters. The MRE was informed by assay results from 123 drill holes and 27,034 metres of assayed intervals. The Company incurred CAD $15 million in drilling expenditures since 2020.

The low discovery cost reflects the efficiency of Sun Summit’s exploration strategy, which included systematic targeting using advanced geological modeling, geophysical surveys, and geochemical analysis. This exploration success underscores the strong potential for further resource growth, as the deposit remains open in multiple directions.

Next Steps

- Additional metallurgical testing will be initiated to optimize metal recoveries and evaluate potential byproduct elements, ensuring the economic viability of future mining operations.

- Further drilling designed to investigate the extents of the Buck Main deposit is recommended. Areas open to the north, west, and east will be targeted in future drill programs.

National Instrument 43-101 Disclosure

The Buck Main MRE was prepared by Sue Bird, M.Sc., P.Eng., V.P. of Resources and Engineering at Moose Mountain Technical Services, an independent Qualified Person as defined by NI 43-101. Darcy Baker, P.Geo, President of Equity Exploration Consultants Ltd, assisted in the preparation of the report and is the Qualified Person responsible for certain sections of the report. Sue Bird has reviewed and approved the technical information about the MRE in this news release.

Mineral resources that are not mineral reserves do not have demonstrated economic viability; however, a reasonable prospect of eventual economic extraction pit has been used to confine the Mineral Resource Estimate using parameters detailed in the table notes.

The QP for the Mineral Resource Estimate is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the potential development of Mineral Resource Estimate. Factors that may affect the estimates include: metal price assumptions, changes in interpretations of mineralization geometry and continuity of mineralization zones, changes to kriging assumptions, metallurgical recovery assumptions, operating cost assumptions, confidence in the modifying factors, including assumptions that surface rights to allow mining infrastructure to be constructed will be forthcoming, delays or other issues in reaching agreements with local or regulatory authorities and stakeholders, and changes in land tenure requirements or in permitting requirement.

This news release has been reviewed and approved by Sun Summit’s Vice President Exploration, Ken MacDonald, P. Geo., a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

Upcoming Events

Sun Summit is pleased to announce its participation in two regional BC events. The Company will display drill core from the 2024 JD exploration program and drill core from the Buck Main zone from April 8-9 at the KEG 2025 Conference and Trade Show (https://www.keg.bc.ca/conference/default.htm), and, again at the Minerals North Conference (https://mineralsnorth.ca/) in Prince George, BC, from April 30 to May 2.

Community Engagement

Sun Summit is engaging with First Nations on whose territory our projects are located and is discussing their interests and identifying contract and work opportunities, as well as opportunities to support community initiatives. The Company looks forward to continuing to work with local and regional First Nations with ongoing exploration.

About the Buck Project

The Buck Project is situated in a historic mining district near Houston, B.C., with excellent nearby infrastructure that allows for year-round, road-accessible exploration.

The project is host to the Buck Main intermediate-sulfidation epithermal-related gold-silver-zinc system. Most of the mineralization drilled to date at Buck Main consists of long, continuous zones of disseminated and breccia-hosted, bulk tonnage-style gold-silver-zinc. Vein-hosted, high-grade mineralization has also been intersected near the center of Buck Main.

Exploration at the Buck Project is focused on investigating the lateral and vertical extent of gold-silver-zinc mineralization at the Buck Main system, and to define additional drill targets across the entire land package through systematic exploration programs.

About Sun Summit

Sun Summit (TSX-V: SMN; OTCQB: SMREF) is a mineral exploration company focused on expansion and discovery of district scale gold and copper assets in British Columbia. The Company’s diverse portfolio includes the JD Project in the Toodoggone region of north-central B.C., and the Buck Project in central B.C.

Further details are available at www.sunsummitminerals.com.

Link to Figures

Figure 1: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2025/02/Fig1_Buck_MRE_Feb2025-scaled.jpg

Figure 2: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2025/02/Fig2_Buck_MRE_Feb2025.jpg

On behalf of the board of directors

Niel Marotta

Chief Executive Officer & Director

info@sunsummitminerals.com

For further information, contact:

Matthew Benedetto, Simone Capital

mbenedetto@simonecapital.ca

Tel. 416-817-1226

Forward-Looking Information

Statements contained in this news release that are not historical facts may be forward-looking statements, which involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, the forward-looking statements require management to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the forward-looking statements will not prove to be accurate, that the management’s assumptions may not be correct and that actual results may differ materially from such forward-looking statements. Accordingly, readers should not place undue reliance on the forward-looking statements. Generally forward-looking statements can be identified by the use of terminology such as “anticipate”, “will”, “expect”, “may”, “continue”, “could”, “estimate”, “forecast”, “plan”, “potential” and similar expressions. Forward-looking statements contained in this press release may include, but are not limited to, estimates of mineral resources, potential mineralization, exploration plans, and engagement with First Nations communities. These forward-looking statements are based on a number of assumptions which may prove to be incorrect which, without limiting the generality of the following, include: risks inherent in exploration activities; the impact of exploration competition; unexpected geological or hydrological conditions; changes in government regulations and policies, including trade laws and policies; failure to obtain necessary permits and approvals from government authorities; volatility and sensitivity to market prices; volatility and sensitivity to capital market fluctuations; the ability to raise funds through private or public equity financings; environmental and safety risks including increased regulatory burdens; weather and other natural phenomena; and other exploration, development, operating, financial market and regulatory risks. The forward-looking statements contained in this press release are made as of the date hereof or the dates specifically referenced in this press release, where applicable. Except as required by applicable securities laws and regulation, Sun Summit disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Source