Investor Insight

Executing a well-defined project development strategy for its lithium assets and advancing Direct Lithium Extraction (DLE), CleanTech Lithium is poised to become a key player in an expanding batteries market.

Overview

CleanTech Lithium (AIM:CTL,FWB:T2N) is a resource exploration and development company with four lithium assets with an estimated 2.72 million tons (Mt) of lithium carbonate equivalent (LCE) in Chile, a world-renowned mining-friendly jurisdiction. The company aims to be a leading supplier of ‘green lithium’ to the electric vehicle (EV) market, leveraging direct lithium extraction (DLE) – a low-impact, low-carbon and low-water method of extracting lithium from brine.

Lithium demand is soaring as a result of a rapidly expanding EV market. One study estimates the world needs 2 billion EVs on the road to meet global net-zero goals. Yet, the gap between supply and demand continues to widen. As the world races to secure new supplies of critical minerals, Chile has emerged as an ideal investment jurisdiction with mining-friendly regulations and a skilled local workforce to drive towards a clean green economy. Chile is already the biggest supplier of copper and second largest supplier of lithium.

With an experienced team in natural resources, CleanTech Lithium holds itself accountable to a responsible ESG-led approach, a critical advantage for governments and major car manufacturers looking to secure a cleaner supply chain.

Laguna Verde is at pre-feasibility study stage targeted to be in ramp-up production from 2027. Laguna Verde has a JORC resource estimate of 1.8 Mt of lithium carbonate equivalent (LCE) while Viento Andino boasts 0.92 Mt LCE, each supporting 20,000 tons per annum (tpa) production with a 30-year and 12-year mine life, respectively. The latest drilling programme at Laguna Verde finished in June 2024, results from which will be used to convert resources into reserves.

The lead project, Laguna Verde, will be developed first, after which Veinto Andino will follow suit using the design and experience gained from Laguna Verde, as the company works towards its goal of becoming a significant green lithium producer serving the EV market.

The Company is carrying out the necessary environmental impact assessments in partnership with the local communities. The indigenous communities will provide valuable data that will be included in the assessments. The Company has signed agreements with the three of core communities to support the project development.

The company also has two prospective exploration assets – the Llamara project and Salar de Atacama/Arenas Blancas project. Llamara project is a greenfield asset in the Antofagasta region and is around 600 kilometers north of Laguna Verde and Veinto Andino. The project is located in the Pampa del Tamarugal basin, one of the largest basins in the Lithium Triangle.

Salar de Atacama/Arenas Blancas comprises 140 licenses covering 377 sq km in the Salar de Atacama basin, one of the leading lithium-producing regions in the world with proven mineable deposits of 9.2 Mt.

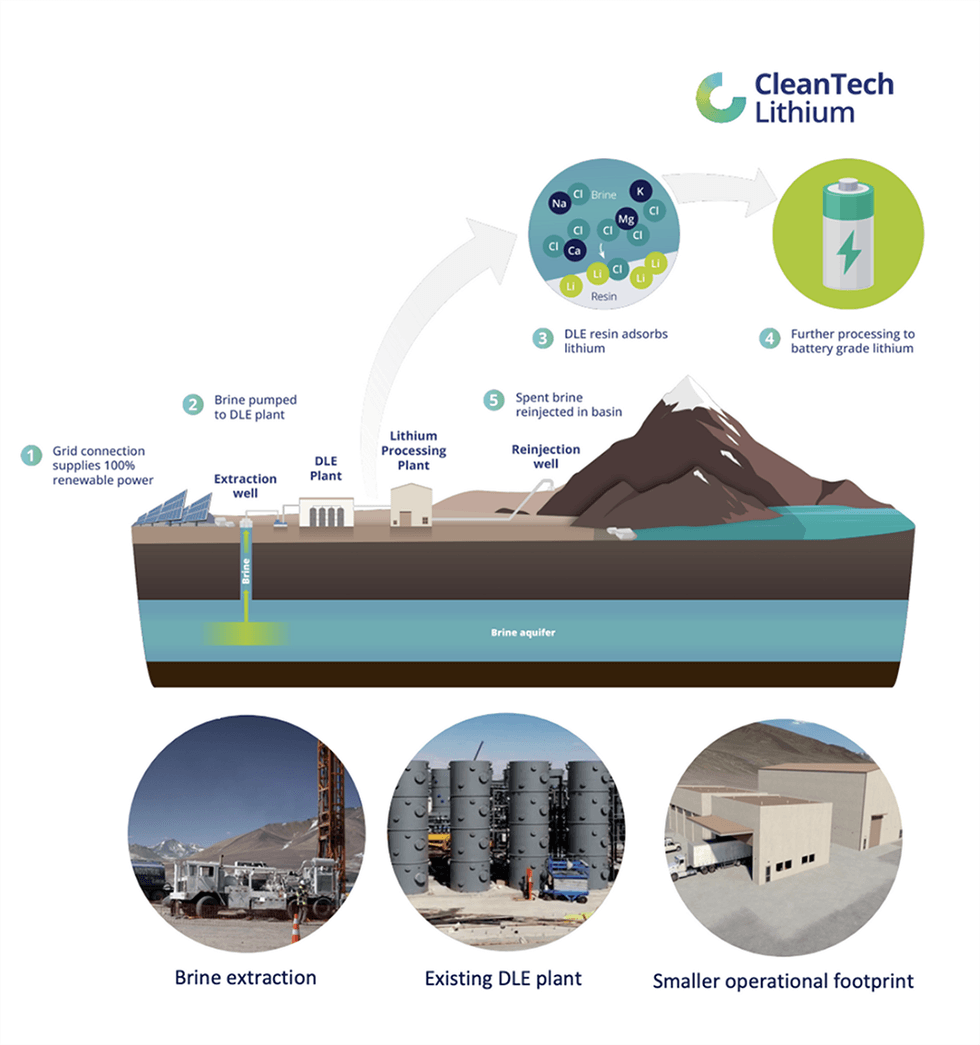

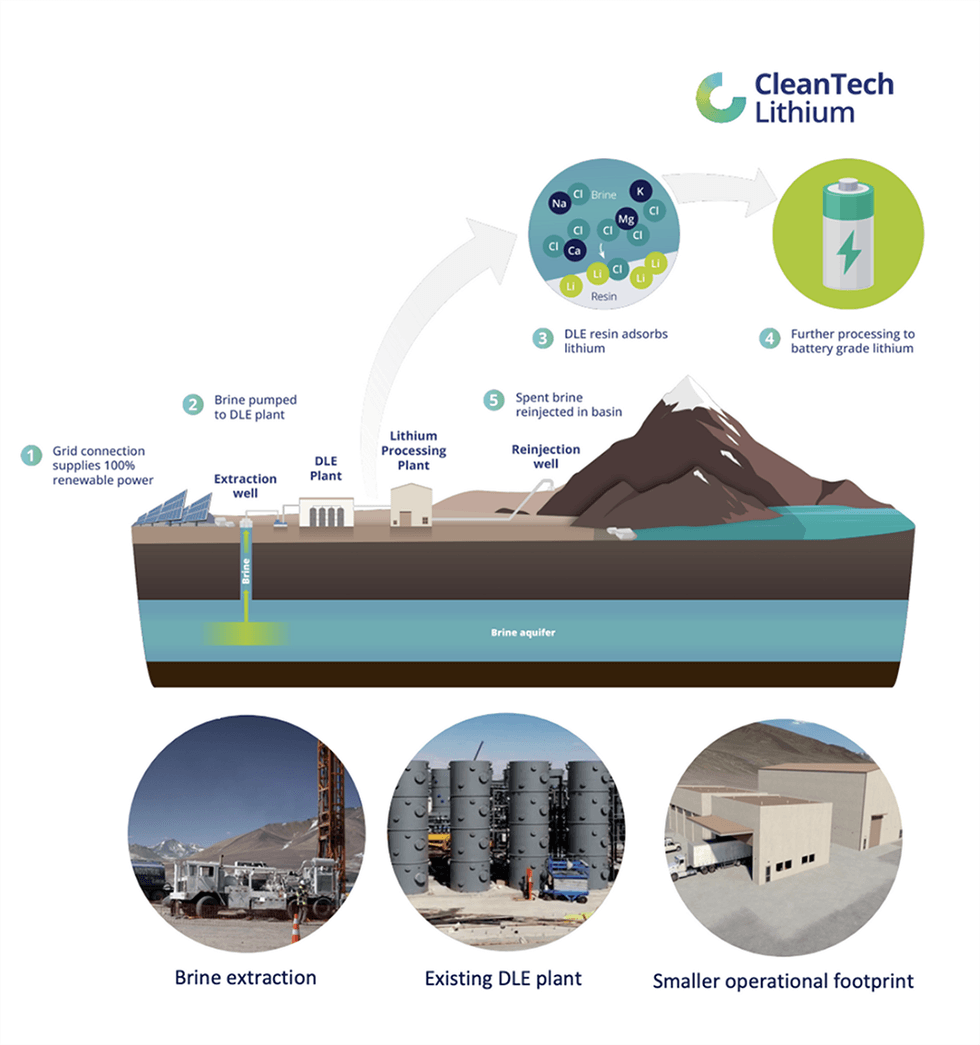

CleanTech Lithium is committed to an ESG-led approach to its strategy and supporting its downstream partners looking to secure a cleaner supply chain. In line with this, the company plans to use renewable energy and the eco-friendly DLE process across its projects. DLE is considered an efficient option for lithium brine extraction that makes the least environmental impact, with no use of evaporation ponds, no carbon-intensive processes and reduced levels of water consumption. In recognition, Chile’s government plans to prioritize DLE for all new lithium projects in the country.

CleanTech Lithium’s pilot DLE plant in Copiapó was commissioned in the first quarter of 2024. To date, the company has completed the first stage of production from the DLE pilot plant producing an initial volume of 88 cubic metres of concentrated eluate – the lithium carbonate equivalent (LCE) of approximately one tonne over an operating period of 384 hours with 14 cycles. Results show the DLE adsorbent achieved a lithium recovery rate of approximately 95 percent from the brine, with total recovery (adsorption plus desorption) achieving approximately 88 percent. The Company’s downstream conversion process is successfully producing pilot-scale samples of lithium carbonate . As of January 2025, the Company is producing lithium carbonate from Laguna Verde concentrated eluate at the downstream pilot plant – recently proven to be high purity (99.78%). Click for highlights video.

CTL’s experienced management team, with expertise throughout the natural resources industry, leads the company toward its goal of producing green lithium for the EV market. Expertise includes geology, lithium extraction engineering and corporate administration.

Company Highlights

- CleanTech Lithium is a lithium exploration and development company with four notable lithium projects in Chile and a combined total resource of 2.72 million tonnes JORC estimate of lithium carbonate equivalent.

- Chile is one of the biggest producers of lithium carbonate in the world and the Chilean Government has prioritized innovative technologies such as DLE for new project development

- The Company leverages DLE, an efficient method for extracting lithium brine that aims to minimize environmental impact, reduce production time and costs, resulting in high-purity, battery-grade lithium carbonate

- The Company is targeting a dual-listing on the ASX in Q1 2025.

- CleanTech Lithium’s flagship project, Laguna Verde is at the Pre-Feasibility Stage, once completed, the Company looks to start substantive conversations with strategic partners.

- The Company has an operational DLE pilot plant in Copiapó, Chile producing an initial volume of 88 cubic meters of concentrated eluate, which is the lithium carbonate equivalent (LCE) of approx. one tonne, proving the Company’s capacity to produce battery-grade lithium with low impurities from its Laguna Verde brine project.

- In January 2025, the Company announced to the market the production of high purity lithium carbonate (99.78%)

- The Board consists of the former CEO of Collahuasi, the largest copper mine in the world, having held senior roles at Rio Tinto and BHP. In-country experience developing major commercial projects runs throughout the team.

- Recently appointed Australian native Tony Esplin as CEO Designate and acts as a consultant until the proposed ASX listing. Mr Esplin’s priority is to take Laguna Verde Project into the development and commercial production phase – previously Newmont’s Suriname Merian GM and director. The US$800m Project was brought to commercial production on time and under budget.

- CleanTech Lithium’s operations are underpinned by an established ESG-focused approach – a critical priority for governments introducing regulations that require a cleaner supply chain to reach net-zero targets.

Key Projects

Laguna Verde Lithium Project

The 217 sq km Laguna Verde project features a sq km hypersaline lake at the low point of the basin with a large sub-surface aquifer ideal for DLE. Laguna Verde is the company’s most advanced asset.

Project Highlights:

- Prolific JORC-compliant Resource Estimate: As of July 2023, the asset has a JORC-compliant resource estimate of 1.8 Mt of LCE at a grade of 200 mg/L lithium.

- Environmentally Friendly Extraction: The company’s asset is amenable to DLE. Instead of sending lithium brine to evaporation ponds, DLE uses a unique process where resin extracts lithium from brine, and then re-injects the brine back into the aquifer, with minimal depletion of the resources. The DLE process reduces the impact on environment, water consumption levels and production time compared with evaporation ponds and hard-rock mining methods.

- DLE Pilot Plant: The pilot DLE plant in Copiapó, commissioned in the first quarter of 2024, has produced an initial volume of 88 cubic metres of concentrated eluate, which is the lithium carbonate equivalent (LCE) of approximately one tonne further confirming the company’s capacity to produce battery-grade lithium with low impurities from its Laguna Verde brine project.

- Scoping Study: Scoping study completed in January 2023 indicated a production of 20,000 tons per annum LCE and an operational life of 30 years. Highlights of the study also includes:

- Total revenues of US$6.3 billion

- IRR of 45.1 percent and post-tax NPV8 of US$1.8 billion

- Net cash flow of US$215 million

Viento Andino Lithium Project

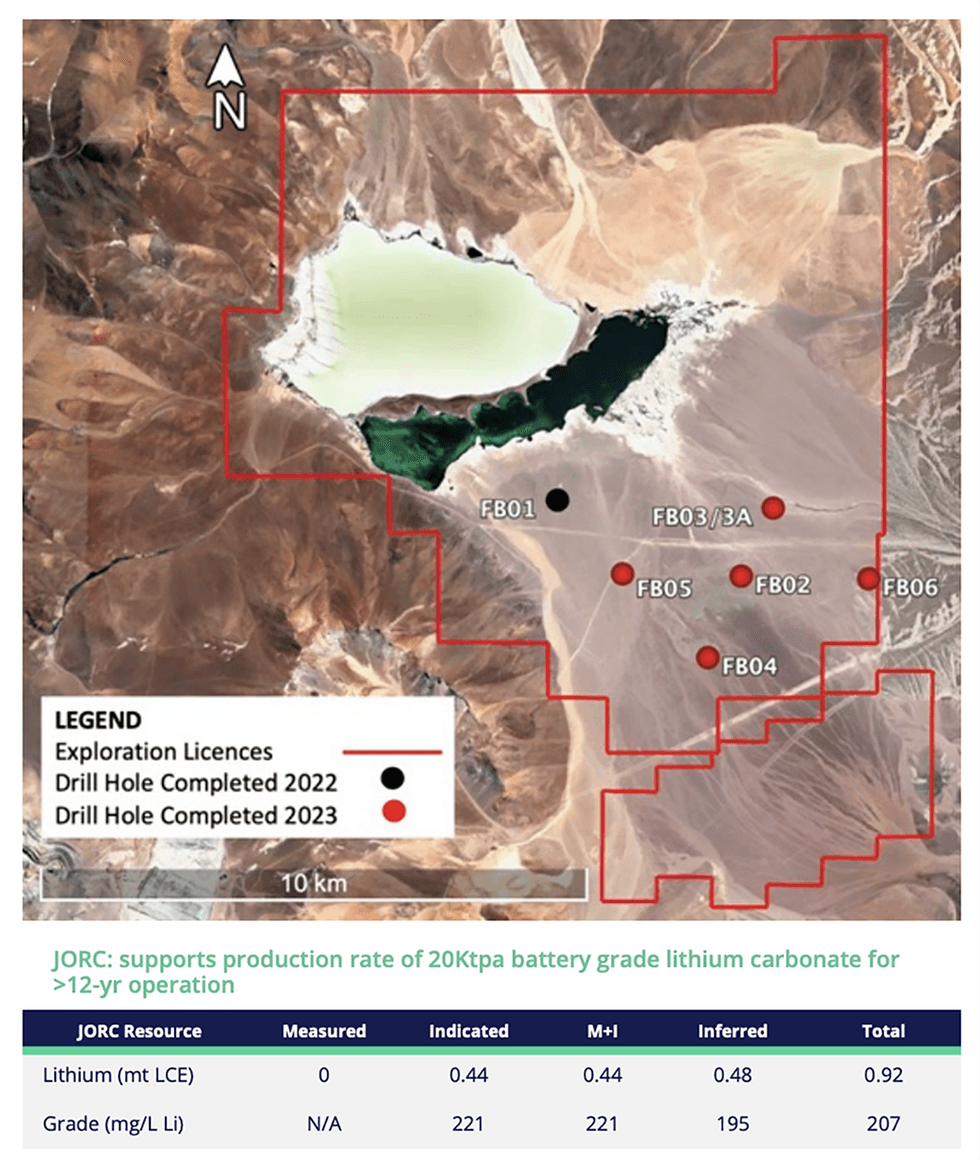

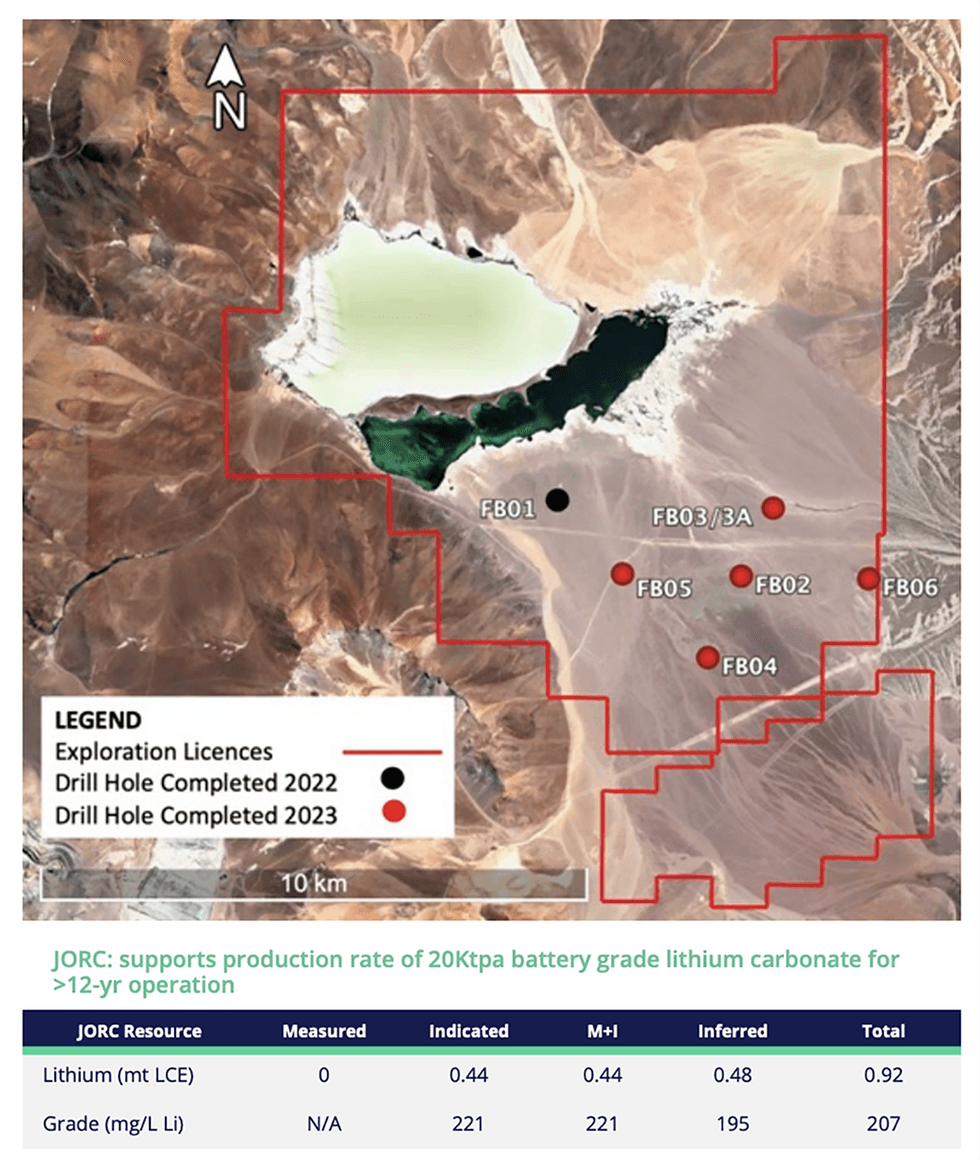

CleanTech Lithium’s second-most advanced asset covers 127 square kilometers and is located within 100 km of Laguna Verde, with a current resource estimate of 0.92 Mt of LCE, including an indicated resource of 0.44 Mt LCE. The company’s planned second drill campaign aims to extend known deposits further.

Project Highlights:

- 2022 Lithium Discovery: Recently completed brine samples from the initial drill campaign indicate an average lithium grade of 305 mg/L.

- JORC-compliant Estimate: The inferred resource estimate was recently upgraded from 0.5 Mt to 0.92 Mt of LCE at an average grade of 207 mg/L lithium, which now includes 0.44 million tonnes at an average grade of 221 mg/L lithium in the indicated category.

- Scoping Study: A scoping study was completed in September 2023 indicating a production of up to 20,000 tons per annum LCE for an operational life of more than 12 years. Other highlights include:

- Net revenues of US$2.5 billion

- IRR of 43.5 percent and post-tax NPV 8 of US$1.1 billion

- Additional Drilling: Once drilling at Laguna Verde is completed in 2024, CleanTech Lithium plans to commence further drilling at Viento Andino for a potential resource upgrade.

Llamara Lithium Project

The Llamara project is one of the largest greenfield basins in the Lithium Triangle, covering 605 square kilometers in the Pampa del Tamarugal, one of the largest basins in the Lithium Triangle. Historical exploration results indicate blue-sky potential, prompting the company to pursue additional exploration.

Project Highlights:

- Promising Historical Exploration: The asset has never been drilled; however, salt crust surface samples indicate up to 3,100 parts per million lithium. Additionally, historical geophysics lines indicate a large hypersaline aquifer. Both of these exploration results indicate potential for significant future discoveries.

- Close Proximity to Existing Operations: The Llamara project is near other known deposits:

- Atacama (SQM / Albemarle): 18,100 square kilometers

- Hombre (Muerto Livent): 4,000 square kilometers

- Pampa del Tamarugal (CleanTech): 17,150 square kilometers

Arenas Blancas

The project comprises 140 licences covering 377 sq km in the Salar de Atacama basin, a known lithium region with proven mineable deposits of 9.2 Mt and home to two of the world’s leading battery-grade lithium producers SQM and Albermarle. Following the granting of the exploration licences in 2024, the Cleantech Lithium is designing a work programme for the project

The Board

Steve Kesler – Executive Chairman

Steve Kesler has 45 years of executive and board roles experience in the mining sector across all major capital markets including AIM. Direct lithium experience as CEO/director of European Lithium and Chile experience with Escondida and as the first CEO of Collahuasi, previously held senior roles at Rio Tinto and BHP.

Anthony Esplin – Chief Executive Officer

Anthony Esplin is an Australian national who has over 30 years’ experience in the mining industry. He has held senior executive and board level positions primarily with tier one gold and base metals producers, including with Newmont Corporation, which consistently ranked among the leading miners on the Dow Jones Sustainability World Index.

He has significant experience in managing large-scale emerging markets assets, including in Peru, Mexico, Suriname, Indonesia, Australia and Papua New Guinea. Most recently COO at Discovery Silver Corporation, a TSX-listed company with development projects in Mexico. Market cap over C$730 million. Prior post as MD Barrick Nuigini.

Esplin worked and lived for over 12 years in Latin America and is fluent in Spanish. Esplin started under a consultancy contract in November 2024, visited the team in Chile and will take full-time role on completion of ASX listing. Australian resident to develop Australian investor base.

Gordon Stein – Chief Financial Officer

Gordon Stein is a commercial CFO with over 30 years of expertise in the energy, natural resources and other sectors in both executive and non-executive director roles. As a chartered accountant, he has worked with start-ups to major companies, including board roles of six LSE companies.

Maha Daoudi – Independent Non-executive Director

Maha Daoudi has more than 20 years of experience holding several Board and senior-level positions across commodities, energy transition, finance and tech-related industries, including a senior role with leading commodity trader, Trafigura. Daoudi holds expertise in offtake agreements, developing international alliances and forming strategic partnerships.

Tommy McKeith – Independent Non-executive Director

Tommy McKeith is an experienced public company director and geologist with over 30 years of mining company leadership, corporate development, project development and exploration experience. He’s held roles in an international mining company and across several ASX-listed mining companies. McKeith currently serves as non-executive director of Evolution Mining and as non-executive chairman of Arrow Minerals. Having worked in bulk, base and precious metals across numerous jurisdictions, including operations in Canada, Africa, South America and Australia, McKeith brings strategic insights to CTL with a strong focus on value creation.

Jonathan Morley-Kirk – Senior Independent Non-executive Director

Jonathan Morley-Kirk brings 30 years of experience, including 17 years in non-executive director roles with expertise in financial controls, audit, remuneration, capital raisings and taxation/structuring.