Metal Hawk Limited (MHK:AU) has announced Exceptional Results Extend High Grade Gold at Thylacine

Metal Hawk Limited (MHK:AU) has announced Exceptional Results Extend High Grade Gold at Thylacine

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to report assay results from the second of two holes from its inaugural diamond drilling campaign at the 100%-owned Red Mountain Lithium Project in Nevada, USA. Drill-hole RMDD002 has returned an outstanding thick intersection of some of the highest-grade lithium mineralisation seen to date at the Project, intersecting:

Key Highlights

The identification of thick, lithium mineralisation in the northernmost drill-hole at Red Mountain highlights the immense scale of the project, with strong lithium mineralisation now intersected in all drill-holes now spanning a north-south strike extent of over 5km and surface sample geochemistry indicating further potential to the north, south and west of the current drilled extents7, 9 (Figure 4).

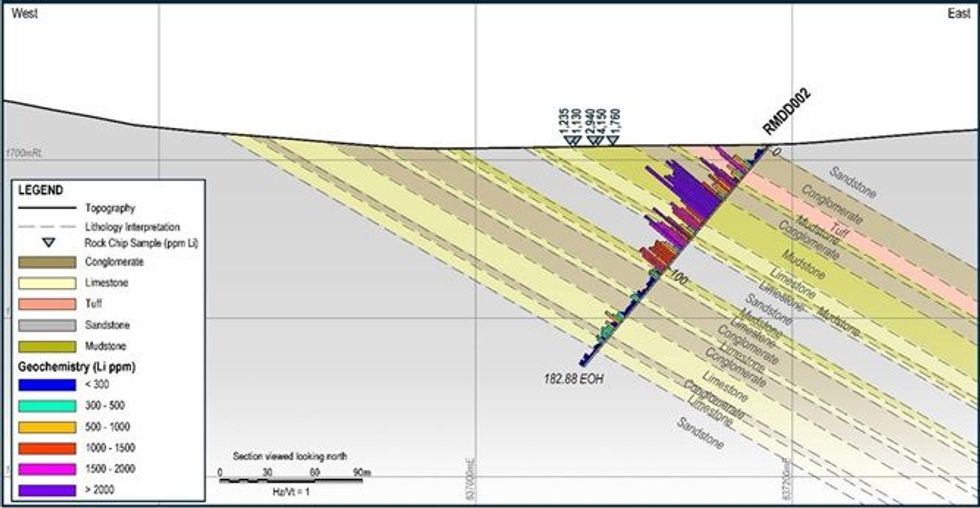

Of particular significance in hole RMDD002 is the presence of an internal 32.1m zone of very high-grade lithium mineralisation averaging 2,050ppm Li. The identification of substantially higher-grade lithium mineralisation in this hole, as well as that in the previously announced diamond drill hole RMDD001, indicates strong potential for further high-grade zones to be discovered at Red Mountain.

With all results for the recent diamond drilling now received, the Company is finalising geological mapping ahead of planning and permitting for the next round of drilling at the Project, which will be conducted at the earliest opportunity in the 2025 field season.

Astute Chairman, Tony Leibowitz, said:

“Like all great discoveries, Red Mountain continues to grow and improve the more we drill. The manifest scale and high tenor of mineralisation are testament to Red Mountain being one of the most important recent US lithium discoveries. This drill hole is the latest in a succession of thirteen, all of which intersected strong lithium mineralisation, establishing a solid foundation for a maiden mineral resource estimate to be advanced rapidly in 2025.”

Background

Located in central-eastern Nevada (Figure 5), the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2. Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 5) such as Lithium Americas’ (NYSE: LAC) 62.1Mt LCE Thacker Pass Project3, American Battery Technology Corporation’s (OTCMKTS: ABML) 15.8Mt LCE Tonopah Flats deposit4 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project5.

Astute has completed substantial surface sampling campaigns at Red Mountain, which indicate widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock with some exceptional grades of up to 4,150ppm Li2,8 (Figure 4).

The Company’s maiden drill campaign at Red Mountain comprised 11 RC drill holes for 1,518m over a 4.6km strike length. This campaign was highly successful with strong lithium mineralisation intersected in every hole drilled9. Two diamond drill holes have been drilled at the project.

Scoping leachability testwork on mineralised material from Red Mountain indicates high leachability of lithium of up to 98%, varying with temperature, acid strength and leaching duration10.

Other attractive Project characteristics include the presence of outcropping claystone host-rocks and close proximity to infrastructure, including the Project being immediately adjacent to the Grand Army of the Republic Highway (Route 6), which links the regional mining towns of Ely and Tonopah.

Results

Hole RMDD002 successfully intersected an 86.9m thick zone of lithium mineralised clay-bearing mudstone, sandstone, tuff and limestone, from 18.3m to 105.2m down-hole. The best grades were developed in the most clay-rich zones, which exhibit a desiccated and cracked appearance in drill core once dry (Figure 2). An internal very high-grade zone of 32.1m graded 2,050ppm Li, with a maximum single sample grade of 3,850ppm Li from 59.4-61.5m (195-201.7ft), which is the drill sample with the highest lithium grade achieved to date at the project.

Figure 1. RMDD002 interpretative cross section, lithium geochemistry and (50-110m off-section) rock chip samples

Interpretation

The two northernmost holes drilled as part of the maiden Red Mountain RC drilling campaign, RMRC002 and RMRC003, intersected thin zones of near-surface lithium mineralisation. It was interpreted at the time that these two holes ‘clipped’ the edge of a zone of lithium bearing clay-rich rocks that was likely to thicken towards the east (see ‘open’ arrow in Figure 3)9. RMDD002 was designed to test this interpretation and, in addition, extend the mineralisation 375m further north beneath an extrapolated zone of strong rock chip sample results (Figure 1).

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Vital Metals Limited (ASX: VML) (“Vital”, “Vital Metals” or “the Company”) is pleased to report an updated Mineral Resource estimate (“MRE”) for the Tardiff Upper Zone (“Tardiff”), part of the Nechalacho Rare Earths Project (the “Project”), located in Northwest Territories (NWT), Canada.

Highlights:

The current MRE follows Vital’s completion of resource definition drilling program at Tardiff in 2023, totalling 74 holes for 6,664m, which returned high-grade results up to 8% TREO.

The current MRE features a total resource tonnage (across all categories) of 192.7Mt grading 1.3% TREO and 0.3% Nb2O5, containing 2.52Mt TREO including 636,000t of NdPr.

Vital Managing Director and CEO Lisa Riley said: “Our updated MRE for the Tardiff deposit shows increased confidence in the deposit, with a 70% increase in the Indicated Resource tonnages and a 56% increase in the Measured + Indicated Resource tonnages compared to our April 2024 historical MRE, while our Inferred Resource tonnages have decreased by more than 20%. While our overall totals of contained TREO and NdPr have only slightly increased on the April 2024 historical MRE, based on the drilling we completed in 2023, we now have more confidence that this is a truer representation of what this deposit holds.

“The current MRE is the final piece awaited for inclusion in our Tardiff Scoping Study, which is now due for delivery in the coming weeks.”

Vital VP Exploration Natalie Pietrzak-Renaud: “The positive changes to the current MRE compared to the April 2024 historical MRE is largely based on the inclusion of the 2023 drill results, the 2024 metallurgical test results we obtained from our 2023 collected composite Tardiff sample, and the carefully considered metrics we used as inputs. Our approach is to establish outputs that are realistic pathways for project development. With the work we completed on the MRE and the forthcoming Scoping Study, we have, and continue, to build a solid foundation of data and knowledge to advance our project.”

The Tardiff MRE is reported within an optimized open-pit shell using Studio NPVS from the Datamine Suite. The optimized pit shell was generated using a 45° maximum final pit wall, and a 150m RL lower pit limit.

Tardiff contains rare earth element (“REE”) and Niobium mineralisation hosted within a nepheline syenite intrusion. Recent metallurgical test work indicates strong potential to produce neodymium oxide (Nd2O3) and praseodymium oxide (Pr6O11), which are light rare earth oxides (LREO) with magnetic properties and are in demand due to their use in technologies such as high-strength magnets, aircraft engines, and various industrial and electronic applications. The recent metallurgical test work also indicates an opportunity to further investigate and advance the potential opportunity to recover niobium minerals from Tardiff ore. Niobium is in demand due to its low oxidation point and relatively high melting point. It is used as an alloy in aeronautic engines, electronic applications (due to its superconducting properties) and as an additive to lithium-ion batteries to enhance battery life.

The current MRE represents a significant increase in reported tonnes in the Indicated Mineral Resource category in comparison to the historical MRE completed in April 2024 and a decrease in reported tonnes in the Inferred Mineral Resource category. The current MRE is also reported above a 0.7% TREO cutoff grade instead of a metal equivalent value as previously used.

Click here for the full ASX Release

This article includes content from Vital Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Unico Silver Limited (“USL” or the “Company”) is pleased to announce further assay results from ongoing drilling at the Cerro Leon project, located in the Santa Cruz province of Argentina. The current drill program at Cerro Leon commenced October 2024 and is anticipated to continue through to the end of Q1 2025.

HIGHLIGHTS

Managing Director, Todd Williams: “Drilling at Cerro Leon continues to return significant mineralisation within multiple structures that fall outside of the current Mineral Resource, including the Karina, CSS, and Archen-Chala prospects.

At Archen, drilling has returned an exceptional hole of 17m at 423gpt silver equivalent from 32m downhole depth, the highest to date for the prospect. At Chala, individual silver assay of 3134gpt silver confirm shallow high-grade silver mineralisation.

We now have 2 diamond drill rigs on site at Cerro Leon to complete a further 10,000m of drilling with a focus on expanding mineralisation at all prospects as well as ongoing regional exploration”

Click here for the full ASX Release

This article includes content from Unico Silver Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.