alfa-marushima-tokyo-japan

EA cuts outlook as growth of one of its key videogame franchises has stalled

Strategic Alliance with Macmahon to Accelerate Redevelopment of Nifty

Cyprium Metals Limited (ASX: CYM, OTC: CYPMF) (Cyprium or the Company), a copper developer focused on recommencing production at the Nifty Copper Complex in the Paterson region of Western Australia (Nifty), has entered into a non-binding Heads of Agreement (HOA) for a Strategic Alliance with leading global mining services provider Macmahon Holdings Ltd (Macmahon) (ASX: MAH) to accelerate Cyprium’s redevelopment of Nifty.

Highlights of the Strategic Alliance include:

- Macmahon to lead and contribute internal resources to complete the Bankable Feasibility Study (BFS), subject to stage gates, for the redevelopment of Nifty via an Early Contractor Involvement (ECI) Contract, building on Cyprium’s recent Pre-Feasibility Study (PFS) announced 27 November 2024.

- Following the completion of the works under the ECI Contract, and subject to the parties’ agreeing all relevant terms, it is envisaged that Cyprium and Macmahon will enter an exclusive period to agree the terms of a life-of-mine, whole-of site alliance style operations contract.

- ECI scope includes Macmahon leading Nifty site operations to accelerate scoping of feasibility studies and refurbishment programs.

- Macmahon to identify early revenue opportunities and undertake rapid restart scenario planning to maximise advantage of brownfield infrastructure and prolific data.

Cyprium Executive Chair, Matt Fifield, commented: “The Strategic Alliance with Macmahon represents a significant step forward in enhancing our operational and execution capacity, building required capability through partnership. Macmahon is a recognised leader in mining services, bringing extensive expertise in engineering, procurement and best-in-class operating and environmental systems. Their operations align with the scale required for the new open-pit development at Nifty. They operate at the scale of mine and equipment that a new open pit at Nifty will require. Macmahon’s expertise brings real-life experience to the feasibility process that further de-risks Nifty and sets parameters of our execution plans.

“It’s clear that Cyprium and Macmahon share a common vision for long-term success – deliver on the 20- year reserve life potential of the Nifty Copper Complex and exploit accretive near-term revenue opportunities. Expect more on this in 2025 as we turn study work into actionable plans.”

Macmahon Managing Director and CEO, Mick Finnegan, said: “We are excited to partner with Cyprium and contribute to accelerating Nifty’s redevelopment. Nifty, the Paterson Range, and copper more broadly, are very interesting to us. The project requirements fit many of our core capabilities including engineering services, operational execution, and providing end-to-end value for our clients. We look forward to the redevelopment of Nifty and resuming its history as a leading producer of Australian copper and being a value-adding execution partner for Cyprium.”

Macmahon to Lead BFS

It is envisaged that Macmahon will take the lead role with the BFS and contribute internal engineering, planning, estimation and project management resources needed to complete the BFS and restart copper production, through the ECI Contract and subject to stage gates. Cyprium will fund BFS costs related to work scopes not completed by Macmahon.

The BFS will build on Cyprium’s 2024 PFS, which demonstrated the economic viability of a new surface mine to feed a refurbished plant to produce 694,000 tonnes of copper in concentrate across a 20-year project life (Concentrate Project), and a low capital, high returning opportunity to reprocess existing above- ground heap leach reserves to quickly establish revenues by producing copper cathode (Cathode Project).

Alliance-Style LOM Contract Expected

The HOA includes an exclusive period during which the parties commit to progressing the feasibility studies and executing an alliance-style life-of-mine contract. The parties expect this contract to cover all operations on site including surface mining, concentrator refurbishment, cathode startup, and ancillary infrastructure. The exclusive period commences from the execution of the ECI Contract.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

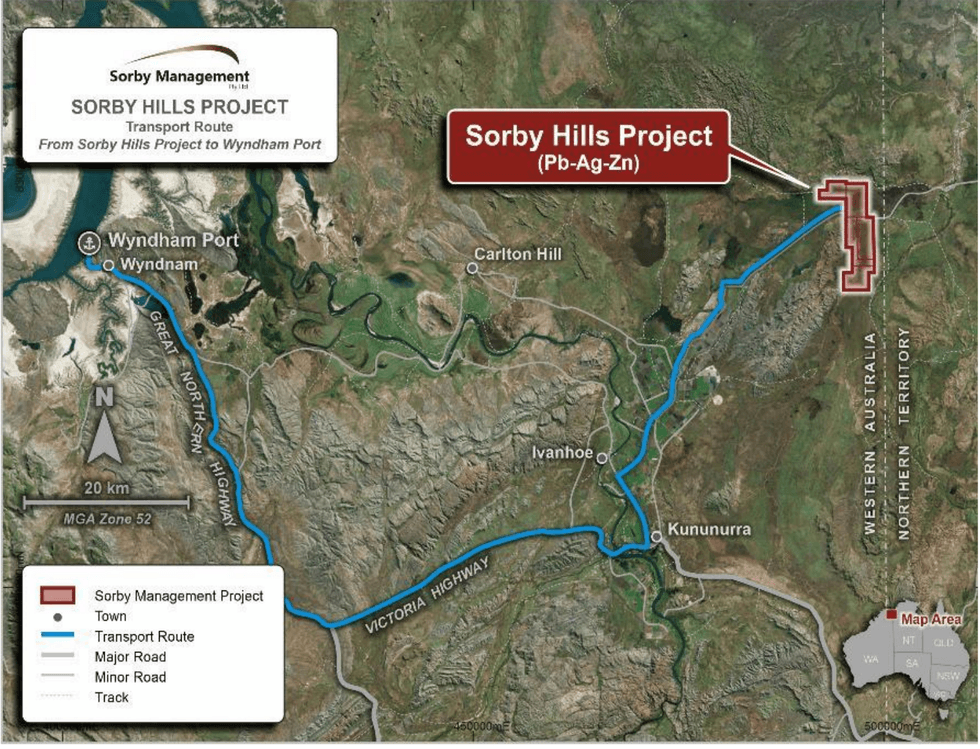

Boab Metals Set to Shine with Sorby Hills Amid 2025 Silver Surge: Report

Description:

Shaw and Partners’ recent research note, dated December 16, 2024, highlights a promising outlook for silver in 2025, emphasizing Boab Metals’ (ASX:BML) strategic position to benefit from this trend.

With its flagship Sorby Hills Project in Western Australia, the company is poised to capitalize on rising silver demand and constrained global supply. The report highlights Sorby Hills’ robust metrics, including a pre-tax net present value (NPV) of AU$411 million and a pre-tax internal rate of return (IRR) of 37 percent, underpinned by low operating costs and a significant lead-silver concentrate output.

The analyst firm also underscores the importance of the binding offtake agreement with Trafigura, which includes a US$30 million prepayment, providing financial flexibility and market access. Boab Metals’ advanced project timeline and favorable economics position it as a standout player in the silver sector.

Key Insights:

- Silver Market Dynamics: The report identifies two primary drivers for silver’s anticipated strength: its historical correlation with a rising gold price and increasing demand from the solar panel industry. This uptick is largely attributed to the solar sector, which has seen its share of silver consumption rise from around 5 percent in 2015 to approximately 14 percent in 2023.

- Sorby Hills Project: Boab Metals’ Sorby Hills Project, located in Western Australia’s Kimberley Region, stands out as one of the most advanced silver projects on the ASX. The project’s Front-End Engineering and Design study, completed in June 2024, outlines compelling metrics: an upfront capital expenditure of AU$264 million, an average C1 cost of US$0.36 per pound of payable lead (inclusive of silver credits), a pre-tax NPV of AU$411 million, a pre-tax IRR of 37 percent, and an average annual EBITDA of AU$126 million.

- Offtake Agreement and Financing: A significant milestone for Boab Metals is the binding offtake agreement with Trafigura for the lead-silver concentrate from Sorby Hills. This agreement includes a US$30 million prepayment, bolstering the project’s financing strategy. Additionally, the company is exploring debt funding opportunities with entities like the Northern Australia Infrastructure Facility, which offers concessional loans for infrastructure projects in northern Australia.

- Lead Market Perspective: Contrary to common misconceptions, the report underscores that lead consumption has been on an upward trajectory, averaging a 3.2 percent annual increase from 2004 to 2023. The forecast anticipates continued growth at 2.2 percent annually through 2030, driven by sustained demand in various industrial applications.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

Netflix keeps defying the doubters. One now thinks the stock could soar 56%.

Fortnite by the numbers: $342M paid to creators in 2024, with creators tripling to 70,000

ByteDance’s UI-TARS can take over your computer, outperforms GPT-4o and Claude

EA’s December quarter was weaker as Dragon Age and soccer missed forecasts

Financial Agreement signed releasing $2M grant

International Graphite (IG6:AU) has announced Financial Agreement signed releasing $2M grant

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for Peru