alfa-marushima-tokyo-japan

DeepSeek R1’s bold bet on reinforcement learning: How it outpaced OpenAI at 3% of the cost

U.S. stock futures fall ahead of Fed meeting, key earnings week for Big Tech

Trump vs Powell: Who will drive the stock market as the Fed holds its first meeting of the year?

Trump’s 25% tariffs against Colombia could affect prices of coffee, flowers, gas

Nifty Copper Project Poised to Unlock Value for Cyprium Metals, Report Says

Description

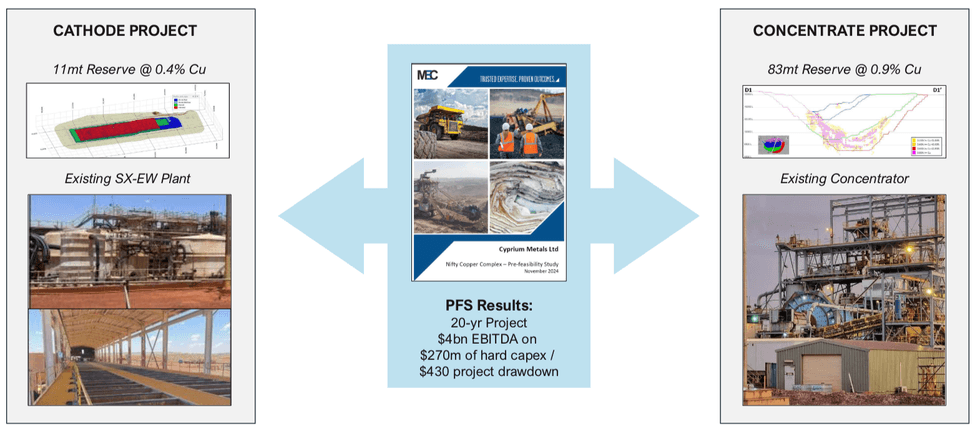

The latest MST Access analyst report values Cyprium Metals (ASX:CYM) at AU$0.10 per share, significantly above its current trading price of AU$0.027. The valuation is underpinned by the company’s dual-track approach to restarting the Nifty copper project, a standout asset with a 20-year mine life and the potential to become one of Australia’s largest open-pit copper producers.

By leveraging existing infrastructure and its low capital intensity, Cyprium is positioned to deliver exceptional returns, according to the report. With plans to secure a strategic partner in 2025 and a fast-tracked production timeline for its Cathode project, Cyprium represents an undervalued opportunity in the ASX copper space.

Report Highlights:

- Development Highlights: The Nifty concentrate project is a large-scale, long-life operation expected to produce between 35,000 and 40,000 tonnes per annum (ktpa) of copper over 20 years. With an all-in sustaining cost (AISC) of US$2.62 per pound, it offers an attractive cost profile. The Nifty cathode project, meanwhile, is a low-capex, fast-start initiative designed to leverage the existing stacked leach pads and SX/EW facilities at the site. The project is projected to produce between 4,000 and 6,000 tonnes of copper cathode per annum over a period of more than four years, with an AISC of US$2.18 per pound. With first production expected as early as late 2025 or early 2026, the cathode project is set to provide early cash flow and reduce risks associated with the larger-scale Concentrate Project.

- Strategic and Financial Advantages: Cyprium’s brownfield restart approach at Nifty provides multiple benefits, including reduced technical risk, expedited permitting, and lower capital requirements. The company’s transformation in 2024, which saw a new management team, a refreshed balance sheet, and a revised development strategy, has set the stage for its emergence as a leading copper developer. The introduction of a strategic partner in 2025 is expected to validate its valuation further and provide funding for the larger-scale project.

- Outlook and Catalysts: Cyprium Metals is poised for a transformative year in 2025, with key milestones including a final investment decision on the cathode project, the introduction of a strategic partner, and the commencement of detailed feasibility studies for the concentrate project. As the company transitions into production and unlocks the full potential of the Nifty copper project, significant value creation is anticipated, positioning Cyprium as an emerging leader in the Australian copper sector.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.