alfa-marushima-tokyo-japan

Altair Minerals Limited (ASX: ALR) – Trading Halt

Description

The securities of Altair Minerals Limited (‘ALR’) will be placed in trading halt at the request of ALR, pending it releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of the commencement of normal trading on Thursday, 30 January 2025 or when the announcement is released to the market.

Issued by

ASX Compliance

Click here for the full ASX Release

This article includes content from Altair Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DeepSeek could represent Nvidia CEO Jensen Huang’s worst nightmare

Bitcoin has ‘nothing to do’ with DeepSeek. Here’s why its price tumbled anyway.

Strategy Update and Cost Restructure

Livium Ltd (ASX: LIT) (“Livium” or the “Company”) wishes to provide a strategic update in response to progress that had been made to shift our various technologies to important inflection points for growth. Livium’s strategy is now focussed on strategic partnering initiatives which will facilitate the ongoing growth and development of the Company’s technologies. With a more focussed set of actions, a review of the business has been undertaken to explore options to reduce costs.

HIGHLIGHTS

- Strategic focus on scaling Envirostream, the Battery Recycling division, due to the potential of increased recycling volumes and cashflows over the years ahead

- Battery Recycling: Continued safe operations, growing volumes and operating profits, and seek partners to scale operations in line with the expected waste outlook

- Livium is well advanced on the near-term commercialisation pathways of its other technologies:

- Battery Materials: Defined pathway for development of an Australian LFP demonstration plant with funding to be secured directly into VSPC from strategic partners

- Lithium Chemicals: Complete JDA activities with MinRes, including assessment of alternate commercialisation pathways and selection of the preferred lithium product

- Restructuring of the organisation and cost reductions being undertaken with estimated annual ongoing savings of A$1.5m

Comment regarding the strategic update from Livium CEO and Managing Director, Simon Linge

“We have advanced our strategy to inflection points, with the next phases of growth for each division requiring strategic partners to underpin their growth and development. With a focus on strategic growth partners, we have reviewed our resourcing and made the decision to restructure our organisation and reduce costs.

Livium remains committed to delivering returns for shareholders. Whilst organisational changes may impact our ability to react to opportunities, right sizing the organisation assists in resetting the Company’s cost base to become sustainable over this critical period.”

NEAR TERM PLANS

The following activities have been identified as key to delivering value in the near term:

- Battery Recycling: Continued safe operations, growing end-of-life volumes, and seeking partners to scale operations in line with the expected waste outlook and to expand into related services

- Battery Materials: Secure funding for an Australian LFP demonstration plant from government and private strategic partners, who will invest directly into VSPC

- Lithium Chemicals: Complete JDA activities with MinRes, including assessment of alternate commercialisation pathways and selection of the preferred lithium product

- Corporate: Complete implementation of organisation restructure and other cost saving initiatives.

BATTERY RECYCLING GROWTH OUTLOOK

The Battery Recycling division generates revenue today, is the largest recycler of lithium-ion batteries in the country, draws on our technical expertise to provide value-added services and has strong commercial relationships. Strategic focus is being placed on Battery Recycling, through Envirostream, due to the potential of increased recycling volumes over the coming years.

During CY2024, Envirostream successfully increased volumes of EV’ andESS2 with most of the volume being received under exclusive customer arrangements. Over CY2024, Envirostream collected 736k tonnes of large format batteries and it is estimated that there are five times these volumes available today which are increasingly expected to be recycled due to consumer demand and government regulation. In their Battery Market Analysis, B-cycle show how EV and ESS batteries are expected to dominate3.

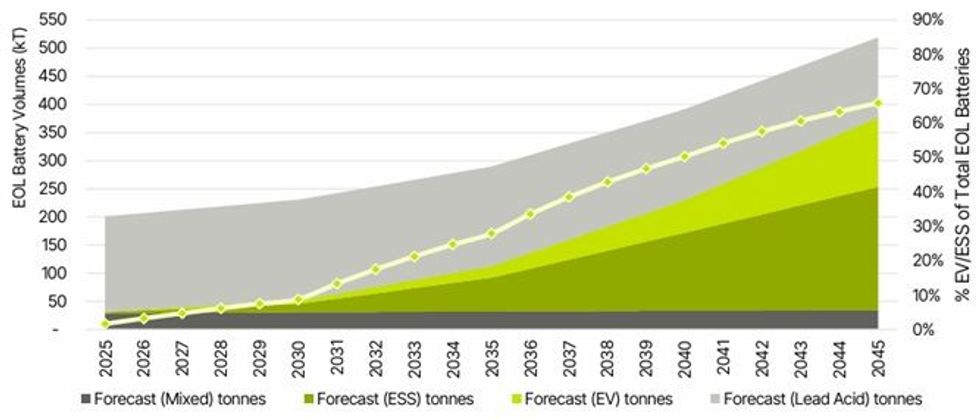

Figure 1. EOL Battery Projections by Market Segment3

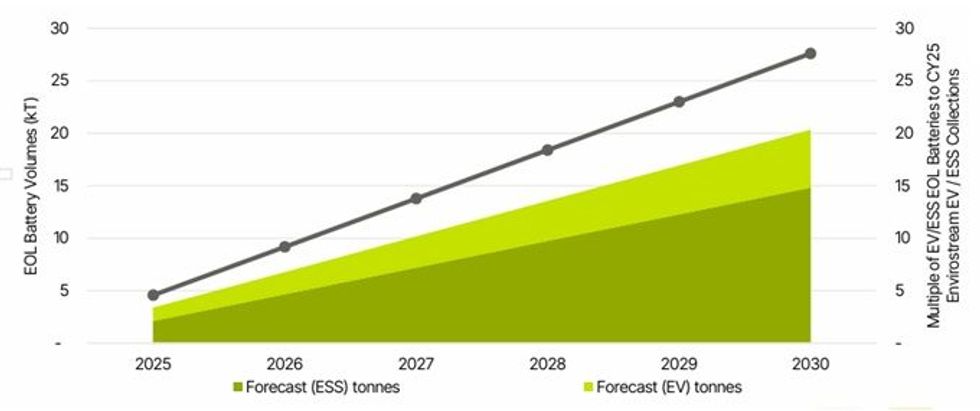

Focusing on only EV / ESS for the balance of the decade demonstrates the near-term opportunity for Envirostream collections growth relative to current performance.

Figure 2. 5-Year EV and ESS EOL Battery Projections3

The near-term outlook for Envirostream is positive, enabling increases of volumes collected and processed, and providing an opportunity to expand our service offerings in line with market requirements.

To accommodate expectations of market growth, the business intends to explore deploying growth capital to improve operating efficiencies and expand capacity. The company has appointed advisors to coordinate discussions around partnership and growth funding options, which includes both strategic partners and other financiers.

Click here for the full ASX Release

This article includes content from Livium Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MicroStrategy is still loading up on bitcoin, but the pace of buying is slowing

Growth-Focused Gold Explorer: Torque Metals and Aston Minerals Unite in Strategic Merger

Torque Metals Limited (“Torque”) (ASX: TOR) and Aston Minerals Limited (“Aston”) (ASX:ASO) are pleased to announce they have entered into a binding scheme implementation deed to facilitate a merger whereby Torque will acquire 100% of Aston in an all-scrip transaction (“Merger”).

HIGHLIGHTS

- The Merger will see Torque and Aston shareholders each own 50% of the merged entity1.

- Combined business to have 1.75Moz in gold resources across two exploration projects, with a dominant land position, and pro-forma cash of over $5 million to drive ongoing gold exploration activities2.

- Paris Gold Project: 250,000oz @ 3.1 g/t Au3, Western Australia Goldfields, ~1,200km²

- Edleston Gold Project: 1.5Moz @ 1.0 g/t Au4, Ontario, Canada. Abitibi Greenstone Belt, ~310km²

- Entities related to Tolga Kumova and Evan Cranston to collectively invest $1.0 million into Torque at $0.05 per share unconditionally (Placement).

- Evan Cranston has been appointed to the Board of Torque as a Non-Executive Director, and upon completion of the Merger, Tolga Kumova will be invited to join the Board of Torque, with Cristian Moreno and Andrew Woskett to remain in their respective roles of Managing Director and Chairman.

- Torque will offer 1 Torque share for every 5.2 Aston shares, representing an offer price of $0.01 per Aston share5.

- Directors of Aston unanimously recommend that all shareholders and option holders vote in favour of Torque’s offer, in the absence of a Superior Proposal.

- The merged entity will benefit from a strong cash position, a refreshed Board to drive the next phase of exploration growth, and the ability to drive gold exploration across two emerging gold assets, being the Paris Gold Project in Western Australia and the Edleston Gold Project in Ontario, Canada.

TRANSACTION SUMMARY

Torque Metals Limited (ASX: TOR) (“Torque”) and Aston Minerals Limited (ASX: ASO) (“Aston”) are pleased to announce a merger of equals, creating a well-funded, growth-focused gold exploration company with projects located in two Tier-1 mining jurisdictions: the Western Australian Goldfields and Ontario, Canada.

The companies have entered into a scheme implementation deed (“Scheme Implementation Deed” or “Scheme”) pursuant to which they have agreed to a merger to be conducted by way of a Scheme of Arrangement under the Corporations Act 2001 (Cth) (“Corporations Act”), whereby Torque will acquire 100% of the fully paid ordinary shares in Aston and 100% of the unlisted Aston options (“Proposed Merger”).

Commenting on the Proposed Merger, Torque Managing Director, Cristian Moreno, said:

“We are pleased to announce the proposed merger between Aston and Torque, creating a dynamic growth-focused gold explorer with a dominant position in two leading mining jurisdictions. This strategic transaction unites our strengths, consolidating a substantial gold resource of 1.75 million ounces (Moz) across two highly prospective exploration projects. Torque will command an extensive landholding in two premier mining jurisdictions and leverage current cash reserves exceeding $5 million to fund ongoing exploration activities.

“As Torque already owns the Paris Gold Project, located in the heart of the Western Australian Goldfields, the merger enhances the strategic potential of this asset and aligns with Torque’s broader growth objectives. With a resource of 250,000 ounces at an impressive grade of 3.1 g/t gold, the project spans a substantial ~1,200km² tenement package, positioning it as a cornerstone of our portfolio. Complementing this, Aston’s Edleston Gold Project in Ontario, Canada, is situated in the renowned Abitibi Greenstone Belt and contributes a significant resource of 1.5 million ounces at 1.0 g/t gold. This project’s ~310km² landholding offers additional high-grade exploration opportunities, further solidifying our growth potential.

“A key advantage of this merger is the injection of $4 million cash on a pre-costs basis from Aston into Torque Metals. This strategic funding approach ensures that the company is well-capitalised to advance exploration efforts in the current robust gold price environment.

“We also welcome a $1 million strategic investment from Tolga and Evan, who have recognised the considerable exploration upside to be unlocked at our expansive Paris Gold Project area. Their involvement will bring valuable insights and leadership to Torque Metals, and I look forward to collaborating with them on the Board of Torque following completion of the merger.”

Commenting on the proposed merger, Aston Managing Director and Chairman, Russell Bradford, said:

“The proposed merger with Torque Metals marks an exciting milestone, and I am particularly impressed by the scale potential of the Paris Gold Project. This project boasts a dominant land package in the highly productive Western Australia Goldfields, with an outstanding resource grade of 3.1 g/t gold and significant potential to expand into a major high-grade deposit.

“Its strategic location, surrounded by prominent producers and explorers such as Goldfields, Westgold, Northern Star, Vault Minerals, and Astral Resources, underscores the quality and opportunity this project represents. To have a project of this calibre in such a prime jurisdiction is truly remarkable.

“I commend Torque Metals’ management for their exceptional work in advancing the Paris Gold Project to this stage. With the significant cash injection from this merger, I have complete confidence in their ability for Torque to uncover gold ounces and deliver outstanding value for the shareholders of Torque and Aston.”

Click here for the full ASX Release

This article includes content from Torque Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Completion of Placement, Parkes Project Acquisition and Site Visit

Adavale Resources Limited (ASX:ADD) (“Adavale” or “the Company”) is pleased to announce the successful completion of a 72.5% interest acquisition in the Parkes Gold and Copper Project (the “Project”), located in the Lachlan Fold Belt of NSW, Australia.

KEY HIGHLIGHTS

- Completion of the acquisition of a 72.5% interest in the Parkes Gold-Copper Project (“Parkes Project”).

- A 354.15km2 tenement holding, encompassing a geological setting that is considered highly prospective for structurally controlled gold and gold rich porphyry copper-gold mineralisation.

- The Parkes Project is located at the intersection of the crustal-scale Lachlan Transverse Zone structural corridor with Early Ordovician-age Macquarie Arc Volcanics.

- The Project is adjacent to the giant Northparkes porphyry-hosted copper-gold mine (5.2Moz Au & 4.4Mt Cu) [ASX:EVN] and in a similar tectono-stratigraphic setting to the world-class Cadia-Ridgeway copper-gold porphyry deposits (35Moz Au & 7.9Mt Cu) [ASX:NEM].

- The key Project asset is the former London-Victoria gold mine located in EL 7242, which contains a remnant (unmined) Historical Estimate of 124koz Au**

- EL7242 was recently successfully renewed until 7 November 2030.

- The Adavale team and the Vendor have conducted a geological reconnaissance to the Project to inspect London Victoria drill core, meet with local landholders and geological consultants and also to carry out some initial rock chip sampling.

- Completion of the placement allows Adavale to progress exploration at a number of target prospects within the Project and focus on upgrading the London-Victoria Historical Resource to a JORC compliant Mineral Resource.

- Directors and Officers co-invest ~$100,000 (over 6%) of the Placement.

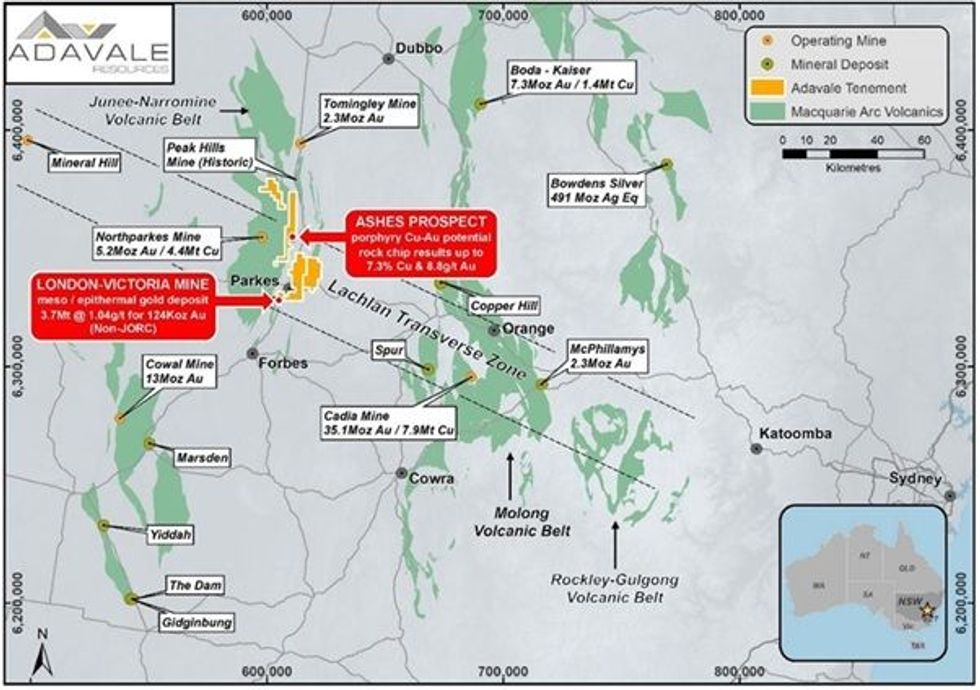

The Project comprises four exploration tenements for a total area of 354.15km2, that are prospective for orogenic, epithermal and gold-rich porphyry-style copper-gold deposits. The Project area is located within the prolific gold and copper producing Macquarie Arc portion of the Lachlan Fold Belt in central NSW. The Exploration Licences (‘EL’s’) are situated where Early Ordovician-aged Junee-Narromine Volcanic Belt rocks of the western part of the Arc are intersected by the crustal-scale structural corridor of the Lachlan Transverse Zone (‘LTZ’). Significantly, the LTZ is host to Tier 1 gold and copper mines, such as Northparkes (5.2Moz Au & 4.4Mt Cu) and Cadia Ridgeway (35.1Moz Au & 7.9Mt Cu) where it intersects Macquarie Arc rocks (Figure 1).

Commenting on the developments, Adavale Resources Executive Chairman and CEO, Mr Allan Ritchie, stated: “The successful completion of the acquisition and placement mark a pivotal step forward to advancing our activity with this world-class asset. The Vendor and the Adavale team along with our very experienced Lachlan Fold Belt geologists have just returned from an initial field trip and we are incredibly excited to start our exploration efforts at our highly prospective Parkes Project. We are very grateful to the shareholders for their continued support, Adavale’s Directors and Officers have also co-invested a further ~$100,000 (6%) in this placement and we look forward to providing regular updates from the Lachlan Fold Belt throughout the program ahead.”

Figure 1: Map of the central New South Wales Lachlan Fold Belt

The Parkes Project’s most advanced prospect is the former London-Victoria Gold Mine which saw estimated historical production by BHP Gold and Hargraves Resources of 200,000 to 250,000 ounces at a head grade of 1.5-2g/t Au. A non-JORC Historical Estimate of 3.7Mt at 1.04 g/t Au for 123.8koz Au is defined for London-Victoria (refer to Cautionary Statement1 below).

At London-Victoria, it is intended to utilise the existing drillhole database, augmented by a small number of new and well-targeted deeper holes, to estimate a Mineral Resource. This opportunity comes at relatively low cost and at a time of record gold prices. The London-Victoria Mine is located on EL7242 which has recently been successfully renewed until 7 November 2030.

The map of the Lachlan Fold Belt area in NSW (Figure 1) shows the location of Adavale’s newly acquired mineral tenure relative to significant copper and gold deposits, the Lachlan Transverse Zone and Ordovician volcanic belts of the Macquarie Arc Group. Note the Project’s proximity adjacent to the Northparkes mine at the intersection of the Lachlan Transverse Zone with the Junee-Narromine Volcanic Belt.

Click here for the full ASX Release

This article includes content from Adavale Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Chemphys Placement Participation Funds Received

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to advise that it has received proceeds from Latam Resources Pty Limited (Latam), an Affiliate of Chengdu Chemphys Chemical Industry Co., Ltd (Chemphys) in relation to the share placement (Placement) announced by the Company on 10 September 2024 and subsequently approved by shareholders at the Galan Annual General Meeting held on 15 November 2024. Chemphys agreed to subscribe for US$3 million worth of shares under the terms of the Placement.

Funds received from Latam will be applied by Galan towards ongoing Phase 1 operations at Hombre Muerto West (HMW), as parties continue to work towards finalising an offtake prepayment facility targeted financial close during the first quarter of 2025.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.