New Murchison Gold Limited (ASX: NMG) (“NMG” or the “Company”) is pleased to announce an Ore Reserve Estimate (ORE) for the Crown Prince Deposit (Crown Prince) at the Company’s flagship Garden Gully Gold Project near Meekatharra, Western Australia.

HIGHLIGHTS

- New Murchison Gold Limited (ASX:NMG) is pleased to announce the results of a Feasibility Study into the Crown Prince Gold Deposit (Crown Prince Feasibility Study) in WA which outlines pre-tax cash flow of $226m (undiscounted) over a period of 30 months at current spot gold prices (A$4,385/oz).

- Capital expenditure required to commence production of $5.4m is very low relative to peer gold projects given the Company’s Ore Purchase Agreement (OPA) with Westgold Resources Limited (WGX or Westgold).

- NMG is also expecting to be able to utilise its substantial tax loss position (30-Sep-24: $84.4m in accumulated losses, $76.4m usable)1 to offset tax liabilities on initial pre-tax profits from Crown Prince.

- 140koz contained ounces of gold are to be mined and trucked to WGX over 30-month open pit.

- Upside in potential underground mine below the pit, which will be studied in 2025.

- NMG’s production plan is based on Ore Reserves only. Contained ounce production profiles in the study comprise only that material delineated in Ore Reserves (estimated using a A$3,250 /oz gold price assumption) for the project.

- Commencement of mining is expected in June 2025 with first ore sales scheduled in August 2025. Mining and environmental approval documentation was submitted to relevant regulators and counterparties in late 2024.

- The Crown Prince Feasibility Study (FS) was completed in January 2025 and demonstrates sound financial returns based on:

- An updated Mineral Resource Estimate (MRE) of 2.205Mt @ 3.Gg/t for 27Gkoz2

- An Ore Reserve estimate for Crown Prince Project of 0.8G million tonnes @ 4.8g/t gold (Au) containing 140,000oz Au.

- Crown Prince ore sold at the mine gate under an Ore Purchase Agreement (OPA) for haulage to Westgold’s Bluebird Mill south of Meekatharra.

- Production from the Crown Prince Open Pit only, which is covered by the granted mining leases.

- Next steps to expand the resource base are to assess Crown Prince underground potential and other deposits including Lydia and New Murchison King. These were not considered in the FS.

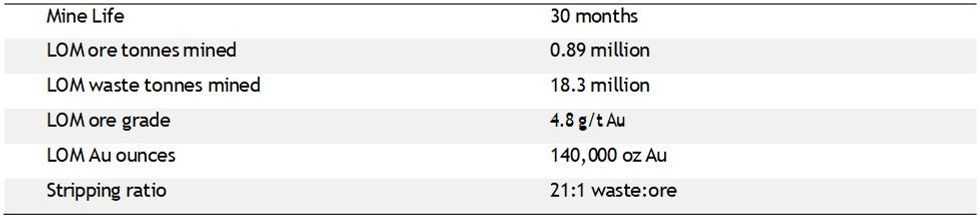

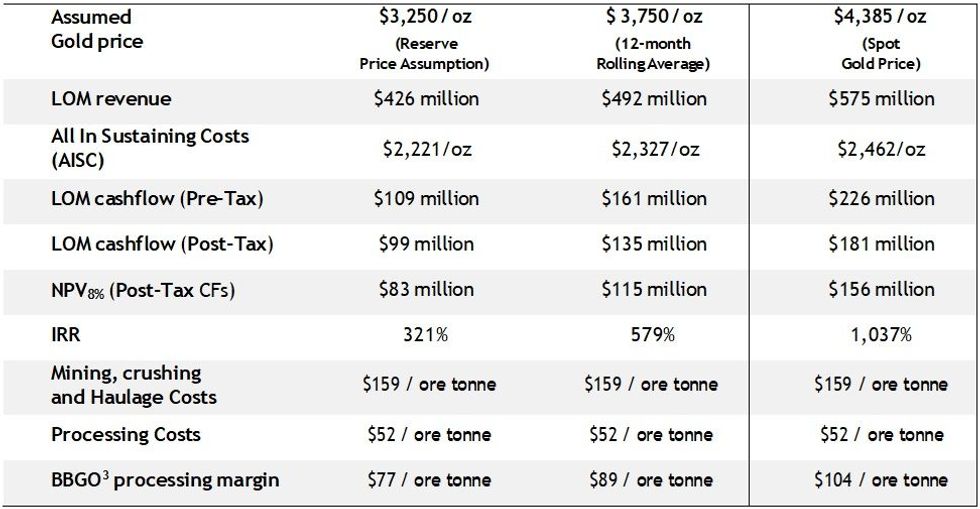

- The FS Life of Mine (LOM) production schedule metrics are shown on Table 1. Financial results with sensitivity to gold price, are shown in Table 2. Summary of LOM Cash Flow is shown in Figure 1.

Table 1: Production Schedule Metrics – Crown Prince Open Pit

Table 2: Financial Results (AUD)

Click here for the full ASX Release

This article includes content from New Murchison Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.