alfa-marushima-tokyo-japan

Inca to acquire Stunalara Metals Limited with high-quality gold/antimony exploration projects in North Queensland

Inca Minerals Limited (ASX: ICG) (Inca or the Company) is pleased to announce that it has entered into a binding Bid Implementation Agreement to acquire Stunalara Metals Limited (Stunalara) via an off market takeover bid (Bid). If successfully completed, Stunalara shareholders will be issued a total of ~ 300,000,000 fully paid Inca shares (being ~ 22.6% of Inca post Bid assuming no other shares are issued).

Stunalara Highlights

- Stunalara is a public unlisted Australian exploration company with projects in Queensland, Tasmania and Western Australia.

- Stunalara’s key asset is the high-grade gold & gold-antimony Hurricane exploration project in North Queensland (NQ) that has multiple undrilled high-grade gold & gold-antimony prospects developed from rock chip and grab sampling.

- Gold Prospects

- Cyclone – up to 4.9 g/t (Au)

- Cyclone North – up to 7.4 g/t (Au)

- Monsoon – up to 4.0 g/t (Au)

- Hurricane North – up to 45.7 (Au)g/t

- Hurricane South – up to 41.5 g/t (Au)

- Tornado – up to 17.6 g/t (Au)

- Typhoon – up to 71.6 g/t (Au)

- Gold-Antimony Prospects

- Bouncer South – Antimony (Sb) up to 20.8% & up to 7.9 g/t Au

- Holmes – Sb up to 29.0% & up to 21.7 g/t Au

- Holmes South – Sb up to 43.2% & up to 5.2 g/t Au

- Pederson West – Sb up to 5.3% & up to 2.2 g/t Au

- Gold Prospects

Transaction Highlights

- At a deemed Inca share price of $0.006, the Bid consideration of 300,000,000 Inca shares implies a value of $1.8 million for Stunalara (fully diluted).

- Stunalara shareholders will be offered 6.448981 Inca shares for every 1 Stunalara share held, valuing each Stunalara share at ~4.5 cents each (Offer)1.

- The Offer will be subject to standard conditions including, that, at or before the end of the Offer period, Inca has a relevant interest in at least 90% of all Stunalara shares on issue (on a fully-diluted basis).

- Stunalara has engaged an Independent Expert to advise Stunalara shareholders on the fairness and reasonableness of the Offer as Inca director, Mr Andrew Haythorpe, is also a Stunalara director and holds a ~18.6% Stunalara shareholding. Stunalara has also established an independent board committee.

- ASX has confirmed that Listing Rules 11.1.2 and 11.1.3 do not apply to the transaction.

- Subject to there being no superior proposal and the Independent Expert concluding and continuing to conclude that the Offer is either fair and reasonable, or not fair but reasonable:

- Inca has been informed by Andrew Haythorpe that he intends to accept the Offer twenty-one days after the Offer becomes open for acceptance with respect to all Stunalara shares owned or controlled by him; and

- Inca has been informed the Stunalara Board will unanimously recommend that all Stunalara shareholders accept the Offer.

- Under the Bid Implementation Agreement, a mutual reimbursement fee of $100,000 may be payable in certain circumstances by either Inca or Stunalara.

- Further details about the Offer, conditions to the Offer and proposed timetable are set out in the Bid Implementation Agreement which is attached as an annexure to this announcement.

Inca’s CEO, Trevor Benson commented:

“Having carefully considered a number of acquisition proposals since I was appointed as CEO last year, it became abundantly clear that Stunalara was a standout opportunity. Its high-grade gold & gold-antimony Hurricane Project in NQ presents a unique opportunity to explore a project with multiple strongly mineralised veins which have historical workings but have never been drilled.”

“In addition, the under explored Mt Reid project in Western Tasmania is located in an area where multiple significant precious and base metal deposits have been discovered, developed and mined over the last 100 years.”

Click here for the full ASX Release

This article includes content from Inca Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Why Trump’s sovereign-wealth fund won’t Make America Great Again

AMD comes up short in a key segment — and that’s pressuring its stock

ALR February 2025 Investor Presentation

Altair Minerals (ASX:ALR) has announced ALR February 2025 Investor Presentation.

Click here for the full ASX Release

This article includes content from Altair Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Updated Maroochydore Copper-Cobalt Resource Demonstrates Large Copper Sulphide System with 1.6Mt Contained Copper

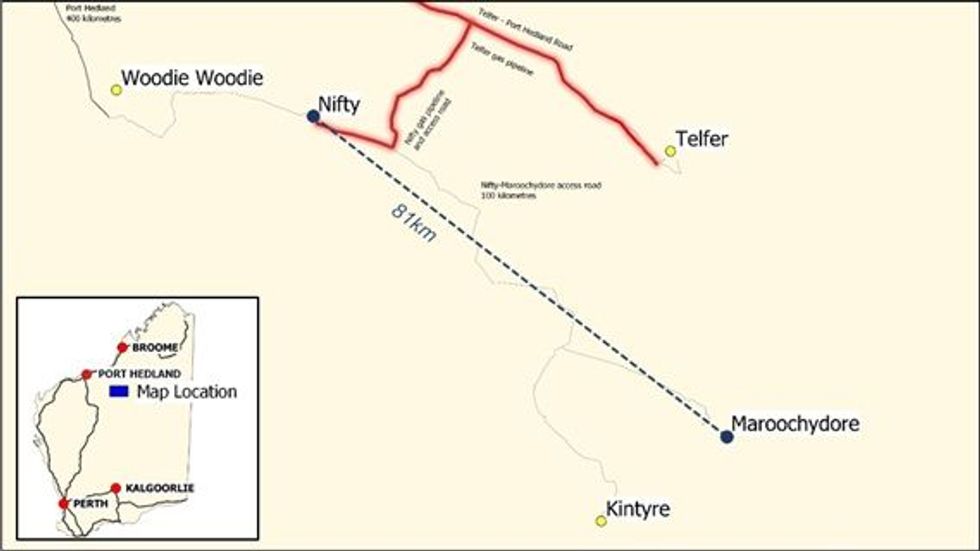

Cyprium Metals Limited (ASX: CYM, OTC: CYPMF) (Cyprium or the Company), a copper developer focused on recommencing production at the Nifty Copper Complex in the Paterson region of Western Australia (Nifty), has upgraded its mineral resource estimate for its 100% owned Maroochydore Copper-Cobalt Project (Maroochydore). The Maroochydore project is also located in the Paterson region of Western Australia, 81km from the Nifty Copper Complex.

Highlights of the Resource Upgrade include:

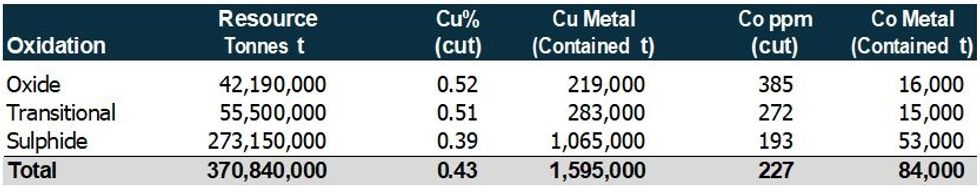

- Inferred resources of 370,800,000 tonnes at 0.43% Cu and 227 ppm Co for 1,595,000 contained copper and 84,000 tonnes contained cobalt at 0.25% Cu cut-off grade.

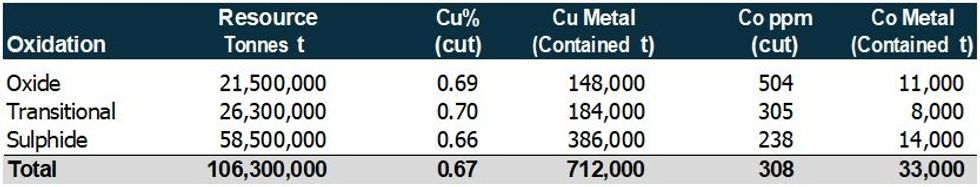

- Higher-grade zone contained within the inferred resource of 106,300,000 tonnes at 0.67% Cu and 308 ppm Co for 712,000 tonnes contained copper and 33,000 tonnes contained cobalt at 0.45% Cu cutoff grade.

- Sedimentary copper mineralisation style demonstrating significant continuity of mineralisation and resource scale – similar geology to nearby Nifty Copper Complex.

- Higher grade domain will be further studied as satellite feed operation to Cyprium’s nearby Nifty mill and concentrator in the Paterson district.

The results are clear – Maroochydore is a very large, near-surface sulphide resource with a higher- grade zone that has high potential to be a medium-term expansion project for Cyprium. An important moment for Cyprium, and a potential meaningful source of Australian copper and cobalt.”

Table 1: Maroochydore January 2025 Inferred Mineral Resource Estimate, by mineralisation category, ≥0.25% Cu Cutoff.

0.25% Cu cutoff. Metal grades take into account top and bottom cut. Numbers are rounded to reflect a suitable level of precision and may not sum due to rounding. The reported contained metal is not the same as a “recoverable” or “marketable” amount, as recovery rates and other factors can influence how much metal can be extracted. See accompanying technical report for additional details and important disclosures.

Table 2: Maroochydore January 2025 higher grade domain by mineralisation category, ≥0.45% Cu Cutoff.

0.45% Cu cutoff. Metal grades take into account top and bottom cut. Numbers are rounded to reflect a suitable level of precision and may not sum due to rounding. The reported contained metal is not the same as a “recoverable” or “marketable” amount, as recovery rates and other factors can influence how much metal can be extracted. See accompanying technical report for additional details and important disclosures.

Updated Resource Model Shows Near-Surface, Flat-lying Sedimentary Copper System

Maroochydore is a sediment-hosted deposit type located in the Paterson region of Western Australia. The project is 81km by air and ~100km by unsealed road from Cyprium’s Nifty Copper Complex.

Figure 1: Maroochydore general location and regional infrastructure

Stratigraphy at Maroochydore is part of the Broadhurst Formation (Yeneena Group) similar to the nearby Nifty Copper Complex.

The deposit is a mixture of oxide/supergene and primary sulphides. The upper resources are dominated by oxide and transitional materials hosted in the 50 to 100m thick mineralised horizon consisting of carbonaceous shales and recrystalised dolostones.

The structural framework that hosts the mineralised sequence is less restricted than what is found at Nifty, which leads to Maroochydore’s more extensive and diffuse mineralisation system. Current mineralised material is defined over a strike length of ~7km and is shallow, with cover varying from 20m depth at the south-eastern end to 80m depth at the north-western end, and relatively flat lying.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Further broad intercepts of high-grade gold at Jasper Hills

Brightstar Resources (BTR:AU) has announced Further broad intercepts of high-grade gold at Jasper Hills