American Rare Earths (ASX: ARR | OTCQX: ARRNF and AMRRY) (“ARR” or the “Company”) is pleased to announce the results of its Updated Halleck Creek Scoping Study, confirming the project’s strong economics, scalability, and strategic importance.

HIGHLIGHTS

- Strong economics, scalable growth: 3 Mtpa base case offers NPV10% of US$558M, IRR 24%, with a low-risk CAPEX of US$456M.

- Billion-dollar potential: 6 Mtpa case delivers NPV10% of US$1.17B, IRR 28.4%, and CAPEX of US$737M.

- First-mover advantage: State land tenure accelerates permitting, positioning ARR as a leading U.S.- based rare earths developer independent of tariffs and reliance on foreign processing.

- Vast Scalability & Growth: The 3 Mtpa Phase 1 will mine ~62.3Mt of ore over 20 years, utilising just ~2.4% of the 2.63Bt JORC resource2. With further studies underway, Halleck Creek could support a larger, long-term operation, with potential for extended mine life and increased production capacity.

- Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~16% of the greater Halleck Creek surface area, highlighting significant expansion potential.

Compiled by independent engineering firm Stantec Consulting Services Inc., the Study highlights Halleck Creek’s strong economic potential, strategic advantages, and clear pathway to development as a U.S.-based rare earths project. Located in Wyoming, a Tier 1 mining jurisdiction, Halleck Creek benefits from state land tenure, allowing for accelerated permitting and development.

Compelling Economics & Scalable Growth

The Updated Scoping Study confirms Halleck Creek as a world-class rare earths project with robust financials and long-term scalability:

- 3 Mtpa Base Case:

- NPV10% of US$558 million, IRR of 24%

- CAPEX of US$456 million, with a 2.7-year payback period

- Annual production: ~4,169 metric tons of TREO, including 1,833 metric tons of NdPr oxide

- 6 Mtpa Case:

- NPV10% of US$1.171 billion, IRR of 28.4%

- CAPEX of US$737 million, with a 1.8-year payback period

- Annual production: ~7,661 metric tons of TREO, including 3,344 metric tons of NdPr oxide

First-Mover Advantage & U.S. Supply Chain Security

As the only large-scale rare earths project in the U.S. with a clear path to production, ARR is positioned to secure a domestic, tariff-free supply of critical minerals for U.S. and allied markets.

- China controls over 90% of global rare earth refining. With the U.S. prioritizing supply chain security, ARR is uniquely positioned as a credible U.S.-based developer to deliver a fully integrated solution— from mining to refining.

- State land tenure accelerates permitting, avoiding the lengthy delays often associated with projects on federal land.

- Halleck Creek’s 100% U.S.-based production and refining will ensure a secure, domestic supply of rare earth oxide metals—eliminating reliance on foreign supply chains and reinforcing the ‘Made in America’ commitment.

- Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~16% of the greater Halleck Creek project area, highlighting significant expansion potential.

Clear Development Pathway & Future Growth

Halleck Creek’s staged development approach ensures financial and operational flexibility, allowing ARR to scale production in alignment with market demand:

- Base Case: 3 Mtpa – Low-risk entry to production to produce an average of 4,169 mt of TREO per annum, including 1,833 mt of NdPr Oxide.

- Alternate Case: Scalable to 6 Mtpa – Enhancing project economics, producing an average of 7,661 mt TREO per annum, including 3,334 mt of NdPr Oxide

- Future Expansion Potential: The Cowboy State Mine (“CSM”) represents only Phase 1 of Halleck Creek’s development, benefiting from a strategic permitting advantage. The 20-year CSM LOM plan includes mining approximately 62.3 Mt of ore—just ~2.4% of the total 2,627 Mt JORC Mineral Resource—highlighting the vast potential for extended mine life and increased production in future phases. Given the increasing demand for rare earths, ARR is evaluating further studies, as Halleck Creek could support a much larger, long-term operation, with potential for extended mine life and increased production capacity that could position ARR among the top rare earth producers outside China.

CEO Commentary

Chris Gibbs, CEO of American Rare Earths, commented:

“The Updated Scoping Study reinforces Halleck Creek strong economic potential, strategic permitting advantage and clear pathway to development. With a large-scale resource and favourable economics, we are uniquely positioned to help secure America’s rare earth supply and reduce dependence on foreign sources.

“The 6 Mtpa case highlights Halleck Creek’s billion-dollar potential, delivering an NPV10% of US$1.17B and an IRR of 28%, showcasing the project’s scalability. The 3 Mtpa base case offers a low-risk entry point, producing 1,833 metric tonnes of NdPr oxide annually, with an NPV10% of US$558M, an IRR of 24%, and a 2.7-year payback period.

“With a scalable development pathway under evaluation, Halleck Creek has the potential to become a major supplier to U.S. and allied markets. Future production scenarios could position ARR among the top rare earth producers outside China, reinforcing America’s supply chain security for decades to come.

“And we’re not just mining—we are developing a fully integrated U.S. supply chain, refining and producing high- purity rare earth oxides for American manufacturers. Halleck Creek aligns with the growing push for Made-in- America critical minerals, securing a domestic supply for defense, aerospace, and high-tech manufacturing.”

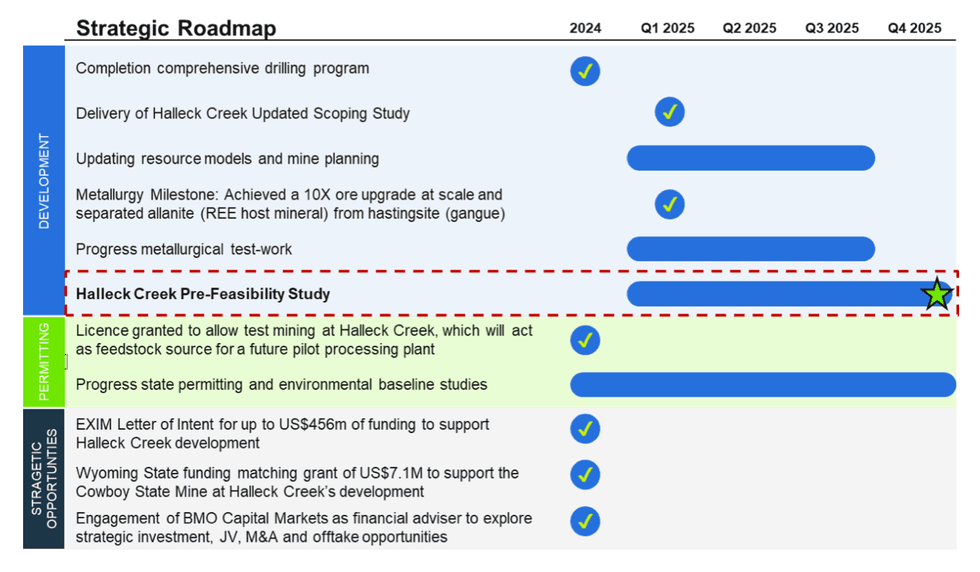

Next Steps & Milestones

Building on strong execution in 2024, ARR is advancing key milestones to further de-risk and develop Halleck Creek, as outlined in the Updated Scoping Study and supported by recent metallurgy results. These developments reinforce the project’s scalability and strategic importance as a leading U.S. rare earths asset. With a staged development approach, first production could be as early as 2029, subject to ongoing technical and economic assessments. The Company is looking at ways to fast-track development, including plans to commence Phase One of a pilot plant for the beneficiation process. The roadmap ahead highlights key next steps for 2025 and the next major stage gate in the project’s development.

Click here for the full ASX Release

This article includes content from American Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.