alfa-marushima-tokyo-japan

Anthropic’s Claude 3.7 Sonnet takes aim at OpenAI and DeepSeek in AI’s next big battle

Acid Labs raises $8M to build viral Web3 games on social chat platforms

Intel launches Xeon 6 processors with performance cores for 2X AI processing

Intel is launching its new Intel Xeon 6 processors with performance-cores, offering better performance across data center workloads and up to two times higher performance in AI processing. The company has new Xeon 6 processors for network and edge applications with built-in Intel vRANBoost deliver up to 2.4 times the capacity for radio access network […]

Segwise launches Creative Analytics AI Agent on its user acquisition platform

U.S. stocks are near record highs. Why are investors so worried?

Comet Gold Project Review Following Gold Discovery Along Strike

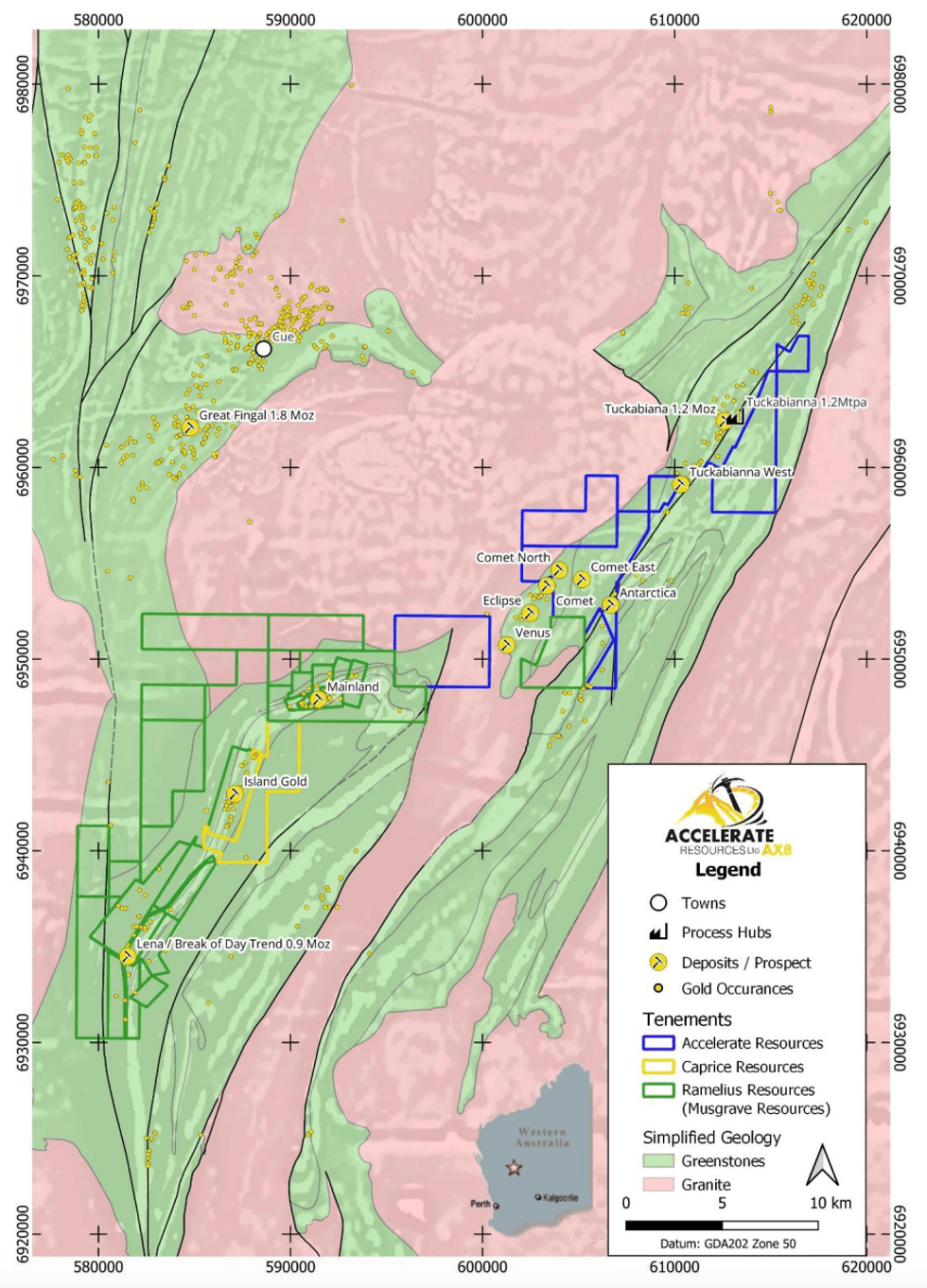

Accelerate Resources Limited (“AX8”, “Accelerate” or the “Company”) is pleased to announce the commencement of a gold prospectivity review and reinterpretation at its Comet Gold Project (“Comet”) inspired by the recent exploration success by Caprice Resources at their Island Gold Project located 10km to the south-west in Western Australia’s Murchison Goldfield.

Key Points

- Accelerate commences comprehensive review of its Comet Gold Project in the Murchison region following the recent high-grade gold discovery at Caprice Resource’s (ASX: CRS) Island Gold Project, just 10km to the south-west.

- The 100% owned Comet Gold Project hosts significant gold mineralisation within Banded Iron Formation (BIF) lithologies, similar to those at The Island Gold Project.

- Notable previous drill intercepts at Comet include 9m at 3.89 g/t Au, 4m at 7.08 g/t Au and 6m at 2.29 g/t Au (see details in main body text).

- Accelerate’s 100% ground holding represents 73km2 with over 26km of prospective strike, strategically situated 19 km from Westgold Resources 1.2 million tonne per annum Tuckabianna gold mill in the +20Moz Murchison Goldfields of WA

Building on the Caprice high-grade gold discovery and the historic success of former ASX- listed Musgrave Minerals (now Ramelius Resources ASX: RMS) along the Break of Day trend, Accelerate is advancing its investigation of Comet by prioritising Banded Iron Formation (BIF) mineralisation at the Comet East, Comet North and the Antarctica Prospects (Figure 1). The review is expected to be complete by end of the Quarter and results will guide next steps in exploration including drill testing of BIF-hosted mineralisation targets along strike of the Caprice discoveries and the Break of Day trend.

Gold Targets

Drilling campaigns by Accelerate and historic explorers, including Silverlake Resources, have delivered significant assay results across three prospects at Comet, with the most recent program completed in 2020 during the peak of the COVID-19 pandemic.

The Comet East Prospect (Figure 2) is situated approximately 1 km east of the former Comet-Eclipse Gold Mine of Westgold Resources (ASX: WGX), where wide-spaced shallow drilling during the 1990’s intersected significant gold mineralisation including 4m at 7.08 g/t Au from 27m (PRB305), and 3m at 4.53 g/t Au from 60m (PRC269)1.

Figure 1: Comet Gold Project in relation to the Island Gold and Break of Day Projects

Click here for the full ASX Release

This article includes content from Accelerate Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Heritage Survey Completed at Yalgoo

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) is pleased to announce that the heritage survey at the Company’s Yalgoo Project has been completed ahead of the first drill program. Premier1 acknowledges the traditional custodians of the land on which the company operates and pay respect to their Elders past, present and emerging. The heritage surveys are critical to ensure sites of significance for traditional owners are protected and not disturbed.

HIGHLIGHTS

- Heritage survey completed with no impediments for first drill program

- Site works have begun for access and drill site preparation

- RC drilling expected to start early March with drill rig secured

- Drilling to target the high-grade gold results from rock chips in the Wadgingarra area including Crescent East, Olive Queen and Carlisle prospect areas

Managing Director Jason Froud commented:

“We would like to thank Sticks and Stones Cultural Resources Management (SandSCRM), the Yamatji Southern Regional Corporation (YSRC) and the Yamatji traditional owners for their efforts and cooperation in completing the heritage survey in a timely manner, and we look forward to working with them as we carry out our future exploration work programs.

We are extremely eager to commence our upcoming and first drill program at Yalgoo and test the high- grade targets across the Wadgingarra area. The drill program is designed to test both extensions to known gold occurrences as well as previously unexplored areas. Our previous work has highlighted the prospectivity of the area and which has seen only very limited exploration since the 1980s.”

The heritage clearance survey was completed by Yamatji Southern Regional Corporation (YSRC), heritage consultants (SandSCRM) and representatives of the traditional owners, the Yamatji People. Surveys were conducted with participants from the YSRC, their heritage consultant and Premier1.

The Yalgoo Project is within a determination area where native title rights and interests have been extinguished and native title is surrendered pursuant to the Yamatji Nation Indigenous Land Use Agreement (Yamatji Nation ILUA – Determination WAD 345 of 2019). Whilst Premier1’s tenements pre- date the establishment of the ILUA, it is critical to ensure sites of significance for traditional owners are protected and not disturbed. The heritage survey has cleared the entire work area and site works for access and drill pads have now commenced (Figure 1).

Programme of Work (PoW) approvals have also been received from the Department of Mines, Industry Regulations and Safety over the priority target areas within Exploration Licence E59/1989 (Figure 2). The PoW provides Premier1 with the ability to construct tracks and drill pads and conduct drilling to a maximum depth of 250m. Premier1 now has in place sufficient PoW and heritage clearances to complete the first phase of drilling exploration at Yalgoo.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Jeffreys Find Gold Mine Gold Sales Exceed $100 Million

Auric Mining Limited (ASX: AWJ) (Auric or the Company)) is pleased to announce an update to the Jeffreys Find Gold Mine (the Project), near Norseman, WA.

HIGHLIGHTS

- Stage One & Stage Two mining generates more than $100 million in gold sales.

- Auric has received a further $1.5 million interim cash distribution making the total received to date for Stage Two of $8.1 million. This is in addition to the $4.8 million received for Stage One.

- BML advises Stage Two on target to deliver $11-$12 million cash surplus for Auric.

- Stage Two gold sold passes 17,900 ounces.

- Latest gold sold at A$4,625 per ounce, for an average of A$4,024 per ounce.

- Remaining 60,000 tonne parcel to be milled in coming months.

Management Comment

Mr. Mark English, Managing Director:

“The first ore was shovelled at Jeffreys Find in May 2023. In just a couple of years this short-life mine has now generated more than $100 million in gold sales for the Project.

“Before starting we estimated a gold price of A$2,600 an ounce. Who could have envisaged that we would be selling gold at more than A$4,600 an ounce. By any measure it’s a brilliant result.

“However, not all the money is in the bank yet. We are expecting millions more in surplus cash to be received. we are expecting millions more in cash over the next few months.

“For the 2024/25 period, Stage Two of the Project, we’ve produced more than 17,900 ounces of gold with more processing to come. Our partner BML is negotiating a toll milling agreement for a parcel of up 60,000 tonnes, which is currently on the ROM Pad at the mine site. When everything is completed, we will get the final picture on just how successful the Jeffreys Find Gold Mine has been.

“Our JV agreement with BML Ventures stipulates that only after all the gold has been sold and all costs have been paid is the final surplus cash distribution paid.

“We’ve just received a further $1.5 million as an interim payment from BML which brings us to $8.1 million in total for Stage Two payments.

“BML has advised to expect an additional $3 million to $4 million in cash payments once the last of the gold is sold.

“Jeffreys Find Gold Mine has been a defining experience for Auric,” said Mr English.

Photo: The Goodbye Cut at Jeffreys Find Pit. Photo – 27 January 2025.

Through Auric’s joint venture partner BML Ventures Pty Ltd of Kalgoorlie (BML) a total of 17,901 ounces of gold has been sold from Stage Two mining at Jeffreys Find as of 21 February 2025.

Ore was milled in multiple campaigns at The Greenfields Mill, Coolgardie (Greenfields) and at the Three Mile Hill Plant, Coolgardie (Three Mile Hill) during 2024 and early 2025.

For Stage Two the highest gold price achieved was A$4,625 an ounce whilst the average price was A$4,024 per ounce.

Click here for the full ASX Release

This article includes content from Auric Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.