Skyharbour Resources Ltd. (TSX-V: SYH ) (OTCQX: SYHBF ) (Frankfurt: SC1P ) (“Skyharbour” or the “Company”) is pleased to announce the commencement of its winter phase of diamond drilling at the 73,314 hectare Russell Lake Uranium Project (“Russell” or the “Project”). The Project is 57.7% owned by Skyharbour as operator with joint-venture partner Rio Tinto Exploration Canada Inc. (“RTEC”) owning the other 42.3%. It is strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan, with access to regional infrastructure, including an all-weather road and powerline. Skyharbour plans to complete an initial 5,000-metre diamond drilling program in 10 to 12 holes at the project, building on the successful results from the drilling campaign completed last year. The Company’s geologists, along with a contracted drilling crew, are based at Skyharbour’s exploration camp on the McArthur River-Key Lake haul road, situated within five kilometres of Denison Mines’ Phoenix deposit at the Wheeler River Project.

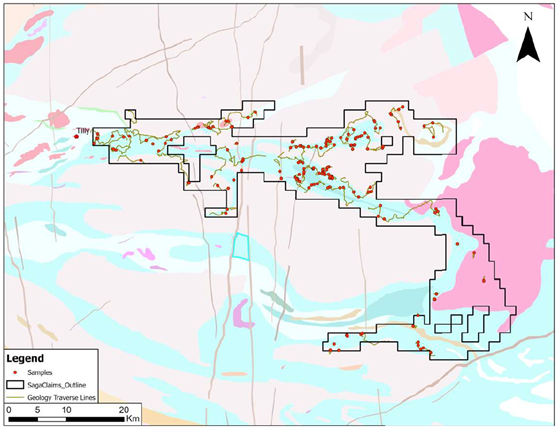

Russell Lake and Moore Projects Location Map:

https://www.skyharbourltd.com/_resources/images/SKY_RussellLake.jpg

Skyharbour is fully-funded for its upcoming drill programs at its co-flagship Russell Lake and Moore Uranium Projects in 2025 starting with this first phase of drilling at Russell. The Company has plans to drill approx. 16,000 – 18,000 metres in 35 – 45 holes across its co-flagship projects representing the largest annual drill campaign ever carried out by the Company.

Jordan Trimble, President and CEO of Skyharbour, stated: “We are thrilled to commence the 2025 drill campaign which will consist of 16-18,000 metres in multiple phases of drilling at Russell and Moore throughout the year. This will provide steady news flow as we follow up on the 2024 programs with the benefit of low-cost drilling and relatively shallow target depths at our co-flagship projects. This first phase of drilling at Russell will continue to test the exploration upside at the project, which hosts widespread uranium mineralization and has the geology necessary for larger, high-grade, Athabasca Basin uranium deposits.”

Winter Phase of Diamond Drilling at Russell Lake:

Skyharbour has commenced its 2025 drilling program at the Russell Lake Project with plans for a first phase consisting of approx. 5,000 metres to follow up on notable recent exploration success and to test new targets developed by the geological team . The focus for this phase of drilling will be on the Fork and Sphinx targets within the broader Grayling target area, as well as the M-Zone Extension (“MZE”) target and the Fox Lake Trail target. This initial winter program will consist of 10 to 12 drill holes, with most of the targets being road accessible and near the exploration camp, bringing the drill costs down. Furthermore, details on the geochemical assay results are pending from the drilling carried out in late 2024 at Russell.

Russell Lake Project Target Areas:

https://www.skyharbourltd.com/_resources/images/20240110-MainTargetsRussellLake2024.jpg

The Fork target is a newly identified target to the southwest of the Grayling Zone and is on strike with Denison’s M-Zone at their adjacent Wheeler River Project. Last year, high-grade uranium was discovered at the Fork target in hole RSL24-02, which returned a 2.5-metre wide intercept of 0.721% U 3 O 8 at a relatively shallow depth of 338.1 metres, including approx. 3.0% U 3 O 8 over 0.5 metres just above the unconformity in the sandstone (see news release dated July 19 th , 2024, titled: “Skyharbour Drills New Discovery at Russell Project with High-Grade Uranium Mineralization Up to 3.0% U 3 O 8 at Newly Identified Fork Zone”). This high-grade intercept is a new discovery which had very limited historical exploration due to a lack of reliable geophysical data and drill targets hampered by interference from nearby powerlines. The mineralization remains open in most directions, including along strike and up-dip, and will be a high-priority target for this drill program. The potential for basement-hosted mineralization at the Fork target remains virtually untested.

Grayling and Fork Target Areas:

https://skyharbourltd.com/_resources/images/2024-Fork-East-Grayling-Drill-Hole-Location-Map_NR.jpg

Skyharbour also plans to drill targets in the M-Zone Extension area along trend from the Grayling Zone and Denison’s M-Zone at Wheeler River, where historical drilling intersected basement-hosted uranium mineralization. More recent drilling by Denison in 2020 at the M-Zone encountered uranium mineralization with significant faulting, core loss, geochemical anomalies, and radioactivity encountered in other drill holes. Like the Grayling Zone, the mineralization at the MZE target is hosted by a graphitic thrust fault within a significant magnetic low. It is also noted that cross structures associated with Denison’s Phoenix and Gryphon uranium deposits potentially trend onto the Russell Lake property within the M-Zone Extension target area, further enhancing the prospectivity of this target.

M-Zone Extension Drill Targets:

https://www.skyharbourltd.com/_resources/images/20240110-M-ZoneExtensionTargetsRussellLake.jpg

The Fox Lake Trail (“FLT”) area is located in the northwestern section of the Russell Lake project. This area encompasses a broad conductive corridor with a strike length exceeding 12 km, which hosts multiple parallel conductors identified by both airborne and ground geophysical surveys, subsequently confirmed by drilling, as graphitic fault zones. Limited historical drilling in the area shows significant alteration and disruption in both sandstone and basement rocks, along with elevated radioactivity and highly anomalous pathfinder geochemistry in drill core samples. These findings indicate the presence of a significant hydrothermal system in the area, which is often associated with the formation of high-grade, unconformity-type uranium deposits in the Athabasca Basin.

Skyharbour to Participate in Red Cloud’s 13th Annual Pre-PDAC Mining Showcase:

Skyharbour is pleased to announce that the Company will be presenting at Red Cloud’s 13th Annual Pre-PDAC Mining Showcase. We invite our shareholders, and all interested parties to join us. The annual conference will take place in-person at The Omni King Edward Hotel in Toronto on February 27 th and 28 th , 2025. President and CEO Jordan Trimble will be presenting on February 28 th at 10:00AM Eastern Standard time.

For more information and to register for the conference please visit:

https://redcloudfs.com/prepdac2025/ .

Russell Lake Uranium Project Overview:

The Russell Lake Project is a large, advanced-stage uranium exploration property totalling 73,314 hectares strategically located between Cameco’s Key Lake and McArthur River Projects, and adjoining Denison’s Wheeler River Project to the west and Skyharbour’s Moore Uranium Project to the east. The northern extension of Highway 914 between Key Lake and McArthur River runs through the western extent of the property and greatly enhances accessibility, while a high-voltage powerline is situated alongside this road. Skyharbour’s acquisition of a majority interest in Russell Lake creates a large, nearly contiguous block of highly prospective uranium claims totalling 109,019 hectares between the Russell Lake and the Moore uranium projects. Several notable exploration targets exist on Russell, including the Grayling Zone, the M-Zone Extension target, the Little Man Lake target, the Christie Lake target, the Fox Lake Trail target and the newly identified Fork Zone target. More than 35 kilometres of largely untested prospective conductors in areas of low magnetic intensity also exist on the Property. Skyharbour is the operator and owns a majority interest in Russell Lake, having formed a joint venture partnership with RTEC at the project.

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Serdar Donmez, P.Geo., VP of Exploration for Skyharbour as well as a Qualified Person.

About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market fundamentals with interest in thirty-six projects covering over 614,000 hectares (over 1.5 million acres) of land. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project, which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine. Moore is an advanced-stage uranium exploration property with high-grade uranium mineralization in several zones at the Maverick Corridor. Adjacent to the Moore Project is the Russell Lake Uranium Project, in which Skyharbour is operator with joint-venture partner RTEC. The project hosts widespread uranium mineralization in drill intercepts over a large property area with exploration upside potential. The Company is actively advancing these projects through exploration and drilling programs.

Skyharbour also has joint ventures with industry leader Orano Canada Inc., Azincourt Energy, and Thunderbird Resources at the Preston, East Preston, and Hook Lake Projects, respectively. The Company also has several active earn-in option partners, including CSE-listed Basin Uranium Corp. at the Mann Lake Uranium Project; TSX-V listed North Shore Uranium at the Falcon Project; UraEx Resources at the South Dufferin and Bolt Projects; Hatchet Uranium at the Highway Project; CSE-listed Mustang Energy at the 914W Project; and TSX-V listed Terra Clean Energy at the South Falcon East Project. In aggregate, Skyharbour has now signed earn-in option agreements with partners that total to over $36 million in partner-funded exploration expenditures, over $20 million worth of shares being issued, and $14 million in cash payments coming into Skyharbour, assuming that these partner companies complete their entire earn-ins at the respective projects.

Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the Athabasca Basin:

https://www.skyharbourltd.com/_resources/images/SKY_SaskProject_Locator_2024-11-21_v1.jpg

To find out more about Skyharbour Resources Ltd. (TSX-V: SYH) visit the Company’s website at www.skyharbourltd.com .

“Jordan Trimble”

_________________________________

Jordan Trimble

President and CEO

For further information contact myself or:

Nicholas Coltura

Investor Relations Manager

Skyharbour Resources Ltd.

Telephone: 604-558-5847

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Forward-Looking Information

This news release contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, completing ongoing and planned work on its projects including drilling and the expected timing of such work programs, other statements relating to the technical, financial and business prospects of the Company, its projects and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of uranium, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses, and those filed under the Company’s profile on SEDAR+ at www.sedarplus.ca. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather or climate conditions, failure to obtain or maintain all necessary government permits, approvals and authorizations, failure to obtain or maintain community acceptance (including First Nations), decrease in the price of uranium and other metals, increase in costs, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

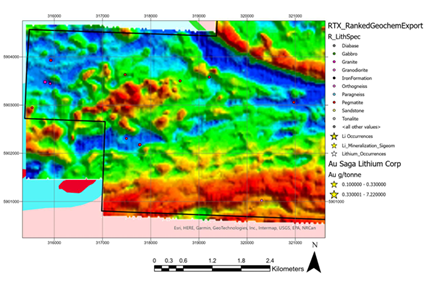

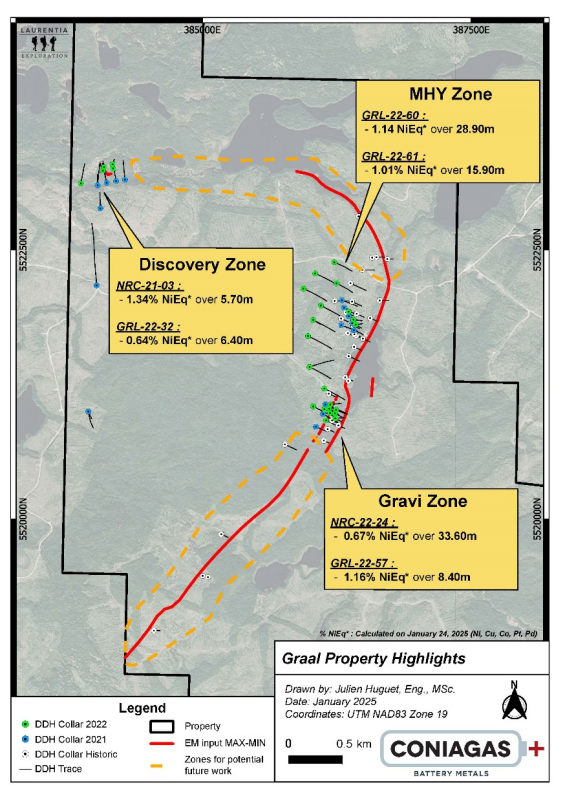

Click Image To View Full SizeAlternative Graal Map with copper equivalent (CuE) calculations shown

Click Image To View Full SizeAlternative Graal Map with copper equivalent (CuE) calculations shown Click Image To View Full Size* For equivalents the prices were taken 2025-01-24 in USD: Cu $9,445.192/tonne, Ni $15,660.10/ tonne, Co $24,299.35/ tonne, Pt $950.00/oz, Pd $1,002.00/oz. Note that the equivilant calculation are for total metal content without consideration for recovery and/or metallurgical losses .Q ualified PersonThis news release has been reviewed and approved by Frank Basa, P.Eng. Ontario, CEO of Coniagas Battery Metals Inc., a qualified person in accordance with National Instrument 43- 101 standards.The technical information reported in this news release and in the Feb. 3, 2025 news release was reviewed and approved by Maxime Bouchard, Geo, M.Sc. (OGQ #1752), an independent Qualified Person as defined by Canadian NI 43-101 standards. The Qualified Person has not completed sufficient work to verify the historical information on the Property, particularly regarding historical drill results. However, the Qualified Person believes that drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.About Coniagas Battery Metals Inc.Coniagas Battery Metals Inc. is a Canadian junior mining company focused on nickel, copper and cobalt and platinum group metals in Québec. Coniagas’ strategy is to create value for shareholders through the development of its mineral properties, with the intention to develop Coniagas into a critical metals supplier to the electric vehicle (EV) market.At its 100% owned Graal project near Saguenay, Quebec, Coniagas has conducted successful exploration involving geophysics as well as shallow drilling that hit mineralization in almost every hole. It has confirmed an open-pit deposit model at Graal along a 6 km strike length of high-grade nickel and copper with cobalt, platinum and palladium byproducts. The Company plans in the near-term to conduct additional drilling leading to the production of a Ni 43-101 resource report, metallurgical testing and consultations with First Nations. The Graal project and immediate work plan are outlined in detail in the “NI 43-101 Technical Report Graal Nickel & Copper Project, Saguenay-Lac-St-Jean, Quebec, Canada” dated January 17, 2024. The report is available along with other information at the Company’s website

Click Image To View Full Size* For equivalents the prices were taken 2025-01-24 in USD: Cu $9,445.192/tonne, Ni $15,660.10/ tonne, Co $24,299.35/ tonne, Pt $950.00/oz, Pd $1,002.00/oz. Note that the equivilant calculation are for total metal content without consideration for recovery and/or metallurgical losses .Q ualified PersonThis news release has been reviewed and approved by Frank Basa, P.Eng. Ontario, CEO of Coniagas Battery Metals Inc., a qualified person in accordance with National Instrument 43- 101 standards.The technical information reported in this news release and in the Feb. 3, 2025 news release was reviewed and approved by Maxime Bouchard, Geo, M.Sc. (OGQ #1752), an independent Qualified Person as defined by Canadian NI 43-101 standards. The Qualified Person has not completed sufficient work to verify the historical information on the Property, particularly regarding historical drill results. However, the Qualified Person believes that drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.About Coniagas Battery Metals Inc.Coniagas Battery Metals Inc. is a Canadian junior mining company focused on nickel, copper and cobalt and platinum group metals in Québec. Coniagas’ strategy is to create value for shareholders through the development of its mineral properties, with the intention to develop Coniagas into a critical metals supplier to the electric vehicle (EV) market.At its 100% owned Graal project near Saguenay, Quebec, Coniagas has conducted successful exploration involving geophysics as well as shallow drilling that hit mineralization in almost every hole. It has confirmed an open-pit deposit model at Graal along a 6 km strike length of high-grade nickel and copper with cobalt, platinum and palladium byproducts. The Company plans in the near-term to conduct additional drilling leading to the production of a Ni 43-101 resource report, metallurgical testing and consultations with First Nations. The Graal project and immediate work plan are outlined in detail in the “NI 43-101 Technical Report Graal Nickel & Copper Project, Saguenay-Lac-St-Jean, Quebec, Canada” dated January 17, 2024. The report is available along with other information at the Company’s website