alfa-marushima-tokyo-japan

Trump’s tariffs unleashed a wave of uncertainty among investors. Here’s what you should do next.

House budget tees up steep Medicaid cuts and big SALT fight. Here’s what’s next.

NioBay Metals Intercepts Up to 22% Titanium (TiO₂) in its Drillings on Zone 1 of the Foothills Property

NioBay Metals Inc. (“NioBay” or the “Company”) (TSX-V: NBY) (OTCQB: NBYCF) is proud to announce that it has intercepted titanium in several of the surface drill holes carried out in Zone 1, on the Foothills Property, located on the lands of the Séminaire de Québec.

The Company had filed an application for authorization for impact projects with the Ministry of Natural Resources with the aim of carrying out a drilling campaign as soon as authorization is received. Below, the Company provides the results of the TiO2 mineralized zones of interest, from the fall 2024 exploration campaign.

The Foothills project is located north of Saint-Urbain, 100 km north of Québec City and 90 km south of Saguenay (La Baie region), Québec. The project covers an approximate area of 285 km2 and includes five separate claim blocks. It covers most of the contact of the intrusive zone known as the Saint-Urbain anorthosite.

It should be noted that the drilling work generated 32.14 tonnes of CO2 equivalents. A donation was granted to Carbone Boreal (Université du Québec à Chicoutimi) as compensation.

Table of Results

Intersections calculated for a cut-off grade of 8% Ti, a minimum length of 1 m and a maximum internal dilution of 1 m.

| Drill Hole | From (m) | To (m) | Length (m) | Dilution (m) | TiO2 (%) |

| 1625-24-002 | 89.75 | 153.00 | 63.25 | 1.00 | 10.57 |

| 1625-24-002 | 185.00 | 186.80 | 1.80 | 0.00 | 17.09 |

| 1625-24-002 | 220.80 | 226.55 | 5.75 | 0.00 | 22.36 |

| 1625-24-003 | 135.25 | 149.00 | 13.75 | 0.00 | 12.62 |

| 1625-24-003 | 151.00 | 156.00 | 5.00 | 0.50 | 19.13 |

| 1625-24-003 | 172.30 | 180.00 | 7.70 | 0.00 | 14.44 |

| 1625-24-004 | 154.10 | 158.40 | 4.30 | 0.00 | 14.73 |

| 1625-24-006 | 16.50 | 18.80 | 2.30 | 0.00 | 9.22 |

| 1625-24-006 | 25.00 | 30.45 | 5.45 | 0.70 | 11.76 |

| 1625-24-006 | 37.00 | 38.00 | 1.00 | 0.00 | 8.01 |

| 1625-24-006 | 48.00 | 49.00 | 1.00 | 0.00 | 14.60 |

| 1625-24-007 | 44.20 | 47.00 | 2.80 | 0.00 | 11.14 |

| 1625-24-007 | 49.00 | 62.65 | 13.65 | 0.00 | 10.56 |

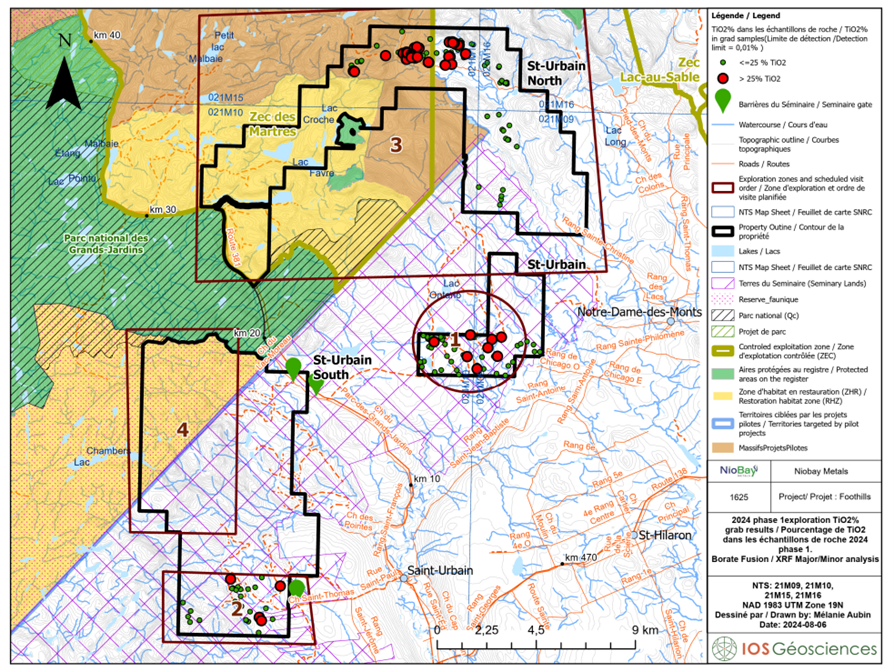

June 2024 prospecting area and sample locations

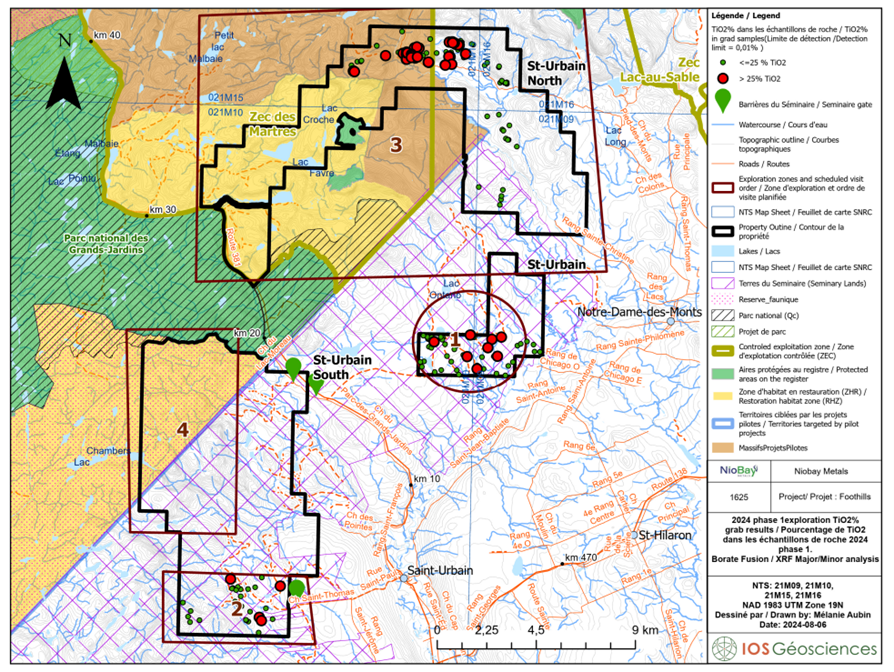

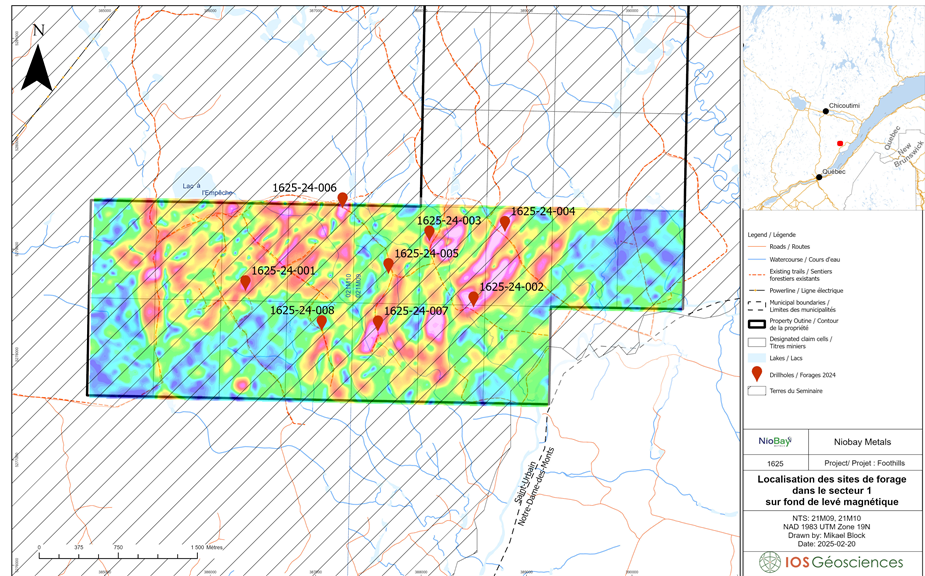

Map 2: Location of Drill Sites

Message from the President

“We are finally able to present our results from Zone 1. We were pleasantly surprised by the grade in certain holes. The next step will be to drill on a section of Zone 3. The application for authorization for this zone have been filed. Remember that sector 3 has demonstrated very good surface values in titanium (Press release of August 7, 2024)”, concluded Mr. David.

PDAC 2025

NioBay will be at PDAC again this year from March 2nd to the 5th inclusively, at the Toronto Convention Centre. Come meet us at booth 3015.

Qualified Persons

This press release has been reviewed and approved by Mr. Mikael Block, P.Geo., a Qualified Person under National Instrument 43-101. Mr. Block is a Project Manager employed by IOS Services Géoscientifiques.

About NioBay Metals Inc.

NioBay aims to become a leader in the development of mine(s) with low carbon consumption and responsible water and wildlife management practices while prioritizing the environment, social responsibility, good governance, and the inclusion of all stakeholders. Our top priority, which is critical to our success, is the consent and full participation of the Indigenous communities in whose territories and/or on ancestral lands we operate.

In addition to others properties, NioBay holds a 100% interest in the James Bay Niobium Project located 45 km south of Moosonee, in the Moose Cree Traditional Territory of the James Bay Lowlands in Ontario. NioBay also holds a 72.5% interest in the Crevier Niobium and Tantalum project located in Québec and on the Nitassinan territory of the Pekuakamiulnuatsh First Nation. The Company has also the option to acquire an 80% interest in the Foothills project, a titanium-phosphate project located near the former St-Urbain mine site in Quebec.

About Titanium

Titanium (Ti) is as strong as steel, but much less dense. It is therefore important as an alloying agent with many metals, including aluminum, molybdenum and iron. These alloys are mainly used in aircraft and spacecraft because of their low density and ability to withstand extreme temperatures. They are also used in sports equipment, laptops, bicycles and medical prostheses. Recently, this metal has been used in some battery components.

Cautionary Statement

Certain statements contained in this press release constitute forward-looking information under the provisions of Canadian securities laws including statements about the Company’s plans. Such statements are necessarily based upon a number of beliefs, assumptions, and opinions of management on the date the statements are made and are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors should change, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

FOR MORE INFORMATION, CONTACT:

NioBay Metals Inc.

Jean-Sébastien David, P.Geo., MPM

President & CEO

jsdavid@niobaymetals.com

www.niobaymetals.com

Kimberly Darlington

Investor Relations

kimberly@refinedsubstance.com

Tel: 514-771-3398

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/29b6747d-ce60-40ad-b263-edd85dcc6921

https://www.globenewswire.com/NewsRoom/AttachmentNg/79550acc-c4ce-4e20-ae0d-13463ccafa16

Get the $250 Rowing Machine That’s Also Good for Business

Sun Summit Announces Inaugural Mineral Resource Estimate on the Buck Project, Central B.C.

Sun Summit Minerals Corp. (TSXV: SMN) (OTCQB: SMREF) (“Sun Summit” or the “Company”) is pleased to report the results of its inaugural Mineral Resource Estimate (“MRE”) for the Company’s 100% owned Buck Project in central British Columbia.

Highlights:

- Indicated Mineral Resources at Buck Main are estimated to include 19,100 gold equivalent ounces1 (oz AuEq) (18,300 oz gold and 158,000 oz silver) at a grade of 0.519 g/t gold equivalent1 (g/t AuEq) (0.496 g/t Au, 4.3 g/t Ag) contained within 1.15 million tonnes (Mt).

- Inferred Mineral Resources at Buck Main are estimated to include 820,400 oz AuEq1 (775,500 oz gold and 8,435,000 oz silver) at a grade of 0.489 g/t AuEq1 (0.462 g/t Au, 5.0 g/t Ag) contained within 52.2 Mt.

- The near-surface Mineral Resource at Buck Main is constrained within an optimized open-pit shell using a 0.25 g/t AuEq cutoff, ensuring reasonable prospects for economic extraction.

- Additional upside at Buck Main as the deposit remains open for expansion in most directions and at depth.

- Effective discovery with average drill costs of CAD $18 per ounce of AuEq included in the MRE.

Notes:

1. Gold Equivalent (AuEq) grade is based on AuEq = Au + 0.0053*Ag (see notes to Table 1 below)

Niel Marotta, Sun Summit CEO commented: “This initial resource is a major milestone for Sun Summit and demonstrates the significant gold-silver potential of the Buck Main deposit. Sound and aggressive infill drilling programs over the past three seasons have successfully achieved our goal of demonstrating the continuity of the resource in the central, high-grade area of the deposit. The deposit remains largely open at depth and along strike and future drilling will examine these areas for further expansion. The scale, grade, and potential economic viability of the Buck Main deposit provides a strong foundation for further expansion and reinforces the Company’s strategy of advancing this district-scale gold-silver asset in British Columbia.”

Buck Main Mineral Resource Estimate

Table 1. Summary of Indicated and Inferred Mineral Resources for the Buck Main deposit

| Class | AuEq Cutoff |

In Situ Tonnage and Grade | AuEq Metal |

Au Metal |

Ag Metal |

||||

| Tonnage | AuEq | Au | Ag | NSR | |||||

| (gpt) | (ktonnes) | (gpt) | (gpt) | (gpt) | ($CDN) | (kOz) | (kOz) | (kOz) | |

| Indicated | 0.25 | 1,148 | 0.519 | 0.496 | 4.3 | 40.40 | 19.1 | 18.3 | 158 |

| Inferred | 0.25 | 52,224 | 0.489 | 0.462 | 5.0 | 38.04 | 820.4 | 775.5 | 8,435 |

Notes to the 2025 Resource Table:

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines, as required National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”)

- The base case Mineral Resource has been confined by “reasonable prospects of eventual economic extraction” shape using the following assumptions:

- Metal prices of US$2250/oz Gold, US$26/oz Silver

- Metallurgical recovery of 79% Gold and 38% Silver

- Payable metal of 95% Silver, 99% Gold in dore

- Forex of 0.72 $US:$CDN

- Offsite costs (transport, smelter treatment and refining) of CDN$8.50/oz Gold and CDN$0.25/oz Silver.

- Processing Costs of CDN$12/tonne milled and General & Administrative (G&A) costs of CDN$ 2.50/ tonne milled

- Mining cost of CDN$2.56 / tonne for mineralized material and CDN$2.50/tonne for waste

- 45-degree pit slopes

- The 120% price case pit shell is used for the confining shape

- The resulting net smelter return (NSR) for the purpose of the AuEq calculation = Au*CDN$98.60/g*79% recovery rate + Ag*CDN$1.08/g*38% recovery rate

- The resulting AuEq = Au + 0.0053*Ag

- Numbers may not add due to rounding

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the estimated mineral resources will be converted into mineral reserves.

The Mineral Resources for the Buck Main deposit has been estimated using a 0.25 g/t AuEq cutoff determined using assumptions listed in the footnotes of Table 1. These assumptions satisfy the requirements of reasonable prospects for eventual economic extraction. Table 2 shows cutoff sensitivities at different grades.

Table 2. Buck Main deposit cutoff sensitivities

| Class | AuEq Cutoff |

In Situ Tonnage and Grade | AuEq Metal |

Au Metal |

Ag Metal |

||||

| Tonnage | AuEq | Au | Ag | NSR | |||||

| (gpt) | (ktonnes) | (gpt) | (gpt) | (gpt) | ($CDN) | (kOz) | (kOz) | (kOz) | |

| Indicated | 0.2 | 1,604 | 0.435 | 0.414 | 3.9 | 33.85 | 22.4 | 21.3 | 203 |

| 0.25 | 1,148 | 0.519 | 0.496 | 4.3 | 40.40 | 19.1 | 18.3 | 158 | |

| 0.3 | 852 | 0.605 | 0.580 | 4.6 | 47.09 | 16.6 | 15.9 | 126 | |

| 0.35 | 645 | 0.695 | 0.669 | 5.0 | 54.12 | 14.4 | 13.9 | 103 | |

| 0.4 | 494 | 0.793 | 0.765 | 5.4 | 61.76 | 12.6 | 12.1 | 85 | |

| 0.5 | 317 | 0.989 | 0.957 | 6.0 | 76.99 | 10.1 | 9.8 | 61 | |

| 1 | 91 | 1.783 | 1.743 | 7.5 | 138.87 | 5.2 | 5.1 | 22 | |

| Inferred | 0.2 | 70,847 | 0.419 | 0.394 | 4.7 | 32.60 | 953.5 | 897.2 | 10,617 |

| 0.25 | 52,224 | 0.489 | 0.462 | 5.0 | 38.04 | 820.4 | 775.5 | 8,435 | |

| 0.3 | 39,248 | 0.560 | 0.532 | 5.3 | 43.60 | 706.5 | 670.9 | 6,721 | |

| 0.35 | 30,088 | 0.632 | 0.602 | 5.6 | 49.21 | 611.3 | 582.5 | 5,419 | |

| 0.4 | 23,644 | 0.703 | 0.671 | 5.9 | 54.71 | 534.0 | 510.3 | 4,477 | |

| 0.5 | 15,697 | 0.833 | 0.800 | 6.3 | 64.87 | 420.4 | 403.6 | 3,171 | |

| 1 | 3,126 | 1.485 | 1.440 | 8.5 | 115.64 | 149.2 | 144.7 | 857 |

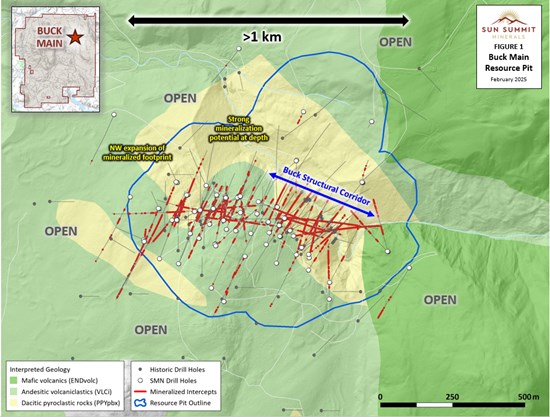

The Buck MRE is centered on the Buck Main deposit, 12 km south of Houston, BC. The road accessible deposit comprises a broad, 800 metre striking zone of intermediate-sulfidation epithermal-related gold-silver mineralization hosted in intermediate to felsic volcanics and intrusions. The MRE is based on 42,440 metres of drilling in 161 holes, of which 34,386 metres in 98 holes were completed by Sun Summit between 2020 and 2023 (Figure 1, Figure 2, Table 3).

Table 3. Drill data used in the Mineral Resources Estimate

| Year | Total Number of DHs |

Total Depth (m) |

Length Assayed (m) |

Total % Assayed (m) |

Number of DHs within Domains |

Assayed Within Modelled Domains (m) |

% Assayed within the Domains |

| Total | 161 | 42,440 | 39,737 | 94% | 123 | 27,034 | 99% |

Figure 1: Buck Main Drilling and Resource Pit Outline

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/242382_38bb74846467eae3_001full.jpg

Figure 2: Buck Main 3D View of Resource Constraining Pit showing AuEq blocks above 0.2 g/t

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/242382_38bb74846467eae3_002full.jpg

The effective date of the MRE, completed by Moose Mountain Technical Services is January 28, 2025. The Company will file a National Instrument 43-101 (NI 43-101) technical report on SEDAR+ within the mandated 45-day period following the date of this press release.

Gold and silver mineral resources were estimated as follows:

- Wireframing of overburden and mineralized domains based on geology.

- Assay capping based on Cumulative Probability Plots (CPPs).

- Compositing of assays to 3m lengths based on the domains.

- Variography to determine the anisotropy of the Au and Ag within each domain.

- Block model interpolations by inverse distance cubed (ID3).

- Classification of the resource to Indicated and Inferred based on the variography.

- Creation of confining pit shape based on industry standard prices and comparable costs.

Discovery Metrics

Sun Summit has efficiently delineated the Buck Main deposit with a total drilling cost of approximately CAD$18 per AuEq ounce included in the MRE. Since 2020, the Company has completed 98 drill holes at Buck Main, totaling over 36,400 meters. The MRE was informed by assay results from 123 drillholes and 27,034 metres of assayed intervals. The Company incurred CAD $15 million in drilling expenditures since 2020.

The low discovery cost reflects the efficiency of Sun Summit’s exploration strategy, which included systematic targeting using advanced geological modeling, geophysical surveys, and geochemical analysis. This exploration success underscores the strong potential for further resource growth, as the deposit remains open in multiple directions.

Next Steps

- Additional metallurgical testing will be initiated to optimize metal recoveries and evaluate potential byproduct elements, ensuring the economic viability of future mining operations.

- Further drilling designed to investigate the extents of the Buck Main deposit is recommended. Areas open to the north, west, and east will be targeted in future drill programs.

National Instrument 43-101 Disclosure

The Buck Main MRE was prepared by Sue Bird, M.Sc., P.Eng., V.P. of Resources and Engineering at Moose Mountain Technical Services, an independent Qualified Person as defined by NI 43-101. Sue has also reviewed and approved the technical information about the MRE in this news release.

This news release has been reviewed and approved by Sun Summit’s Vice President Exploration, Ken MacDonald, P. Geo., a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. Mr. MacDonald has verified the data disclosed in this press release pertaining to the MRE, including the sampling, analytical and test data underlying this information that has been collected by Sun Summit. Verification procedures include industry standard quality control practices. Some technical information contained in this release is historical in nature and has been compiled from public sources believed to be accurate. The historical technical information has not been verified by Sun Summit and may in some instances be unverifiable dependent on the existence of historical drill core and grab samples.

Mineral resources that are not mineral reserves do not have demonstrated economic viability; however, a reasonable prospect of eventual economic extraction pit has been used to confine the Resource Estimate using parameters detailed in the table notes.

The QP for the Mineral Resource estimate is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the potential development of Mineral Resource Estimate. Factors that may affect the estimates include: metal price assumptions, changes in interpretations of mineralization geometry and continuity of mineralization zones, changes to kriging assumptions, metallurgical recovery assumptions, operating cost assumptions, confidence in the modifying factors, including assumptions that surface rights to allow mining infrastructure to be constructed will be forthcoming, delays or other issues in reaching agreements with local or regulatory authorities and stakeholders, and changes in land tenure requirements or in permitting requirement.

Upcoming Events

Sun Summit Minerals Corp. is also pleased to announce its participation in two key events in Toronto. The Company will join the Precious Metals Summit Conferences One-on-One Meeting program on March 3-4 and exhibit at the Prospectors & Developers Association of Canada (PDAC) Convention on March 4-5 at Booth 2412B. Sun Summit’s new CEO, Niel Marotta, and Executive Chairman, Brian Lock, will be available to share insights into the Company’s strategic direction and highlight recent project developments.

Community Engagement

Sun Summit is engaging with First Nations on whose territory our projects are located and is discussing their interests and identifying contract and work opportunities, as well as opportunities to support community initiatives. The Company looks forward to continuing to work with local and regional First Nations with ongoing exploration.

About the Buck Project

The Buck Project is situated in a historic mining district near Houston, B.C., with excellent nearby infrastructure that allows for year-round, road-accessible exploration.

The project is host to the Buck Main intermediate-sulfidation epithermal-related gold-silver-zinc system. Most of the mineralization drilled to date at Buck Main consists of long, continuous zones of disseminated and breccia-hosted, bulk tonnage-style gold-silver-zinc. Vein-hosted, high-grade mineralization has also been intersected near the center of Buck Main.

Exploration at the Buck Project is focused on investigating the lateral and vertical extent of gold-silver-zinc mineralization at the Buck Main system, and to define additional drill targets across the entire land package through systematic exploration programs.

About Sun Summit

Sun Summit Minerals (TSXV: SMN) (OTCQB: SMREF) is a mineral exploration company focused on expansion and discovery of district scale gold and copper assets in British Columbia. The Company’s diverse portfolio includes the JD Project in the Toodoggone region of north-central B.C., and the Buck Project in central B.C.

Further details are available at www.sunsummitminerals.com.

Link to Figures

On behalf of the board of directors

Niel Marotta

Chief Executive Officer & Director

info@sunsummitminerals.com

For further information, contact:

Matthew Benedetto, Simone Capital

mbenedetto@simonecapital.ca

Tel. 416-817-1226

Forward_Looking Information

Statements contained in this news release that are not historical facts may be forward-looking statements, which involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, the forward-looking statements require management to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the forward-looking statements will not prove to be accurate, that the management’s assumptions may not be correct and that actual results may differ materially from such forward-looking statements. Accordingly, readers should not place undue reliance on the forward-looking statements. Generally forward-looking statements can be identified by the use of terminology such as “anticipate”, “will”, “expect”, “may”, “continue”, “could”, “estimate”, “forecast”, “plan”, “potential” and similar expressions. Forward-looking statements contained in this press release may include, but are not limited to, estimates of mineral resources, potential mineralization, exploration plans, and engagement with First Nations communities. These forward-looking statements are based on a number of assumptions which may prove to be incorrect which, without limiting the generality of the following, include: risks inherent in exploration activities; the impact of exploration competition; unexpected geological or hydrological conditions; changes in government regulations and policies, including trade laws and policies; failure to obtain necessary permits and approvals from government authorities; volatility and sensitivity to market prices; volatility and sensitivity to capital market fluctuations; the ability to raise funds through private or public equity financings; environmental and safety risks including increased regulatory burdens; weather and other natural phenomena; and other exploration, development, operating, financial market and regulatory risks. The forward-looking statements contained in this press release are made as of the date hereof or the dates specifically referenced in this press release, where applicable. Except as required by applicable securities laws and regulation, Sun Summit disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ASX Listing and CEO Designate

CleanTech Lithium PLC (AIM: CTL), an exploration and development company advancing sustainable lithium projects in Chile, announces that it now expects the Australian Securities Exchange (“ASX”) listing to launch in April and complete in May. While the ASX listing process is taking longer than initially expected, the Board and our advisers believe that waiting for a positive decision by the end of March on entering the streamlined direct negotiation process for the Special Lithium Operating Contract (“CEOL”) for Laguna Verde and completing the Pre-Feasibility Study (“PFS”) will significantly strengthen our investment case in the Australian market.

The Company also recognises that, under ASX listing rules, it will now have to include 2024 year-end audited financials (“2024 Financials”) in the ASX-listing Prospectus before the Prospectus can be published. The 2024 Financials are well-advanced and expected to be released by the Company before the end of March 2025, some three months earlier than normally planned so that the Prospectus can be finalised shortly thereafter. The Prospectus will also include results of the PFS, which is progressing well and is anticipated to be finalised and published in April.

The Company has been informed by Tony Esplin, nominated as CEO designate in November 2024, that he has reconsidered his position and, for personal reasons, will not be taking up his intended appointment as CEO. Mr Esplin’s appointment was conditional on the successful listing of the Company on the ASX which is now expected to complete in May. The Company´s Executive Chairman, Steve Kesler, will continue as interim CEO whilst the Board re-engages with alternative candidates as the CEO to lead CleanTech Lithium into its next phase of growth.

Steve Kesler, Executive Chairman, CleanTech Lithium PLC commented:

“We believe that pushing out the ASX listing to include the resolution allowing the Company to enter direct negotiation with Government on the CEOL and results from the PFS will be taken positively by Australian investors. We regret that Tony has decided to withdraw from the proposed appointment as CEO, and we will start to re-engage with other high calibre candidates immediately.”

The Board believes the ASX listing will enhance shareholder value and will provide further updates on the ASX listing and CEO search in due course.

Investor Webinar

CleanTech Lithium will be hosting a live webinar via the London Stock Exchange platform Spark Live on Wednesday 26th February. This webinar will begin at 13:00 GMT and investors can register for free via this link: https://shorturl.at/5020m

|

For further information contact: |

|

|

CleanTech Lithium PLC |

|

|

Steve Kesler/Gordon Stein/Nick Baxter |

Jersey office: +44 (0) 1534 668 321 Chile office: +56 9 312 00081 |

|

Or via Celicourt |

|

|

Celicourt Communications Felicity Winkles/Philip Dennis/Ali AlQahtani |

+44 (0) 20 7770 6424 |

|

Beaumont Cornish Limited (Nominated Adviser) Roland Cornish/Asia Szusciak |

+44 (0) 20 7628 3396 |

|

Fox-Davies Capital Limited (Joint Broker) Daniel Fox-Davies |

+44 (0) 20 3884 8450 |

|

Canaccord Genuity (Joint Broker) James Asensio |

+44 (0) 20 7523 4680 |

Beaumont Cornish Limited (“Beaumont Cornish”) is the Company’s Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish’s responsibilities as the Company’s Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

Notes

CleanTech Lithium (AIM:CTL) is an exploration and development company advancing lithium projects in Chile for the clean energy transition. Committed to net-zero, CleanTech Lithium’s mission is to become a new supplier of battery grade lithium using Direct Lithium Extraction technology powered by renewable energy.

CleanTech Lithium has two key lithium projects in Chile, Laguna Verde and Viento Andino, and exploration stage projects in Llamara and Arenas Blancas (Salar de Atacama), located in the lithium triangle, a leading centre for battery grade lithium production. The two most advanced projects: Laguna Verde and Viento Andino are situated within basins controlled by the Company, which affords significant potential development and operational advantages. All four projects have good access to existing infrastructure.

CleanTech Lithium is committed to utilising Direct Lithium Extraction with reinjection of spent brine resulting in no aquifer depletion. Direct Lithium Extraction is a transformative technology which removes lithium from brine with higher recoveries, short development lead times and no extensive evaporation pond construction. www.ctlithium.com

Click here for the full release

This article includes content from Cleantech Lithium PLC, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.